Bitcoin’s (BTC) price rebounded on Monday, racing to $57,050 for the first time in five days. This comes after an underwhelming start to a historically bearish September, as it initially dropped to $53,930.

As of this writing, the coin trades at $57,226. While the market might hope for a sustained bounce, on-chain analysis suggests that BTC might be set for one last dip before a rally that could last the whole of this year’s last quarter.

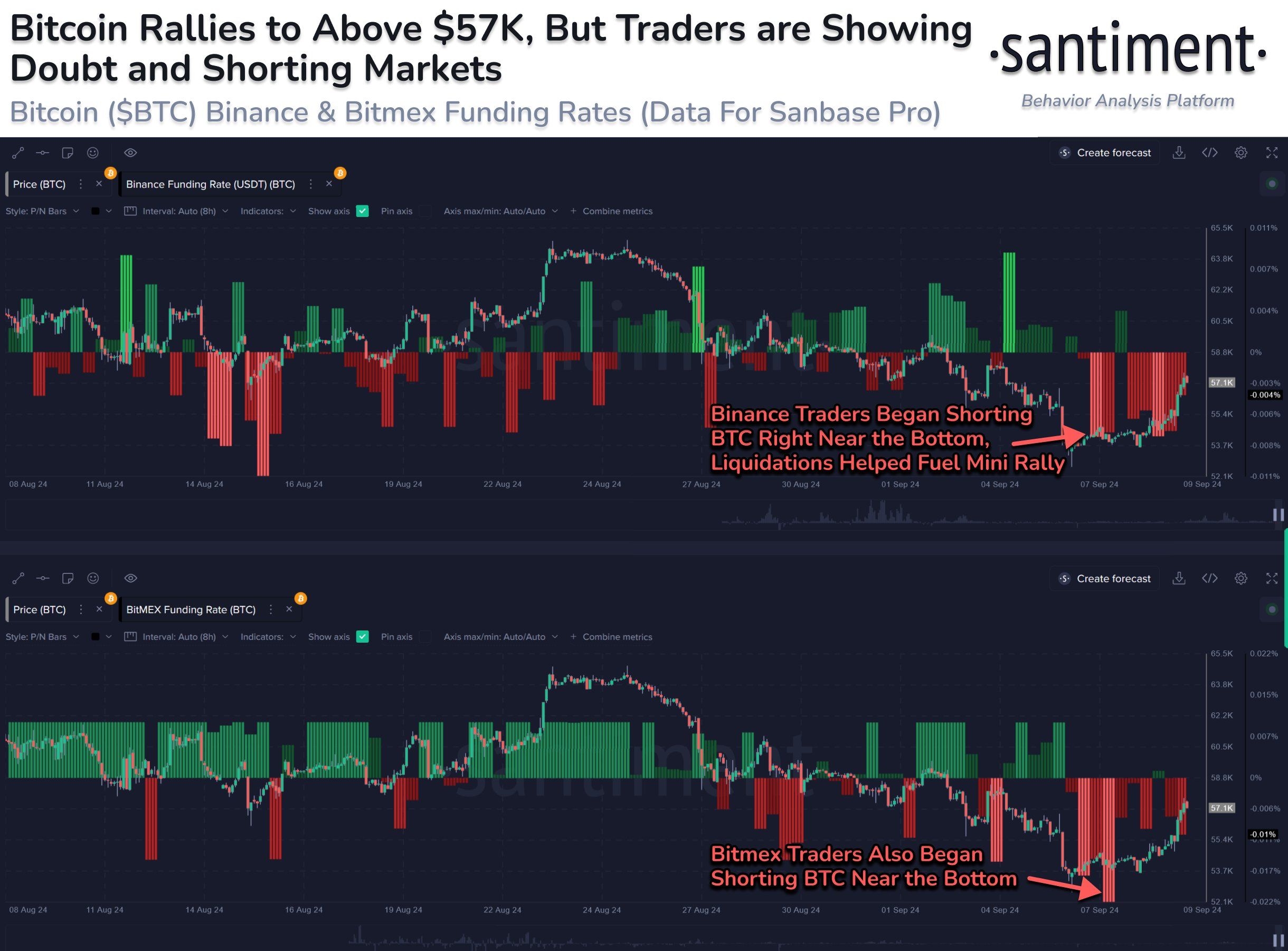

FUD-Driven Shorting Lifts Bitcoin

Earlier today, the on-chain analytic platform explained that the recent upswing occurred as a result of heaving Fear, Uncertainty, and Doubt (FUD) in the market. This FUD led traders to short Bitcoin heavily on major crypto exchanges.

Historically, massive short positions, which translate to pessimistic investor sentiment, usually trigger a bounce. According to Santiment’s post on X, if short positions continue to dominate, the rally might continue.

“On major exchanges like Binance & Bitmex, Bitcoin has been heavily shorted since Saturday. Trader FUD and doubt in this rally will only fuel prices higher,” the post read.

However, other indicators, such as the Delta Cap, suggest that while Bitcoin’s price shows bullish potential, it may take time to fully materialize.

The Delta Cap helps identify Bitcoin’s bottom by analyzing the Realized Cap. Historically, when the Delta Cap aligns closely with the Realized Cap, it signals an ideal accumulation zone for Bitcoin.

Currently, Bitcoin’s Delta Cap stands at $407.36 billion, while the Realized Cap is $621.35 billion. The significant gap between these metrics suggests it may be a while before BTC enters a sustained uptrend.

Read more: Where To Trade Bitcoin Futures: A Comprehensive Guide

Considering the difference between them, BTC might be close to its bottom, but not exactly there. As such, Bitcoin’s price might decline again before it eventually begins an “up only” movement. Crypto analyst Rekt Capital also appears to agree with the sentiment.

“You just need to survive September. Because if history repeats, Bitcoin may be heading for three straight months of positive upside Monthly returns,” the analyst wrote.

BTC Price Prediction: Drop to $52,000 Possible

Bitcoin began September much like August’s Black Monday, when its price dipped below $50,000. This month, the rapid drop below $54,000 is likely due to market distribution and weaker-than-expected US jobs data.

From a technical standpoint, the daily chart shows Bitcoin is trying to extend its gains. However, for this to happen, the price needs to close above the 20-day Exponential Moving Average (EMA).

Currently, Bitcoin is trading below the 20 EMA (blue), suggesting resistance around $58,000. Even if it manages to close above $58,000, additional resistance from the 50-day EMA (yellow) lies near $60,000.

Read more: 5 Best Platforms To Buy Bitcoin Mining Stocks After 2024 Halving

If Bitcoin fails to break through, its price may fall to $56,209 or, in a worst-case scenario, to $52,954. On the flip side, if BTC clears the $60,000 resistance, it could invalidate the bearish outlook. This would set the stage for a strong last-quarter rally, potentially driving Bitcoin toward $70,000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source: https://beincrypto.com/bitcoin-price-to-face-pullback-before-rally/