- Bitcoin expected to hit $150,000 by 2025 driven by institutional interest.

- Record institutional inflows through spot ETFs boost legitimacy.

- U.S. policy reforms further support Bitcoin’s adoption and potential.

Global financial consulting firm deVere Group, on August 16, predicted Bitcoin could hit $150,000 by year-end 2025, driven by institutional inflows and US policy support.

Bitcoin’s projected rise highlights its growing legitimacy as an asset amid strong institutional adoption and supportive US policies, impacting market sentiment and investment strategies.

Bitcoin’s Institutional Surge and Policy Impact

Global consultancy deVere Group forecasts Bitcoin reaching $150,000 by late 2025. CEO Nigel Green argues that strengthening institutional purchases, corporate bond integration, and favorable U.S. policies underpin this bullish outlook.

With the record inflows into spot ETFs and corporate recognition of Bitcoin as a reserve asset, market dynamics have shifted drastically. This momentum has been bolstered by the expectation of looming policy support.

Financial markets have noted this prediction; major figures echo supportive sentiments. Green emphasizes Bitcoin’s legitimacy elevation due to vast institutional endorsement, urging investors to monitor policy and sovereign signals closely.

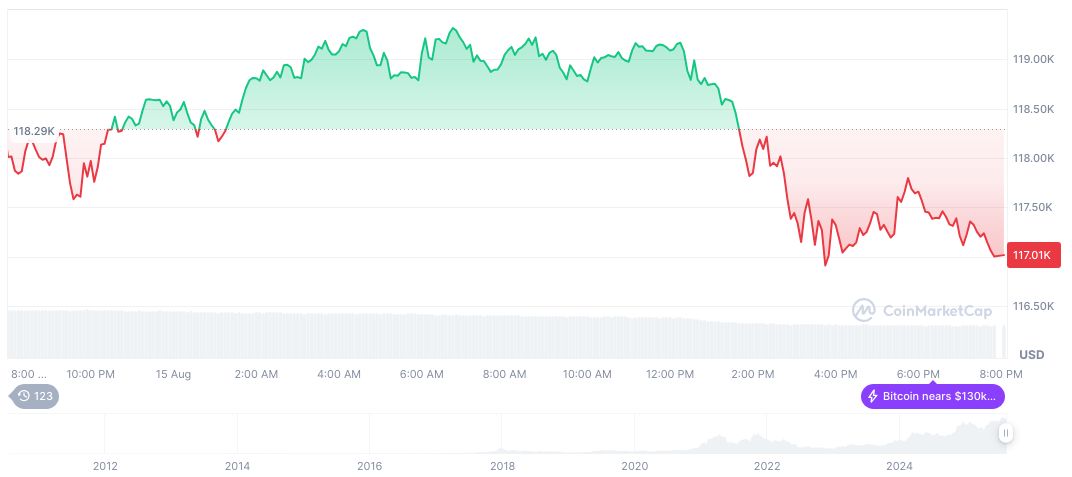

Bitcoin at $117,799: Analysis and Future Outlook

Did you know? In 2020, institutional recognition began lifting Bitcoin from a volatile asset class to a digital strategic reserve, foreshadowing broader mainstream adoption later observed in ETFs and national reserves by 2025.

As of August 16, 2025, Bitcoin (BTC) trades at $117,799.52, with a market cap of $2.35 trillion, per CoinMarketCap. It commands a market dominance of 58.97%. Despite recent price fluctuations, Bitcoin’s positioning remains robust due to institutional and policy endorsement.

Experts from Coincu highlight that Bitcoin’s rise aligns with trends in U.S. regulatory favorability and the steady technological advancements driving mainstream financial integration. Historical data suggests these factors often catalyze price climbs.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/bitcoin-target-150000-2025/