- President Trump ruled out a U.S.-EU agreement amidst tariff issues.

- Potential delay in tariff discussions remains contingent.

- Market volatility continues, impacting global financial indices.

U.S. President Trump announced on May 24, 2025, that he is not pursuing an agreement with the European Union during the ongoing trade disputes.

U.S. President Trump has stated that he will not pursue an agreement with the European Union as trade tensions persist. This announcement reflects the ongoing challenges in the U.S.-EU relations over tariff impositions. The decision aligns with prior positions voiced by U.S. trade representatives. Existing tariffs have already seen EU leaders prepare countermeasures, as their trade chief previously announced comprehensive retaliatory considerations. The trade war disputes remain unresolved amidst efforts for potential recalibration by both sides.

Trump Rules Out Trade Agreement With EU

The possible delaying tariffs discussion hinges on the EU contemplating a turn toward the U.S. Such a shift could introduce new dimensions to the ongoing dialogues. Stakeholders continue to analyze the implications of halted agreements on both U.S. and EU economies, leaving questions regarding future strategies.

Financial markets reacted promptly, with prominent figures expressing concerns about what these tensions mean. U.S. Treasury Secretary Besent highlighted the need for mutual “sincere negotiations” in advancing diplomatic solutions. Industry reactions remain diversified as economic leaders discuss the impact on global trade trajectories.

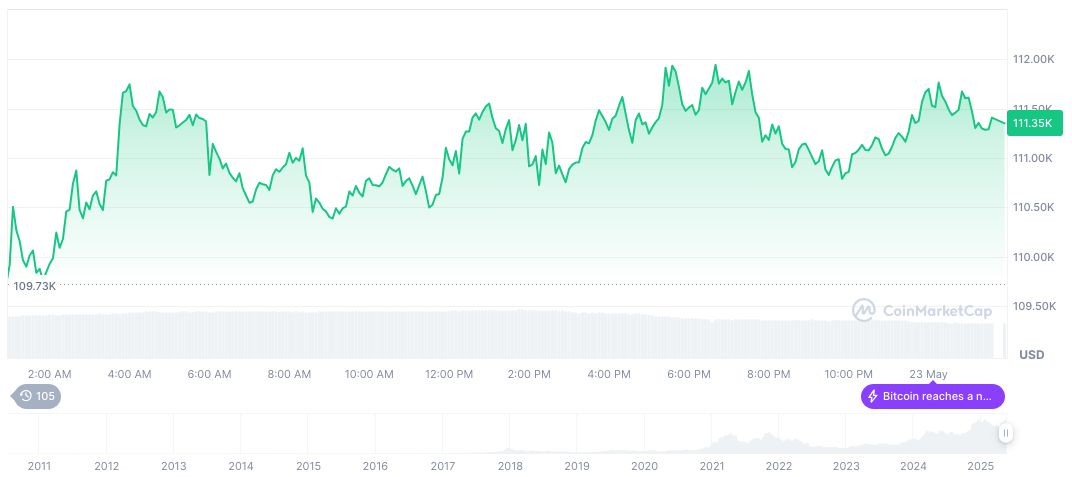

Bitcoin’s Reaction Highlights Market Volatility

Did you know? Trade tensions between the U.S. and EU have roots dating back to early 2025, when tariffs were first imposed, sparking broader international economic impacts that continue to evolve today.

Bitcoin’s current market statistics show it trading at $108,850.59, with a significant market cap of $2.16 trillion and a dominant 62.98% market share, as reported by CoinMarketCap. Monday’s activity saw a 2.67% dip, while weekly gains reached 4.85%. Its circulating supply is at 19,868,853 BTC, nearing its maximum supply of 21 million.

Coincu’s research anticipates potential shifts in global financial landscapes, as regulatory and technological changes proceed in response to U.S. trade decisions. Analysts suggest continued scrutiny on market performance and regulatory adaptations as influencing factors in shaping global economic strategies.

“This is a significant turning point for the U.S., but we stand prepared to negotiate.” — Ursula von der Leyen, President of the European Commission

Source: https://coincu.com/339339-bitcoin-market-u-s-eu-trade-tensions/