- Bitcoin HODLers exited the cycle after cashing in on huge gains.

- Is the dawn of a ‘new cycle’ around, or are we witnessing the end?

Bitcoin[BTC] kicked off November at $68K, but just two months later, it soared to a new all-time high of $109K – a massive 60% surge.

With such gains, profit-taking was bound to happen, and in December alone, investors cashed out a staggering $3 billion in profits.

Now, the market awaits a recovery. Otherwise, even holding Bitcoin at $100,000 could become a nightmare.

FOMO or Greed: Which side will dominate?

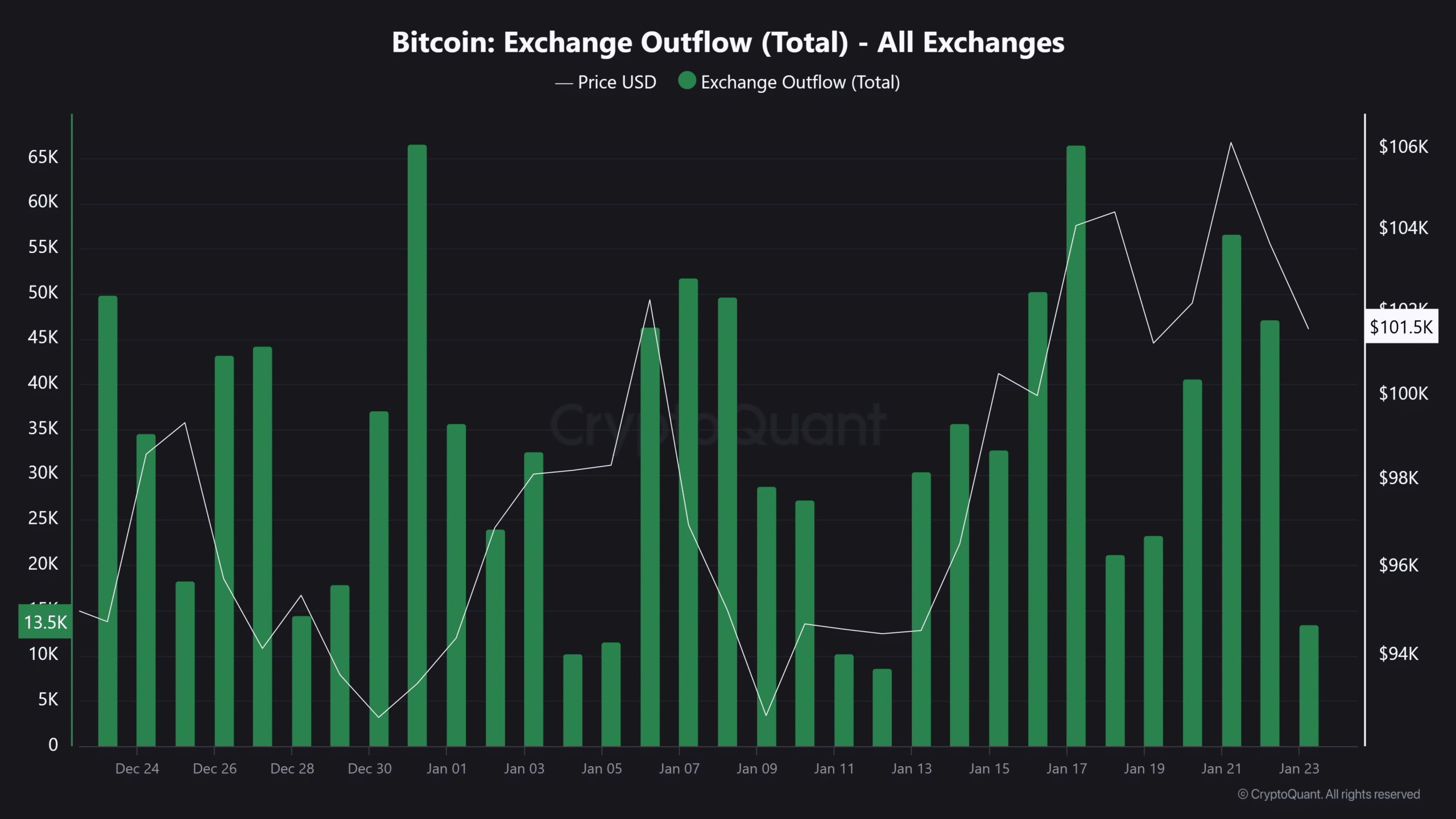

Traders are getting less risky in the derivatives market, where the leverage ratio is shrinking fast. This shows they’re unsure where Bitcoin’s price will go next. Also, fewer people are moving Bitcoin off exchanges.

In fact, the exchange outflows saw a staggering 16% drop in a single day.

Source: CryptoQuant

Together, these factors suggest that FOMO is fading. However, the greed has bounced back from “extreme” levels – a bullish sign. Why? Profit-taking might be nearing its peak, as indicated by a Glassnode report.

As per the report, profit-taking is way down, falling from $4.5 billion in December to just $316 million now – a 93% drop. According to AMBCrypto, if FOMO returns while excessive greed subsides, it could set the stage for a significant price increase.

A look at the Bitcoin market

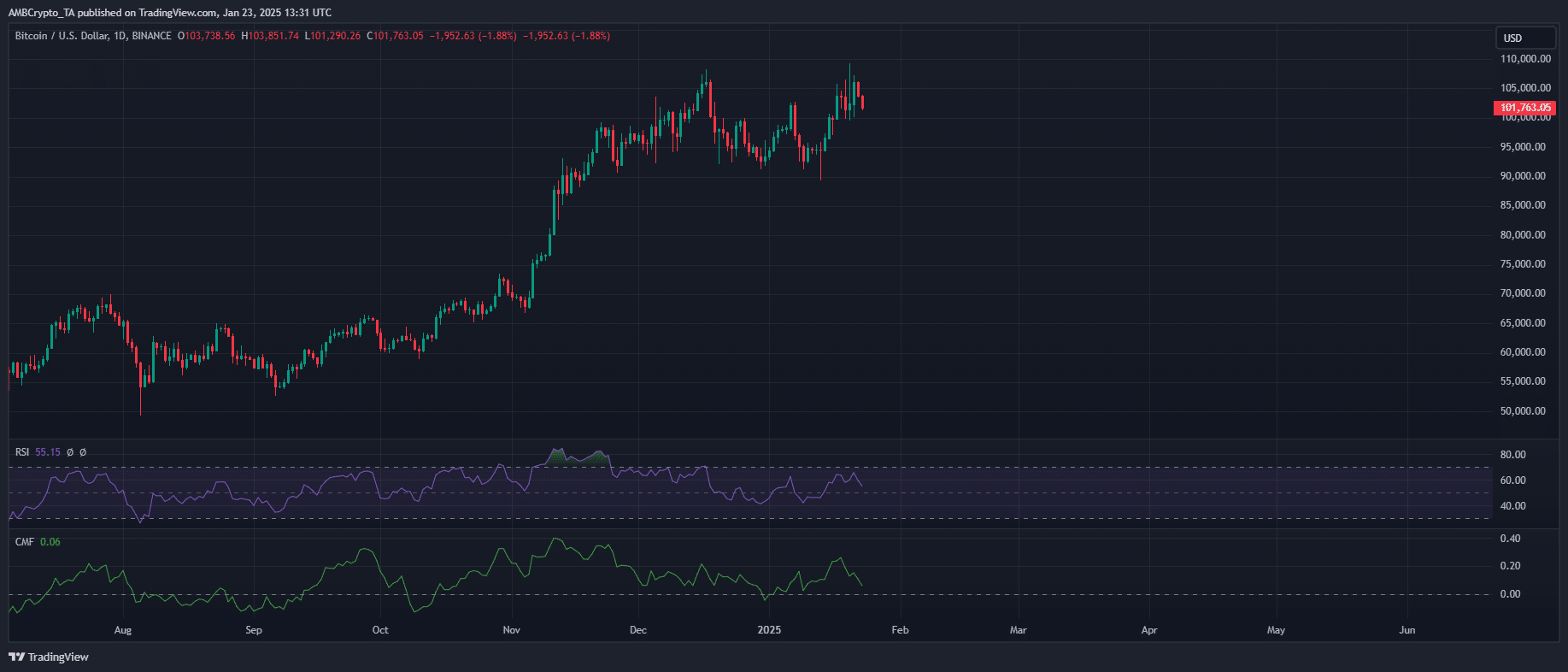

Bitcoin dropped 3.26% in a day, but the market isn’t overheating. This means strong buying, likely fueled by FOMO, is needed to push the price back up.

Source: TradingView

However, the upcoming FOMC meeting could significantly impact Bitcoin’s recovery. With the meeting just a week away, uncertainty is likely to persist, making a strong rebound less probable in the near term.

Interestingly, this consolidation period might be a positive sign. It could allow institutions to quietly accumulate Bitcoin while the market stabilizes after a period of significant profit-taking.

The key is what the Fed does. If they cut rates, things could get interesting. But if they surprise us, Bitcoin might dip further.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

For now, the market’s showing signs of life. Greed is back, and profit-taking is cooling down. This could ignite a new buying frenzy, especially once the Fed dust settles.

Keep an eye on the U.S. economic calendar – it will ultimately determine whether extreme greed takes over or FOMO makes a comeback.

Source: https://ambcrypto.com/bitcoin-profit-taking-plummets-93-since-december-whats-next-for-btc/