- Bitwise forecasts significant future Bitcoin price increase.

- Projected BTC price of $1.3 million by 2035.

- Main growth factors: adoption, inflation hedge, supply constraints.

Bitwise Asset Management predicts Bitcoin’s value may surge to $1.3 million by 2035, driven by institutional adoption, inflation fears, and limited supply, according to their August report.

The forecast signifies a pivotal moment for Bitcoin, positioning it as a potentially dominant institutional asset amidst inflationary concerns, though risks such as regulatory changes remain.

Bitcoin’s Future: $1.3 Million Forecast and Institutional Impact

Bitwise analysts predicted Bitcoin’s price could climb to $1.3 million by 2035, driven by factors such as institutional adoption and demand for hard assets amid inflation. The report, led by CIO Matt Hougan, emphasizes Bitcoin’s fixed supply as integral to its valuation.

Expected changes include rising allocations to Bitcoin in institutional portfolios. The analysis foresees a compound annual growth rate of 28.3%. Nevertheless, volatility will remain a critical characteristic, even if it trends lower than past cycles.

Market reactions are varied. Cathie Wood, CEO of Ark Invest, and Brian Armstrong, CEO of Coinbase, expressed similar optimism regarding Bitcoin’s future value. Regulatory shifts and technological threats like quantum computing are viewed as potential hurdles.

Bitcoin’s Growth and Challenges Explained by Experts

Did you know? A consistent annual growth rate of 28.3% for Bitcoin would substantially exceed most traditional assets, underscoring its potential transformative effect on institutional investment strategies.

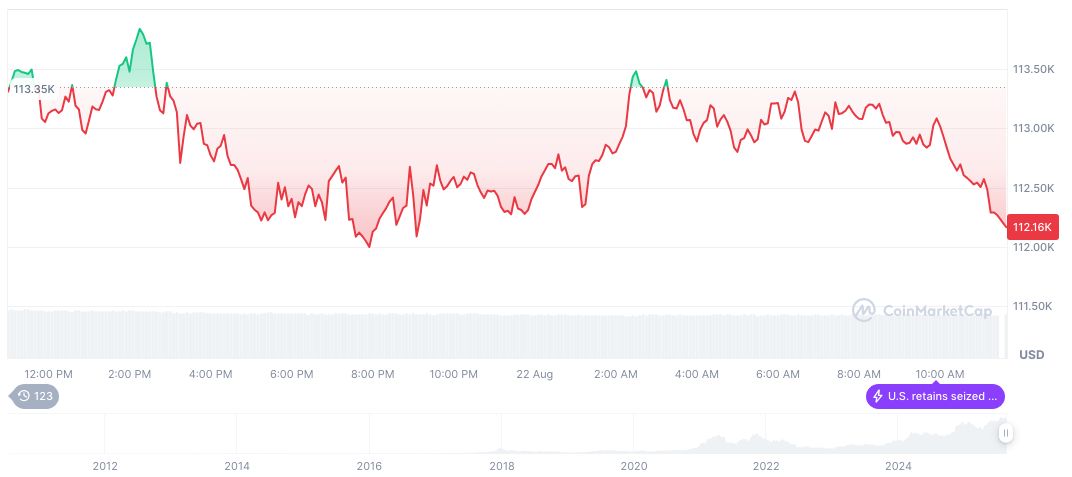

Bitcoin (BTC) holds a current price of $116,970.36, as noted by CoinMarketCap. Its market cap stands at $2.33 trillion with a market dominance of 57.68%. Over the past 24 hours, BTC saw a price increase of 3.71%, while trading volume experienced a 40.58% rise.

Expert analysts from Coincu highlight potential regulatory challenges as a significant factor. Emphasis on institutional expansion under environmental scrutiny is vital. Historically, technological advances like quantum computing pose threats, but favorable legislative environments could drive future markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/bitwise-bitcoin-price-forecast/