Bitcoin price has managed to maintain above $90,000 on Thursday, following a bearish market trend triggered by the Federal Reserve’s recent interest rate cut.

The total crypto market has reported a 3% decrease in the last 24 hours. This decline follows as traders respond to the third rate drop of the year by the Fed, and huge liquidations by big crypto holders.

Fed Rate Cut Impact on Crypto Markets

The Fed had been expected to be much more dovish, which resulted in a profit-taking phase after Bitcoin briefly surged to $92,000.

Other cryptocurrency markets, including Ethereum, Solana, XRP, ADA, and DOGE, have also been trading in a downtrend after a slight sell-off.

Consequently, the aggregate market capitalization of crypto has declined to 3.07 trillion, as compared to $3.22 trillion.

The issues regarding the direction of Fed monetary policy have escalated after some of the officials dissent on the same.

Also, the news that the Fed would purchase up to 40 billion of treasury bills in the next 30 days has increased more uncertainties. There will be no immediate rate cuts; therefore, the next meeting of FOMC is in January 2026.

Bitcoin Price Faces Resistance, Key Support Levels Ahead

The recent market analysts point out that the attempts of Bitcoin price to break beyond the range of $93,000 to $94,000 have not been successful. Such failure has resulted in more focus on the subsequent levels of important support. The $88,000 to $89,000 bracket that is likely to retest in the near future is notably so.

$BTC tried to reclaim the $93,000-$94,000 level but failed.

The next major support zone is around the $88,000-$89,000 level, which will most likely get retested.

If Bitcoin holds this level, another rally could happen.

Otherwise, BTC will drop towards the $85,000 level again. pic.twitter.com/U4r2GzFXX8

— Ted (@TedPillows) December 11, 2025

In case Bitcoin price can hold on to this support zone, it is possible that it will take off again. But in case the price does not stand, the price is expected to further fall to the point of $85,000, analysts predict.

Bitcoin Traders Eye Buy-the-Dip Opportunities as Realized Loss Drops

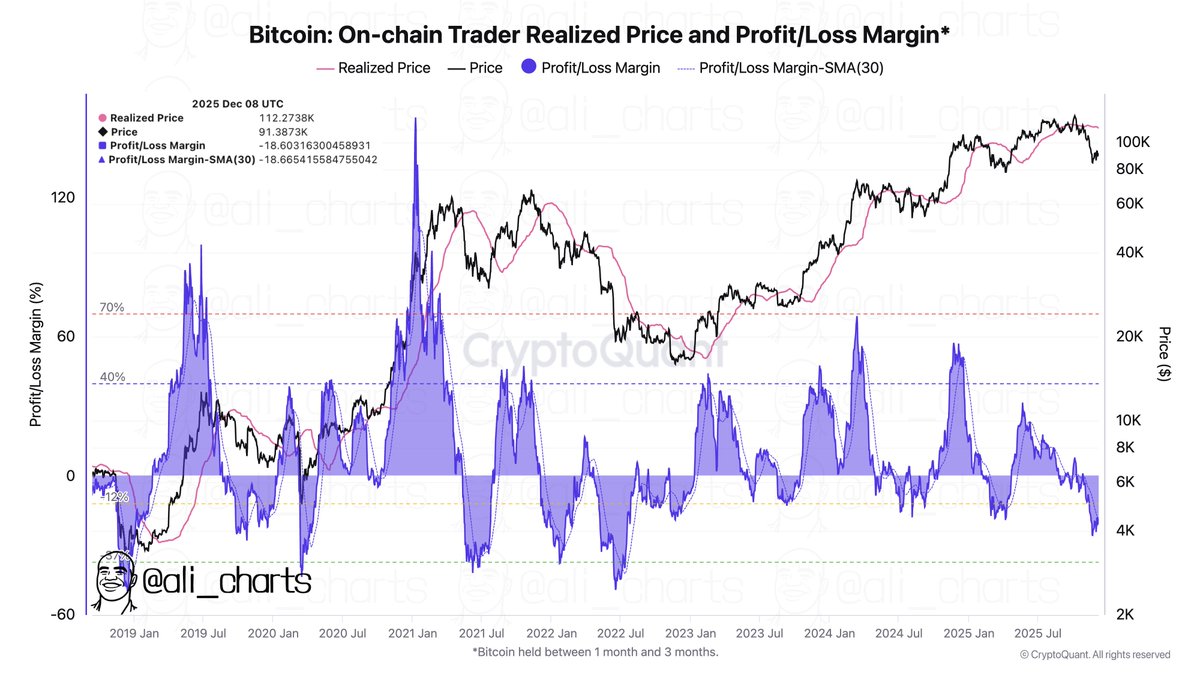

Recent on-chain activities of Bitcoin show a high potential among traders. Once the realized loss on-chain is less than 37, it is a good indicator of a solid buy-the-dip opportunity. At present, the actual loss is -18% which may indicate that investors may enter the company.

The on-chain realized price of Bitcoin and the profit/loss margin of Bitcoin are displayed in a graph provided to crypto analyst Ali.

What’s Next For BTC Price?

As of December 11, 2025, the BTC price is $90,298, showing a slight 2% decrease over the last 24 hours.

If the Bitcoin price falls below $90,000, further downward pressure is possible. A breakout above $95,000 could signal a potential uptrend as the future Bitcoin outlook remains bullish.

The indicator of bearish momentum is the MACD (Moving Average Convergence Divergence). The histogram indicates a decreasing buyer strength.

The MACD line is less than the signal line, and it is an indication of further downward pressure. The RSI (Relative Strength Index) stands at 45, which represents a neutral market sentiment.