Bitcoin price regains momentum and is finally above $36,000 as supply held by long-term holders increases to all-time highs.

Published 16 hours ago

Bitcoin price prediction reveals the possibility of another bigger breakout in November, which could blast the bellwether crypto above $40,000 over the next few weeks and trigger an extended rally to $50,000 before the end of the year.

BTC price had reclaimed support above $35,000 on Wednesday and was trading 0.6% higher at $35,400.

Although the trading volume has shrunk significantly from the highest levels recorded in October, it was holding above $15 billion — noticeably higher than levels seen in September and August.

Bitcoin Supply is Historically High

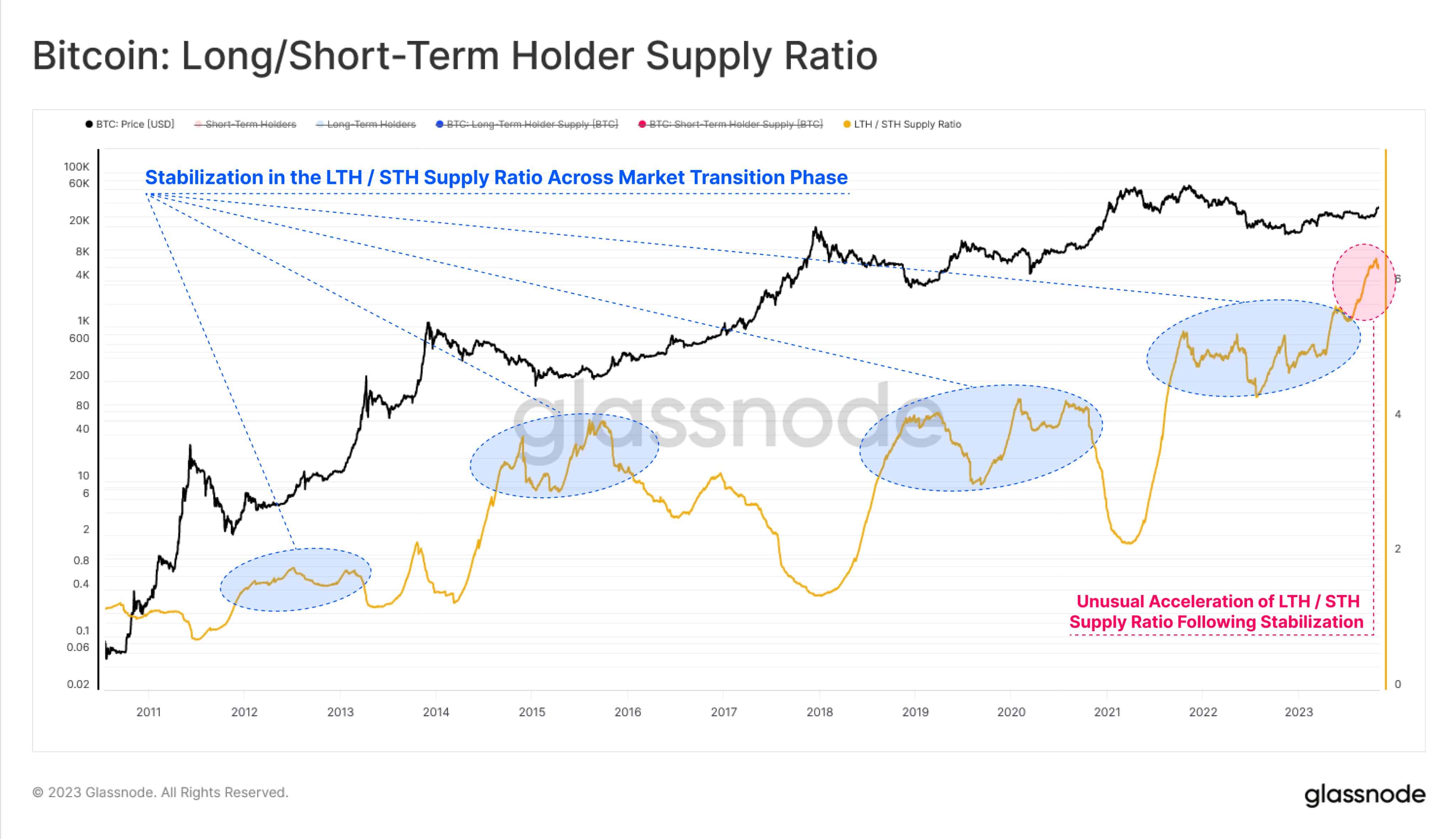

According to the latest on-chain insights by X user @_Checkmatey_ using blockchain metrics from Glassnode, “The Bitcoin supply is historically tight, with an all-time high in coins held by long-term investors, and impressive rates of accumulation taking place.”

On-chain metrics highlighted by analysts at Glassnode reveal that long-term investors are not motivated to spend their coins, leaving the supply dormant. However, BTC purchased in the last year, which mainly comprise short-term holders moved in a cyclical nature. What stands out among all cohorts of Bitcoin holders is that supply across the board is hitting new all-time highs in 2023.

Meanwhile, the number of active addresses transacting Bitcoin is at the highest level since 2022 following following the rally to the all-time high close to $70,000 in 2021.

As more people transact Bitcoin, they create liquidity and momentum for the anticipated rally. Therefore, it is safe to say that Bitcoin price is gradually getting fundamentally ready for the bull run.

Bitcoin Price Prediction: Are Traders Ready to Back The Next Breakout?

Based on the On-Balance-Volume (OBV) indicator, traders are willing to bet on long positions in Bitcoin price as opposed to shorting the largest crypto. The OBV shows the direction of the volume in the market, either flowing in or out. A consistent uptrend indicates that the inflow volume significantly outweighs the outflow volume, hence the growing potential for another breakout in the short term.

In addition to trading above all three Bitcoin bull market indicators; the 50-week Exponential Moving Average (EMA), the 100-day EMA (blue), and the 200-day EMA (purple), a bullish cross on the weekly chart increases the chances of Bitcoin price climbing above $36,000—the immediate resistance and reaching to close the distance to $40,000.

The bullish cross would manifest with the 50-week EMA flipping above the 100-week EMA. It validates the optimistic thesis, encouraging traders to keep their long positions open for gains toward $40,000.

However, if BTC price is rejected from $36,000 for the second time, the correction that follows may need to extend to lower levels at $33,000 and $30,000 where bulls will seek liquidity for a large larger breakout.

Related Articles

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/markets/bitcoin-price-prediction-as-supply-tightens-can-bulls-push-btc-to-50k-before-year-end/