Bitcoin price crash to the support levels at $110,000 in another major crypto market liquidation event, as analysts predict another 15% drop ahead. Furthermore, as the ‘debasement trade’ kicks in, Gold has had an upper hand with price soaring to $4,200 per ounce. Short traders are piling up, and if they break the immediate support level, BTC could crash to $96,530.

Bitcoin Price Crash Tests Crucial Support in a Make-or-Break Event

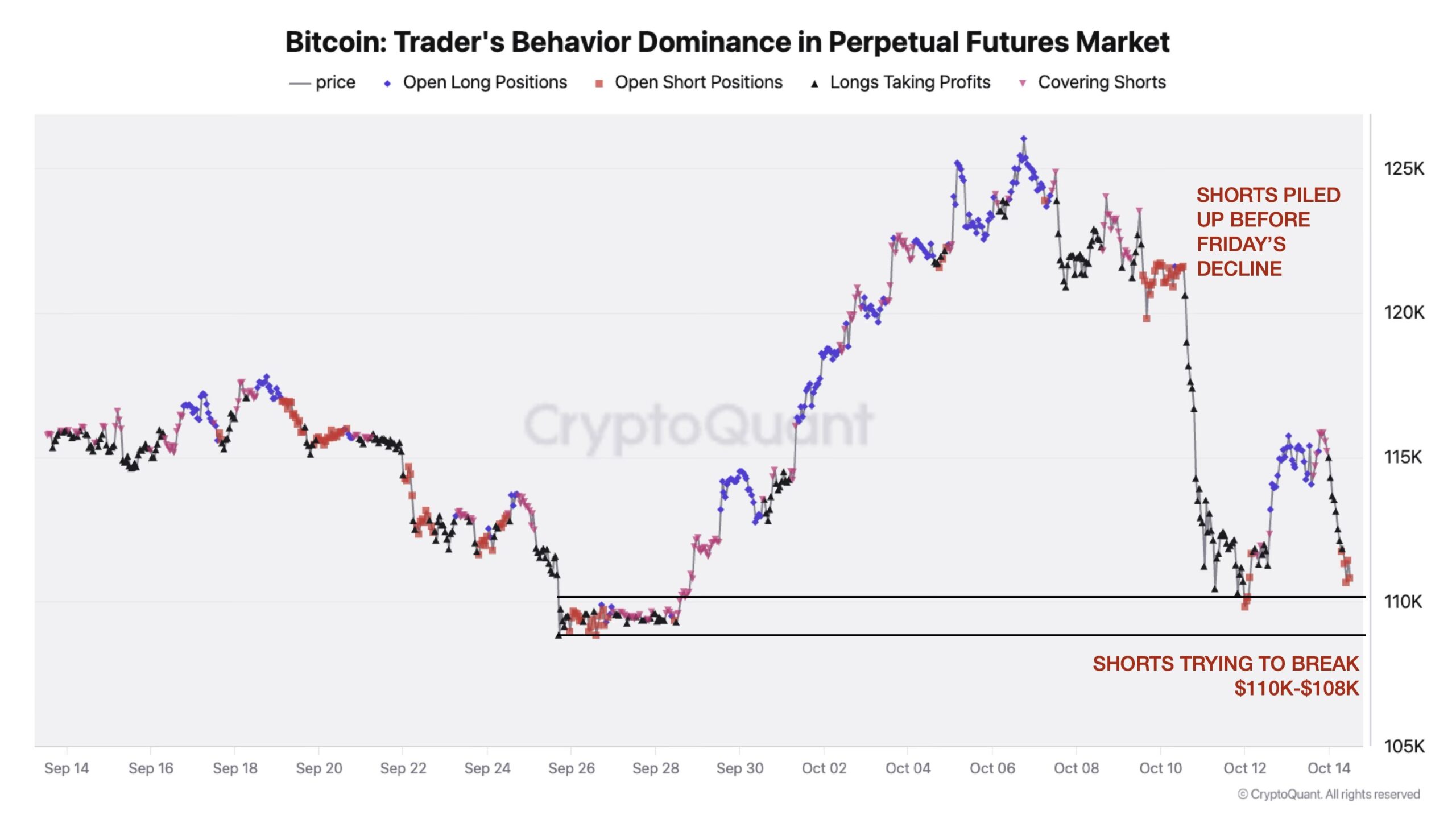

CryptoQuant Head of Research Julio Moreno noted that short traders are repeatedly attempting another Bitcoin price crash to the key $110,000–$108,000 range. Moreno highlighted that this is the third such attempt, adding that a significant buildup of short positions occurred just before Friday’s crypto market crash.

On the other hand, crypto analyst Ali Martinez also stated that BTC needs to regain the $119,000 level to maintain its bullish momentum. He noted that the on-chain data and BTC pricing bands hint that failure to regain these levels, could trigger a correction with potential Bitcoin price crash to $96,530.

Bloomberg senior commodity strategist Mike McGlone questioned Bitcoin’s recent performance, noting that despite carrying “over twice the risk,” it has delivered roughly the same returns as the S&P 500 since surpassing the $100,000 mark.

McGlone added that with most risk assets underperforming gold in 2025, the trend could be signaling a potential “sell bell” for broader markets. Furthermore, the Bitcoin ETF outflows also suggest that institutions are selling during the current market conditions.

Gold Gains An Upper Hand In Debasement Trade

With the US Dollar losing its value, Gold seems to be having the upper hand over other asset classes as part of the debasement trade. The current Bitcoin price crash has further widened the difference between the two. However, BTC might regains strength as Fed Chair Jerome Powell hinted at upcoming Fed rate cuts in his recent speech.

Gold futures surged past $4,200 per ounce for the first time in history, marking a nearly 60% gain in 2025 alone. The precious metals rally has outpaced major equity benchmarks, with gold and silver rising more than four times the performance of the S&P 500. Speaking on the development, Bitwise Investment CEO Hunter Horsley wrote:

“It’s all a debasement trade. It increasingly seems that all asset classes – equities, real estate, crypto, commodities, fx, fixed income, credit, infra – can and should be evaluated by the extent to which they benefit from the underway and coming currency debasement”.

Analysts note that such simultaneous strength in safe-haven assets and risk markets reflects growing concerns over fiat currency stability. The strong performance of gold and silver amid a broader equity uptrend signals waning investor confidence in fiat currencies.

Source: https://coingape.com/bitcoin-price-crash-to-96530-ahead-per-expert-as-gold-wins-in-debasement-trade/