- Michael Saylor’s rumored Bitcoin price prediction sparks discussion.

- Statement lacks verified evidence.

- Debate on Bitcoin’s market potential persists.

Michael Saylor’s alleged claim that Bitcoin could reach $10 million per coin has surfaced, though it lacks verification from primary sources like official press releases or direct interviews.

This speculative statement highlights Bitcoin’s potential allure and underlying sentiment, but its unverified nature calls for cautious interpretation among market participants and stakeholders.

Michael Saylor’s $10 Million Bitcoin Rumor Under Scrutiny

Michael Saylor’s alleged statement regarding a potential Bitcoin price surge to $10 million if recommended by banks has attracted attention. This claim lacks primary evidence, as official channels do not verify it. Such speculation feeds ongoing debates around the digital asset’s valuation trajectory.

Market reactions have been mixed. Some investors view institutional endorsements as pivotal for Bitcoin’s future growth potential, while others emphasize the need for careful analysis of such unverified claims. Bitcoin market supporters remain hopeful, underscoring their belief in long-term growth prospects driven by institutional adoption.

Michael Saylor, Executive Chairman, MicroStrategy – “The future is indeed bright for Bitcoin as institutional adoption grows and more companies recognize its immense value.”: MicroStrategy Newsroom

Bitcoin’s Market Dynamics and Institutional Influence

Did you know? When MicroStrategy first announced Bitcoin purchases in 2020, it marked one of the early instances of a public company integrating Bitcoin into its treasury strategy, setting a precedent for corporate adoption.

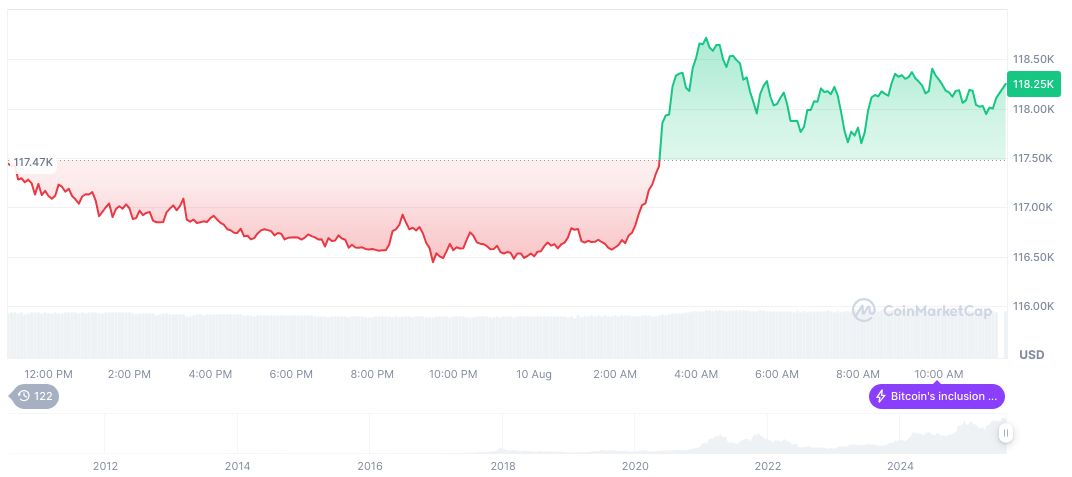

According to CoinMarketCap, Bitcoin (BTC) is valued at $120,742.96 with a market cap of 2,403,344,112,273.26 and accounts for 59.67% market dominance. 24-hour trading volume surged by 25.74%, reaching 68,332,984,057.60. Over three months, Bitcoin’s price changed by 18.07%, reflecting ongoing market dynamics.

Financial experts from Coincu highlight potential regulatory impacts and technological developments affecting Bitcoin’s trajectory. Institutional involvement could influence financial regulations, integrating cryptocurrencies into mainstream financial systems. Long-term market expectations remain optimistic, supported by historical adoption trends and strategic treasury incorporations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/bitcoin-price-speculation-saylor-rumors/