Bitcoin might be having trouble initiating a major rally soon, however, investors’ interest in the flagship digital asset appears to be growing as the number of active addresses has begun to rise once again, indicating heightened engagement from both old and new investors.

Bitcoin Active Addresses Regains Steam

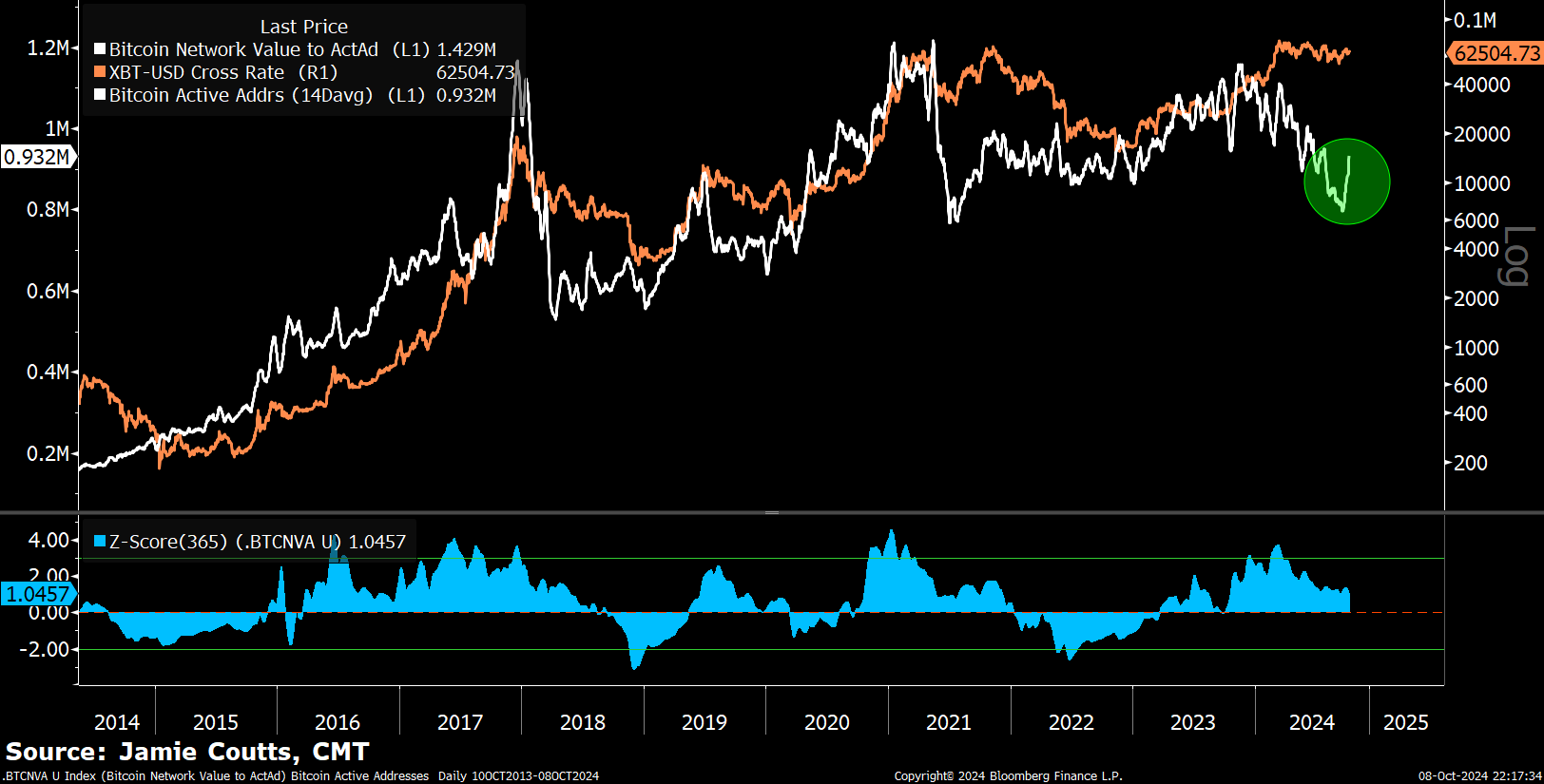

In a positive and significant development, the number of active Bitcoin addresses has rebounded sharply in light of ongoing market fluctuation, highlighting renewed interest and network activity. The chief crypto analyst at Real Vision, Jamie Coutts shared the development on the X (formerly Twitter) platform on Tuesday.

This resurgence in active BTC addresses comes after a lengthy downtrend, which lasted for about 11 months, signaling a possible shift in market dynamics. Following the surge, BTC’s price could be poised for an upward movement since it usually correlates with potential price movements.

According to the expert, this indicator is still one of the most important base-level on-chain metrics, despite a decline in forecast accuracy during the last four years. Coutts further pointed out several factors that might have triggered the drop such as significant Exchange-Traded Fund (ETF) flows, rising usage of Layer 2 solutions like Lightening for payments, and modification of on-chain behavior due to the influence of Non-Fungible Tokens (NFTs), Ordinals, and others.

He also highlighted his anticipation about a 2x to 5x rise in the value of Bitcoin in the upcoming months, which will mark its all-time high for the ongoing cycle. While Coutts expects BTC to hit a new all-time high, he underlined that a corresponding breakout in active base chain addresses would surely confirm the valuation of the network. This is due to the fact that Bitcoin is a global monetary network, and its future is majorly dependent on its capability to exhibit organic network expansion and adoption across all metrics.

Overall, the end of this lengthy decline in active addresses may represent a turning point for BTC as it gathers traction while providing investors with optimism in light of market turbulence.

Is A New All-Time High For BTC On The Horizon?

Even though BTC has been consolidating for the past few months, several crypto analysts are confident that the crypto asset will hit a new peak soon. Crypto Bullet, a market expert, has underscored Bitcoin’s potential to reach a new all-time high in the short term, triggering optimism within the community.

The expert made the bold prediction based on the BTC Puell Multiple Indicator, which has reached the Green zone, suggesting the end of bear markets. As a result, Crypto Bullet believes that the next or final leg up for Bitcoin, possibly to a new peak, has begun.

Featured image from Unsplash, chart from Tradingview.com

Source: https://bitcoinist.com/bitcoin-active-addresses-count-rebounds/