Bitcoin continues to weaken as the price trades under growing structural pressure, reflecting sustained seller dominance at the daily level. The current price action displays constrained liquidity status, diminishing upside follow-through and decreasing responsiveness to demand. This pressure occurs as the macro uncertainty increases and puts additional pressure on a weak structure.

Regardless of changing political narratives, Bitcoin has not attracted stabilizing inflows, keeping downside risk alive. The core analytical focus now centers on whether current structure can stabilize organically, or whether BTC price must revisit deeper demand zones before recovery conditions can form.

Trump’s Fed Chair Choice Reshapes Macro Risk For Bitcoin

Bitcoin price faces renewed macro tension as Donald Trump signals plans to name the next Federal Reserve Chair Today, reducing uncertainty around future monetary policy direction. This development arrives while BTC price already reflects sensitivity to rate expectations and institutional credibility.

The fact that Trump favors looser monetary conditions raises policy-independence concerns, which the market is likely to value as risk before it becomes clear. As a result, Bitcoin price has not responded with defensive inflows, keeping traders focused on structure rather than political optimism.

Previously, pro-crypto Governor of the Federal Reserve Chris Waller had a brief burst of momentum as a candidate due to anticipation of a more crypto-responsive policy approach. Prescription markets, however, have since repriced sharply.

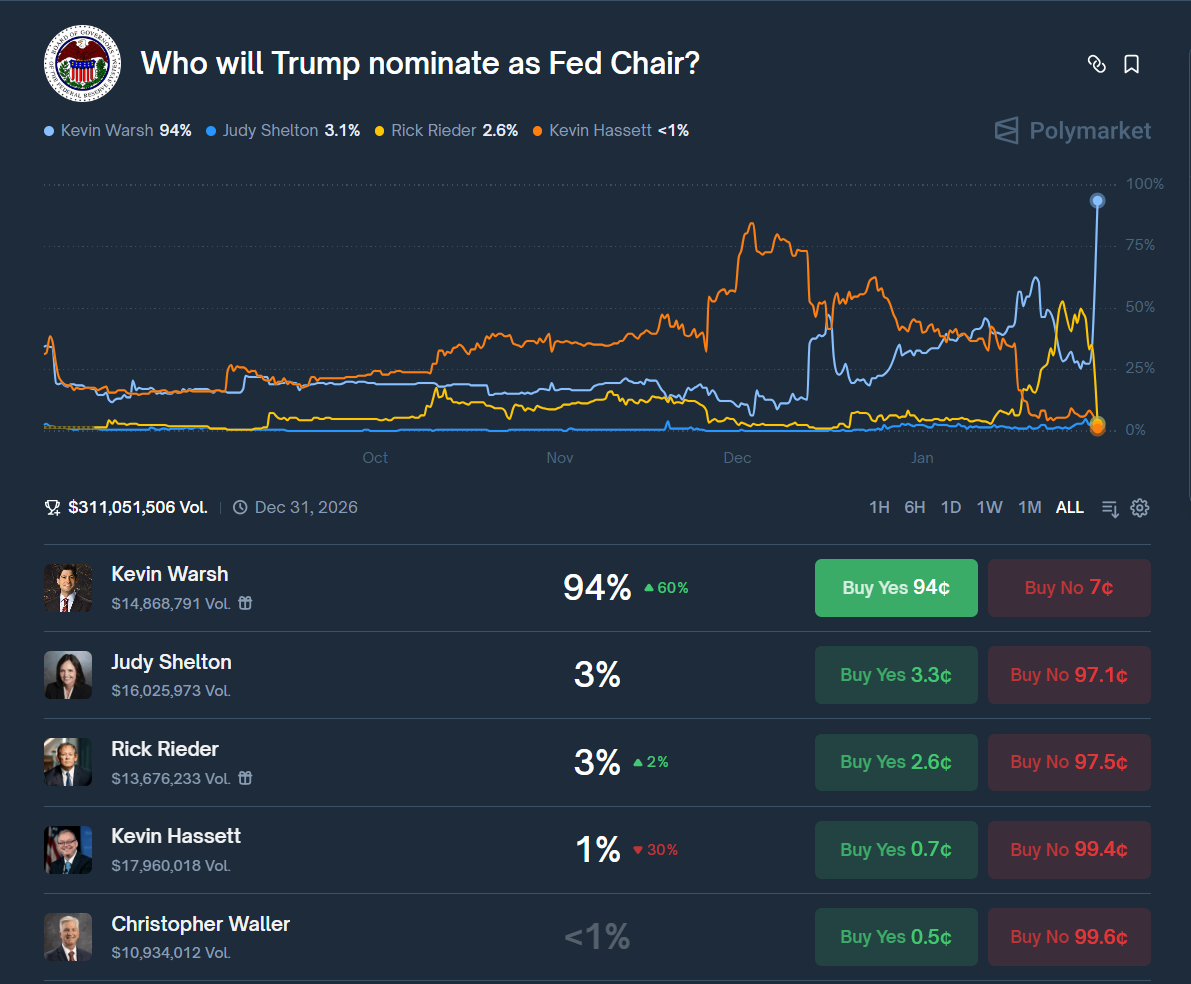

According to the polymarket odds, Kevin Warsh is the new favorite with about 94% probability, with Waller trailing him to 1%. This sudden change emphasizes the rapidity of the development of macro narratives. Thus, the Fed chair decision is not a directional trigger, but a volatility enhancer of BTC price unless policy clarification will be converted into observable liquidity transformation.

Bitcoin Price Structure Indicates More Severe Pullback Risk

The structure of the Bitcoin price still indicates further decline after the evident bearish pennant flag setup on the daily chart. At the time of press, BTC market value sits near $82,000, reflecting persistent sell-side control after repeated rejection at higher levels.

This weakness followed a mid-January rally attempt toward the $100,000 region. However, BTC price stalled near $97,000 and failed to sustain momentum.

The bearish pennant occurred when the price contracted in converging trendlines following that rejection indicating consolidation under the pressure instead of accumulation.

Once BTC price broke below the lower boundary of the pennant, sellers reasserted control, confirming the pattern as a continuation structure rather than a pause.

Following this breakdown, BTC price has started drifting toward the $80,500 level, which now stands as the next structural demand zone. This movement is in line with worsening momentum behaviour. RSI rolled over from the 70 level during the mid-January rally attempt.

The indicator has declined steadily alongside price action since then now sitting at 30. This reinforce the sustained selling pressure rather than exhaustion. The price behavior reflect this decrease, with lower highs and weak rebounds, highlighting weak strength of recovery.

If the $80,500 level fails to hold under continued pressure, BTC price could extend losses toward the $75,000 before recovery. This negative aspect holds true provided that momentum does not stabilize and previous resistance areas are not taken back. Therefore, the long-term BTC price forecast remains corrective, with further downside favored unless buyers decisively repair broken structure.

Summary

To sum up, Bitcoin price remains biased toward further downside as BTC price structure, momentum, and behavior remain aligned bearishly. The dominant outcome favors a move toward $80,500, with risk extending to $75,000 if selling pressure persists.

This assumption is true unless consumers recapture previous resistance areas with a sense of conviction. Until then, rallies will end up being a distribution, but not a recovery, mechanism. Therefore, the Bitcoin price forecast stays corrective, with stabilization dependent on structural repair rather than macro narrative shifts.

Source: https://coingape.com/markets/bitcoin-price-prediction-as-trump-names-the-next-fed-chair-today/