- The Bitcoin price correction breaks below a support trendline of the falling wedge pattern.

- Recent U.S. government shutdown disruptions halted the planned October CPI release.

- A potential death crossover between the 50- and 200-day exponentials could further intensify the market selling.

The crypto market witnessed yet another round of sell-off on Friday, which plunged the Bitcoin price to an intraday low of $93,861. The selling pressure came amid a growing sentiment that a December rate cut from the Federal Reserve is becoming less likely. A continued distribution from BTC’s long-term holders, ETF outflows, and liquidation cascades are putting additional downward pressure on this asset. The falling BTC price signals another technical breakdown, which could signal a prolonged correction in the market.

New Market Entrants Face Heavy Losses as BTC Drops Below $94K

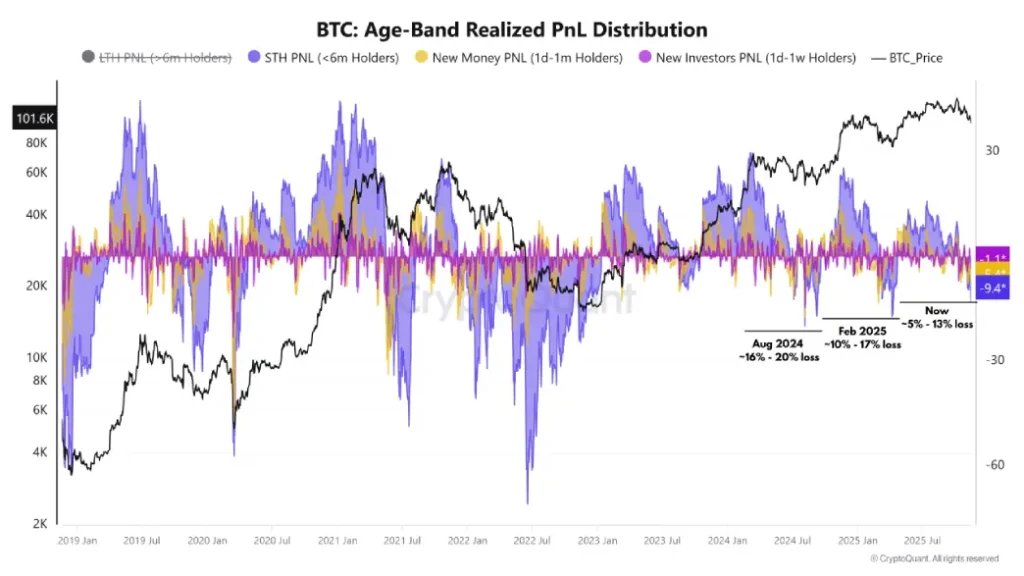

The crypto market has witnessed a rough first half of November as its pioneer digital asset, Bitcoin, plunged from a $111,130 high to a six-month low of $93,861. The drop has triggered understandable panic among market participants, with on-chain data highlighting precisely where the pain is most concentrated.

Metrics tracking age groups in the wallet show that traders who have joined the market recently are taking the most severe hits, setting the stage for heavy sell-side pressure.

According to shared analysis from Crazzyblock, the data associated with addresses active in the last week shows these buyers sitting on just over 3% losses. Wallets that accumulated coins in the past month have seen that figure widen to almost 8%. The most notable strain, however, is with holders who entered in the last six months. This group, which tends to be highly sensitive to rapid price shifts, is currently underwater by almost 13% on average.

This threshold is important as it marks the area in which short-term market participants historically have started to give up their positions in big waves. Once their aggregate cost basis is breached, selling speeds up in an effort to avoid deeper drawdowns, adding more downward force to an already fragile setup. The speed with which this feedback loop occurs through these reactions can lead to distorted price action, resulting in sharp declines that are out of proportion to wider market conditions.

As these wallets shed coins, the market essentially moves away from the reactive traders to shift into the hands of longer-term entities, which tend to accumulate in times of market stress. The pattern has been repeated over a number of cycles: sharp drawdowns concentrated losses among short-duration holders, which are forced out, triggering increased volatility.

Bitcoin Price Loses Key Support, Rising Selling Pressure

In a four-day downfall, the Bitcoin price plunged from $107,465 to $93,961, accounting for a 12.57% loss. The daily chart evidently shows the increase in red candles and trading volume during this downturn, accentuating the strengthening dominance of sellers.

Interestingly, the falling BTC price also gave a decisive breakout from the falling wedge, a traditionally known continuation pattern. Theoretically, the pattern appears between an established uptrend as it allows buyers to recuperate the exhausted bullish momentum and drive renewed recovery post-breakout.

However, the downside breakout from the pattern further accentuates the aggressive nature of sellers to prolong this correction. As of now, the Bitcoin price must offer a suitable follow-up on the downside to confirm this breakdown. With sustained selling, the post-breakdown drop could push the Bitcoin price towards the next significant support of $91,500, followed by a dip towards $88,500.

On the contrary, if the coin price re-enters the channel range with a sharp upsurge, the bearish thesis would be under a threat of invalidation.

Also Read: Wolf Capital CEO Sentenced to 5 Years in Jail for Ponzi Scheme

Source: https://www.cryptonewsz.com/bitcoin-price-to-six-hardest-more-pain-ahead/