Key Takeaways

Why is retail dominance rising in Bitcoin?

Smaller order sizes and red Futures Taker CVD confirmed that retail traders were driving market activity.

How could this affect BTC’s next move?

With whale activity low and inflows up, Bitcoin may stay range-bound between $111k–$115k.

Bitcoin [BTC] extended its rebound, reaching a two-week high of $116,400 before retracing to $114,472 at press time.

Despite the rally, data suggested that institutional investors and whales stepped back from active trading.

Bitcoin retail traders take control

According to CryptoQuant, after BTC recovered from the $108k–$109k demand zone, Futures AverageOrder Size showed a decline in whale participation.

The market instead saw an increase in smaller, retail-driven orders. Usually, when this metric shows red with no green clusters, it indicates a total dominance in retail activity.

Source: CryptoQuant

This market behavior is common during mid-range consolidation or the later phases of local recovery.

Historically, periods of retail dominance have mostly coincided with short-term distribution, as whales wait to reaccumulate at lower levels.

In fact, retail investors leading the Futures market were mostly sellers. The Futures Taker CVD remained red, confirming seller dominance and aligning with smaller order activity.

Source: CryptoQuant

This has coincided with the period of increased retail-driven orders in the Futures market. Futures Netflow further evidences this market trend.

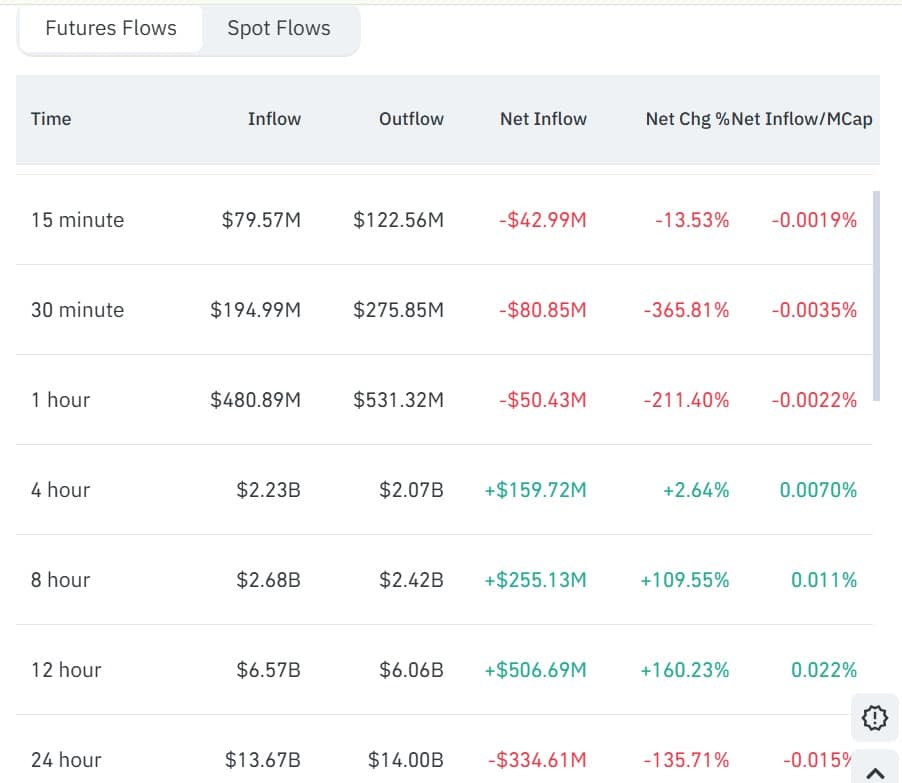

As per CoinGlass data, Futures Netflow dropped 135%, to -$334.6 million at press time, with outflow hiking to $14 billion.

A negative Netflow suggested most investors in the Futures were actively closing positions, a clear bearish sign.

Source: CoinGlass

Spot mirrors the same trend

The Spot Taker CVD chart also stayed red for seven consecutive days, highlighting persistent selling pressure from retail traders.

Source: CryptoQuant

At the same time, Exchange Netflow was positive for four of the last six days, with inflows around $42 million, signaling increased deposits to exchanges—usually a precursor to selling activity.

Source: CoinGlass

What’s next for BTC?

AMBCrypto’s analysis showed that retail traders now dominate both Futures and Spot markets. Whales have largely withdrawn, waiting to buy at lower levels.

When retail activity peaks, BTC often trades sideways within a defined range as professionals remain cautious.

If this retail-driven volatility continues, BTC could stay between $111k–$115k. A breakout within that band, driven by renewed large-order flows, would indicate institutional accumulation.

Like the 2024 whale-led rally, fresh institutional entry could lift BTC toward $119,717, the next key resistance.

Source: https://ambcrypto.com/bitcoins-rally-loses-its-whales-to-retailers-is-btcs-consolidation-ahead/