- Bitcoin dips 2.5%; long liquidation, Musk-Trump spat impact.

- Institutional demand strong, $9B in ETF inflows.

- Retail shifts towards crypto stocks amid high BTC prices.

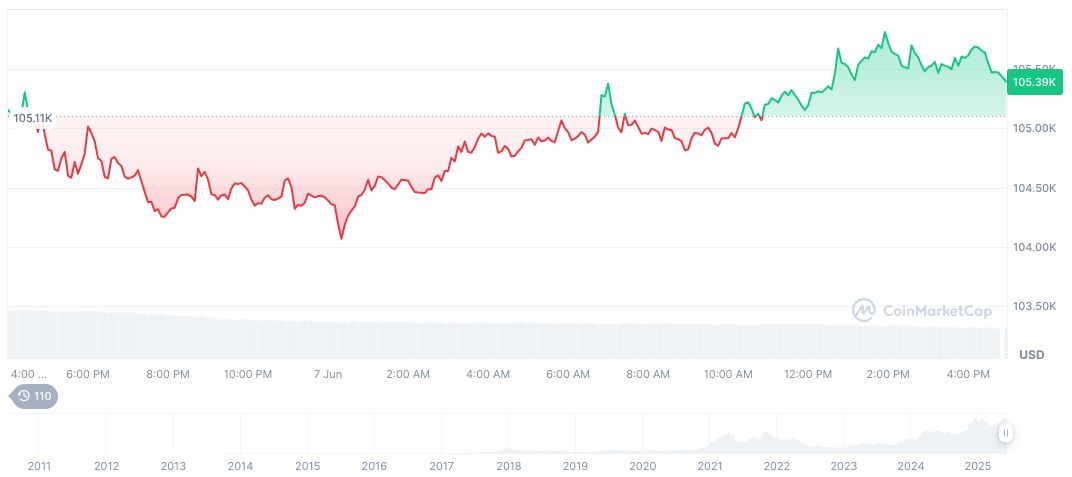

Bitcoin’s price dropped 2.5% over the past week, due in part to a hefty $3.08 billion long position liquidation and tensions between Elon Musk and Donald Trump. As of June 8, 2025, Bitcoin’s price stayed stable at around $105,100.

The price movement underlines a growing trend among retail investors shifting towards crypto stocks rather than direct purchases of Bitcoin, given the high prices of the latter. This trend is highlighted by increased investments in crypto equities over the past weeks.

Bitcoin Decline Amidst $3.08B Liquidation and Musk-Trump Tensions

The market saw a major Bitcoin price decline attributed to a $3.08 billion liquidation. The public dispute between Elon Musk and Donald Trump aggravated market uncertainties. Additional insights can be found on Twitter, where Market insights from Ted Pillows on current trends are shared.

Institutional interest remains robust amid these pressures, with $9 billion in recent inflows into U.S. spot Bitcoin ETFs, indicating confidence among large investors despite the short-term price dip. According to the Research Team at 10x Research, “The heavy institutional inflows to Bitcoin ETFs signal an ongoing maturation of the market despite price fluctuations.” Retail investors, deterred by high prices, are increasingly favoring crypto stocks to gain exposure instead of directly holding Bitcoin.

Market reaction included noticeable shifts as crypto investment vehicles adjust. High-profile events such as Robinhood’s growing crypto revenue and Circle’s anticipated IPO reflect the structural market shift. While key industry figures have yet to comment on these developments, the rise in stock market caps suggests a strong institutional backing paired with retail excitement surrounding crypto equities.

Retail Shifts Towards Crypto Stocks as BTC Prices Soar

Did you know? Historical large-scale liquidations, particularly during high-profile disputes such as the recent Musk-Trump confrontation, have routinely led to rapid Bitcoin price shifts, underscoring the considerable impact such events have on short-term volatility.

Bitcoin’s current price is $105,557.40, according to CoinMarketCap, representing minor decreases in the recent period. The asset’s dominance in the market stands at 63.71%, with a trading volume dipped by 18.64%. Over 60 days, Bitcoin saw a significant 38.80% price jump, demonstrating its inherent volatility.

According to industry analysis, the ongoing shift towards crypto equities could continue if Bitcoin remains expensive for retail investors. Analysts suggest that this trend aligns with previous cycles where crypto stocks temporarily outperformed spot assets before corrective adjustments. Insights on these market movements are elaborated by Crypto Mich. As institutional demand sustains, crypto equities like Coinbase and Robinhood may experience much of the retail focus traditionally reserved for Bitcoin itself.

Source: https://coincu.com/342148-bitcoin-drop-musk-trump-impact/