Bitcoin ($BTC) is often referred to as digital gold. One interpretation is that it has the potential to fetch profits in the long run. In other words, long-term investors in Bitcoin are more likely to take profits home. The current trend demonstrates this, as victims of the 2014 Mt. Gox breach started calculating the value of bitcoin they had acquired in 2013.

On the other hand, short-term holders represent an alternative theory that has garnered significant attention. They are known to trade their investments after holding them for a short period, such as a week, a month, or even four months. Analysts have highlighted how such traders affect how BTC prices move on the chart. This happens in one of two ways: buying tokens brings a rise in the value and selling the tokens brings a decline in the value.

The trend has been more noticeable since August of this year. Several short-term traders have reportedly offloaded 642,333 Bitcoin tokens since mid-August 2024. For reference, every flagship token is paired with the US dollar at $59,083.45, with a surge of 2.89% in the last 24 hours at press time. Such an activity has created selling pressure, which is becoming increasingly difficult to navigate.

The crypto market experienced a bear run in mid-August as a result of the ongoing market collapse. BTC was above $60,000 but later slipped to below $54,000. It has yet to breach the $60k mark. It is anticipated that the current value will increase by 18.31% to $69,874 within the next five days, despite the volatility of 3.71%, according to Bitcoin predictions.

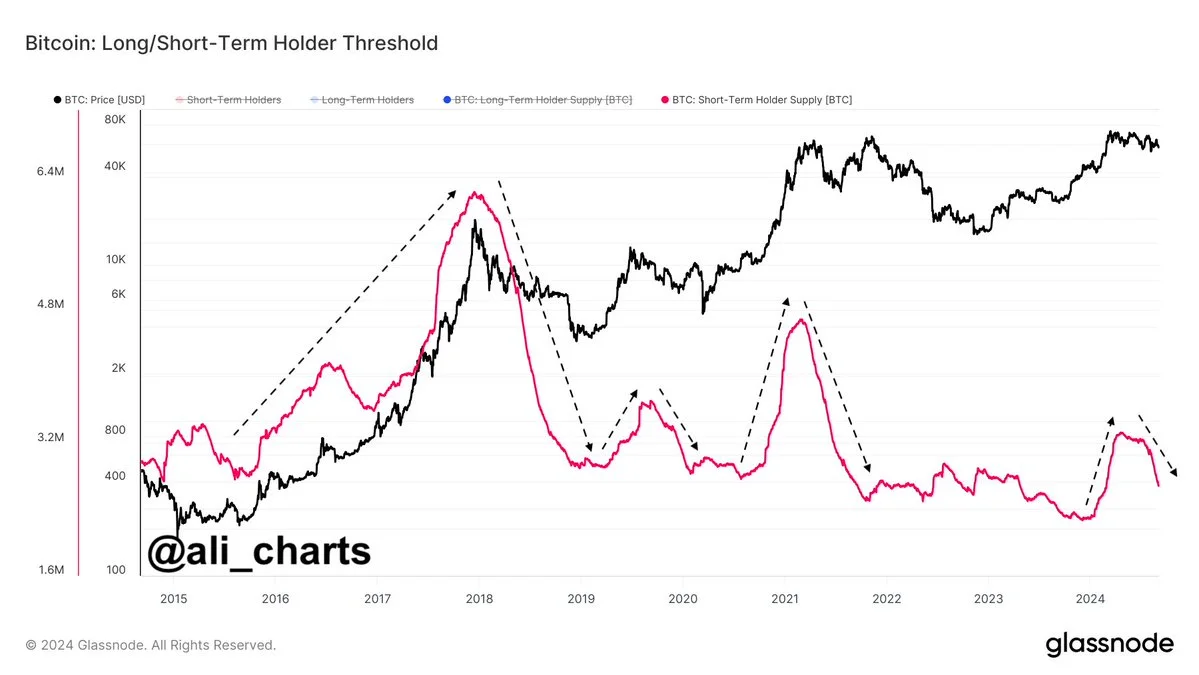

According to a chart provided by Glassnode, the zenith for short-term holders occurred between 2017 and 2018. At that time, the price of BTC was also approaching $40,000 in a gradual manner. Subsequently, there was a sharp plummet in prices and a rapid decrease in holdings. The latter was able to maintain a price above $2,000; however, the holdings dropped to a new low.

Short-term holdings are yet to recover, while prices have seen a recovery already. Despite the ongoing trend, Bitcoin is poised to challenge the mark of $100k as a year-end target. In fact, the price could reach $82,545 in the next 30 days with a surge of 39.76%.

One of the obvious questions that need to be addressed is how the market will respond to this in the coming days. With upticks in BTC, there is a chance that the market will develop resilience. Spot Bitcoin ETFs may play a supporting role here, as well as the conclusion of the upcoming US elections. All of these factors will eventually combine to balance the effects of short-term investors offloading.

Some crypto enthusiasts have also pointed out that low liquidity could largely be affecting the price of Bitcoin tokens at the moment.

Read More on Bitcoin: As Bitcoin Holds Near $60K, Will a Wedge Pattern Signal the Next Big Move?

Source: https://www.cryptonewsz.com/short-term-holders-impacting-bitcoin-price/