After a brutal sell-off on Monday that wiped out over $8 billion in positions across crypto markets, Bitcoin (BTC) bounced 12.35% to $102.5K. A closer look at the funding rate explains the sharp recovery rally and why the outlook remains bullish for Bitcoin price.

Bitcoin Price Today: BTC up 3.59%, Trades at $98,859.0

Although Bitcoin price briefly recoverd above $100K on Monday, today BTC trades at $98,859.0. The 12.35% recovery rally on Monday has come undone. Does this mean the bullish recovery momentum has declined? Will this lead to a consolidation, or will BTC climb higher?

*bitcoin price updated as of 10 AM

BTC is up 3.59% on February 4, but the funding rate hints at what Bitcoin price could do next.

Bitcoin’s Funding Rate Predicts Recovery Rally to Continue

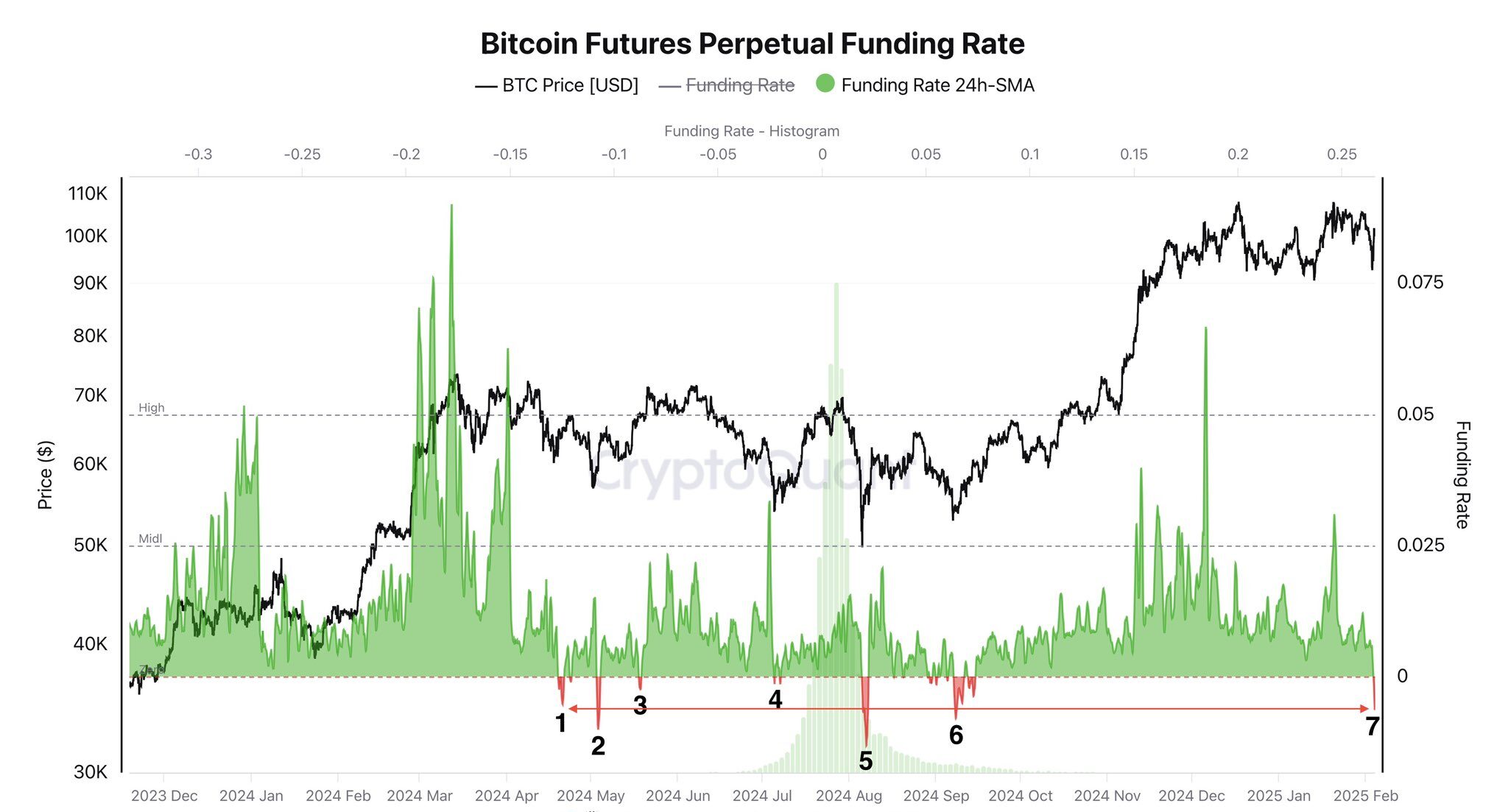

The funding rate is a recurring fee collected from traders to maintain the price of a perpetual contract and the underlying asset’s spot price. A positive funding rate suggests a bullish sentiment, and negative funding indicates a bearish sentiment. If funding is positive, long positions pay short positions and vice versa.

The chart shows that the last few times the 24-hour funding rate flipped negative, BTC catalyzed a quick reversal. If history rhymes, the recent crash could also be undone, and the initial spike would be just a hint of what’s next.

While the recent recovery rally and funding rates are hinting at an optimistic future, let’s look at what Bitcoin price analysis is indicating

Bitcoin Price Analysis: What’s Next?

Despite the recent crash and more than $8 billion in liquidations, the bullish Bitcoin price trend remains intact. Although BTC briefly swept $92.5K, the recovery has led to a daily candlestick close above a key support level of $97.2K. So long as the bulls defend this level, investors can expect the uptrend to resume.

The next critical range extends from $101.4K to $105.5K, where Bitcoin price could face resistance. Escaping the $110K all-time high (ATH) could propel BTC to a new ATH of $123K. This new peak coincides with the 161.8% Fibonacci extension level of the 23% uptrend between January 13 and 20.

A similar fractal was seen with the 14% rally noted between November 14, 2024, and November 23, 2024. Extending this move showed Bitcoin forming an ATH at $108.3K, which coincided with the 161.8% Fibonacci level.

Key Levels to Buy BTC & Book Profits

As noted above, the next key hurdle ranges from $101.4K to $105.5K. Clearing this would open the path to revisiting the ATH at $110K. Bitcoin price prediction notes that clearing $110K could lead to a new ATH of $123K.

If Bitcoin price flips the critical support level of $97.2K, it could catalyze another leg down. In such a case, the strategic levels to buy dips include $92.5K, $89K and $85.8K. These levels have previously served as key support levels hence a bounce here is high probability.

Source: https://coingape.com/bitcoin-price-briefly-reclaims-100k-funding-flips-negative-whats-next-for-btc/