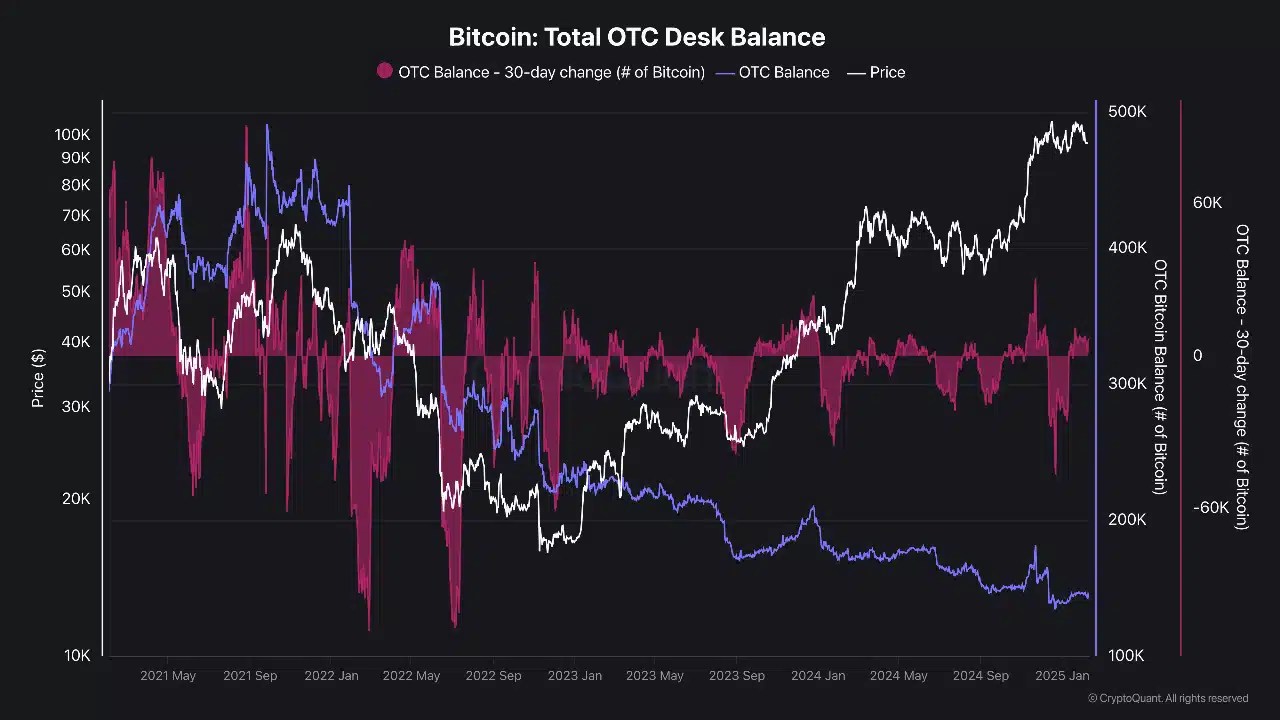

- Bitcoin’s OTC Desk balance declined sharply, which could constitute a key factor in this cycle.

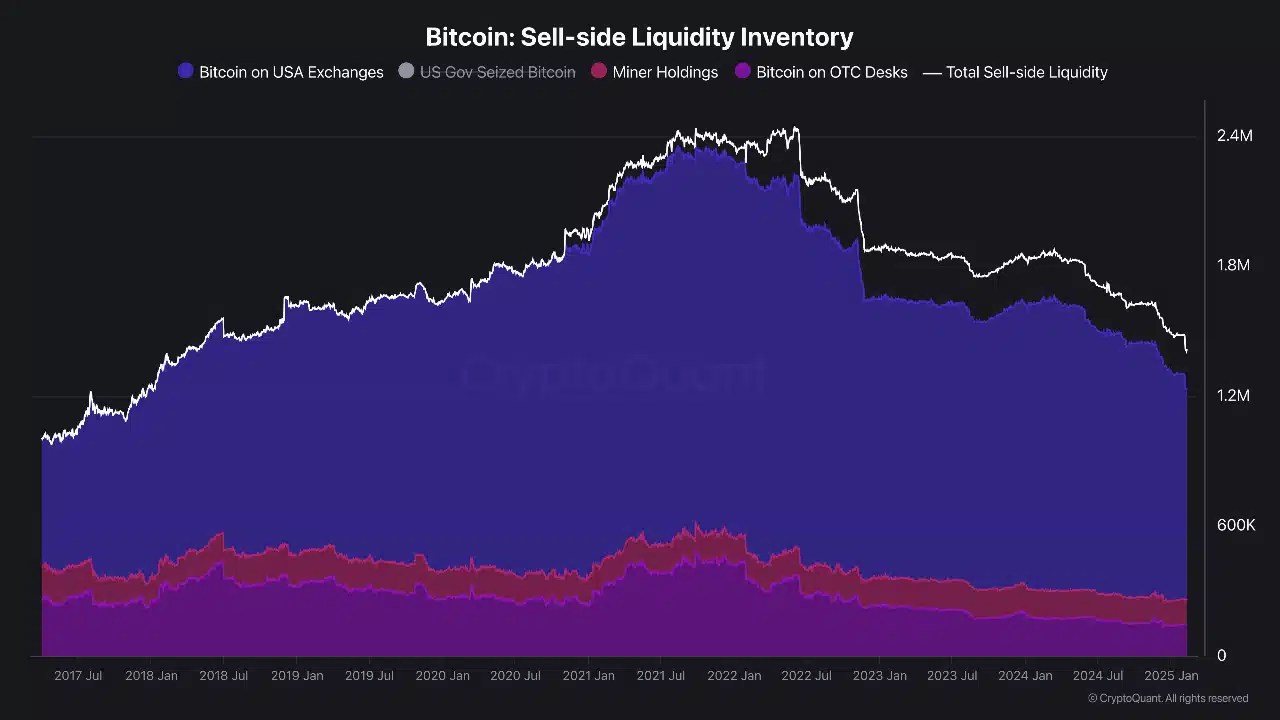

- U.S. exchanges were holding nearly 1M BTC, contributing to a substantial sell-side liquidity inventory.

Over time, Bitcoin’s [BTC] price movement has been impacted by many factors, including market sentiment and institutional investment strategies.

A critical but often overlooked factor is the role of Over-The-Counter (OTC) desks.

How large players trade Bitcoin

OTC desks allow large-scale Bitcoin transactions to occur privately and with minimal market impact.

These desks are primarily used by institutional investors, enabling them to buy or sell large quantities of Bitcoin without causing substantial price slippage.

Source: CryptoQuant

According to CryptoQuant, Bitcoin’s OTC desk balance was around 480k BTC in September 2021. Now, this balance has decreased to just 146k BTC, despite the king coin reaching $100k.

This steady decline reflects sustained institutional demand, which indicates the increasing use of OTC desks for large transactions.

The decline of OTC balances and its impact

Sequentially, the fall in Bitcoin held by OTC desks has substantial implications.

With only 146k BTC remaining, future large purchases will likely need to happen directly on public exchanges, which could influence prices more directly.

Source: CryptoQuant

U.S. exchanges currently hold nearly 1M BTC, contributing to a substantial sell-side liquidity inventory.

Additionally, miners, who have around 117k BTC, may also sell through OTC, but this varies depending on their preferences.

As OTC desk balances deplete, exchange-based transactions will become more prominent, leading to more noticeable and immediate price movements.

Deciphering large transactions

Recent whale movements in Bitcoin are significant, with over 60,000 BTC moved in the past week. These movements, alongside netflow data, offered valuable insights into market behavior.

Source: IntoTheBlock

As indicated by Into The Block analysis, positive Netflow into exchanges suggests selling pressure, but recent trends indicate a shift toward accumulation, which may signal an impending price rally.

So, large investors are positioning themselves strategically, either in anticipation of market movements or as a reaction to current conditions, directly impacting Bitcoin’s price trajectory.

Navigating Bitcoin’s evolving landscape

The decline in OTC desk balances and the shift toward exchange-based transactions could cause Bitcoin’s price to become more volatile.

Also, large trades on exchanges may lead to short-term price spikes or drops, depending on market liquidity and sentiment.

Given the accumulation by whales and the dwindling OTC reserves, we could see increased market volatility followed by a price stabilization at a higher level due to continued institutional demand.

As Bitcoin’s market evolves, large transactions on exchanges will become the norm, making the market more dynamic and responsive to these shifts.

The depletion of Bitcoin held on OTC desks and the shift to exchange-based buying signals a transformative phase for Bitcoin’s market.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

Institutional investors’ moves will increasingly influence the price, making Bitcoin’s market more volatile in the short term.

Over time, this could lead to higher prices as demand continues to pressure the market, highlighting the importance of adapting to these evolving market dynamics.

Source: https://ambcrypto.com/bitcoin-otc-supply-drops-70-since-2021-a-sign-of-looming-supply-shock/