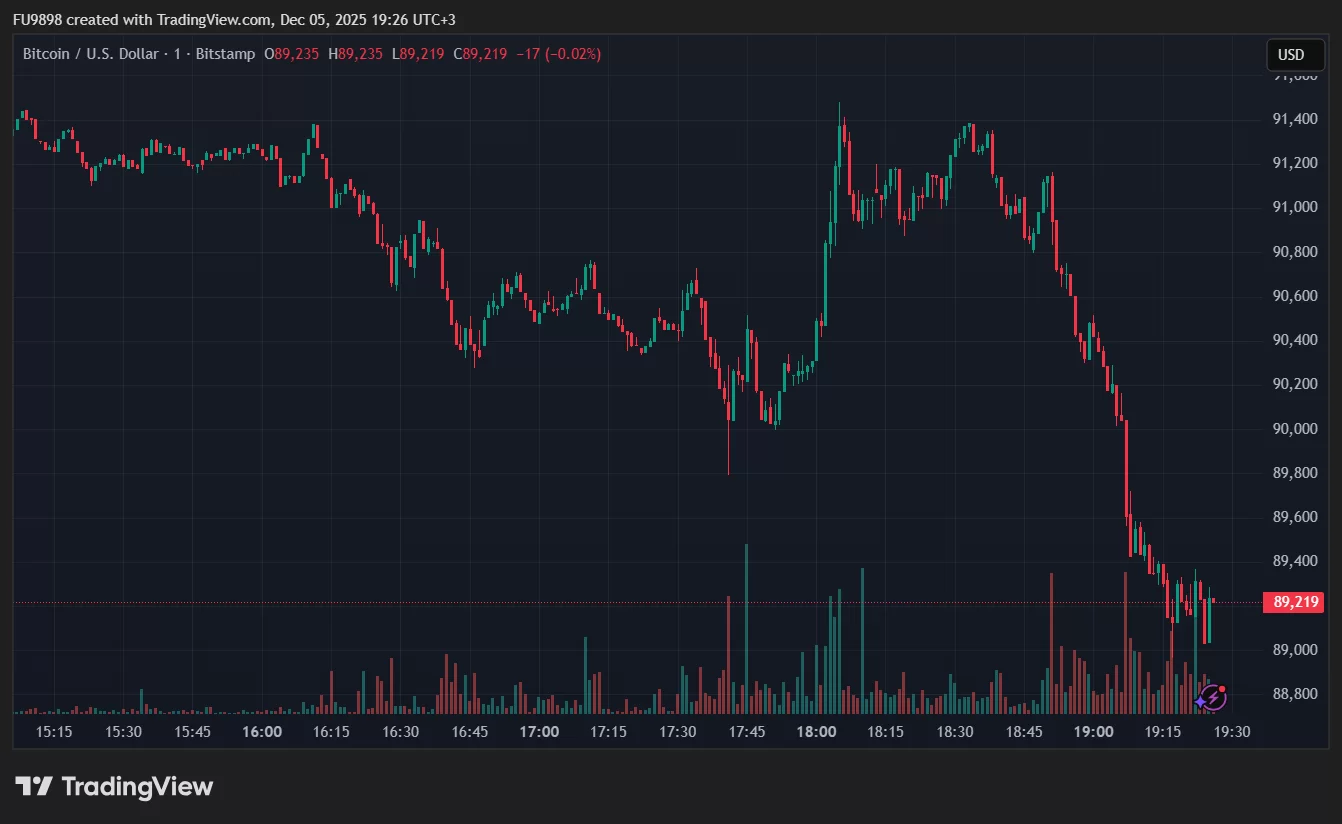

The price of Bitcoin (BTC) experienced a sudden drop below $90,000 amid renewed volatility in the market.

BTC, which lost nearly 2% of its value in the last hour, fell to $88,964. This move led to sharp liquidations, particularly in highly leveraged positions. Bitcoin’s market capitalization stood at $1.78 trillion, with 24-hour trading volume reaching $60.6 billion.

This sudden price surge triggered a cascade of leveraged liquidations. A total of $96.9 million in positions were liquidated in the last hour, $93.8 million of which were long positions. The total of liquidations in the last 24 hours reached $435.6 million, with Bitcoin alone accounting for $170.9 million in liquidations.

The rest of the market is experiencing similar volatility, led by Bitcoin. Ethereum fell to $3,072, shedding over 2% in the last hour. While the 24-hour outlook for major altcoins like Solana, XRP, BNB, and Dogecoin remains positive, short-term volatility has increased significantly.

A look at the distribution of liquidations shows Bitcoin and Ethereum leading the way. Over the 24-hour period, $170.9 million was liquidated in BTC, $101.8 million in ETH, and $22 million in Solana. Even smaller-cap assets like FARTCOIN, ZEC, and PUMP experienced millions of dollars in liquidations, indicating that selling pressure has spread throughout the market.

Despite this volatile trend, a slight selling trend was also noted in traditional markets. The Nasdaq index ended the day with a small 0.02% decline.

*This is not investment advice.