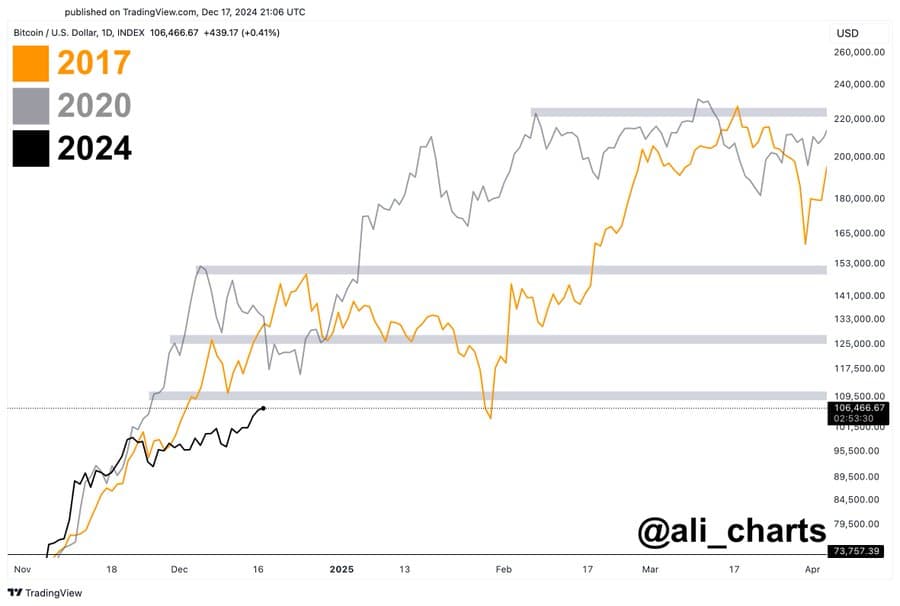

- BTC appeared to be following the trajectory of the previous bullish cycles of 2017 and 2020, potentially setting the stage for a significant price surge.

- Long-term holders were expected to play a pivotal role in this phase, contributing to upward price momentum.

Bitcoin’s [BTC] has maintained its position above the psychological level of $100,000 for several days, despite broader market declines following its all-time high of over $108,000.

Over the past week, BTC has struggled to sustain its monthly profitability, posting a modest gain of 0.64%. In the last 24 hours, it recorded a 2.05% increase.

According to AMBCrypto, these fluctuations could be part of a broader rally, as BTC moves toward establishing new record highs.

BTC to $220,000: A cautious journey ahead

BTC was mirroring the historical patterns of its 2017 and 2020 bullish cycles, suggesting a potential market peak at $220,000, according to crypto analyst Ali Chart.

As BTC follows this trajectory, it is expected to encounter three key resistance levels, where selling pressure may arise before resuming its upward momentum.

The ongoing market decline appears to align with this broader structure, progressing toward these critical zones.

Source: X

Ali Chart outlined the potential price milestones:

“If Bitcoin (BTC) behaves like in 2017 and 2020, there will be a brief correction after reaching $110,000, a steep correction after hitting $125,000, a big correction at $150,000, and the end of the bull market at $220,000!”

AMBCrypto analysis indicates that these corrections will likely be influenced by long-term holders, who are currently contributing to BTC’s downward movement.

Long-term holders drive distribution in the market

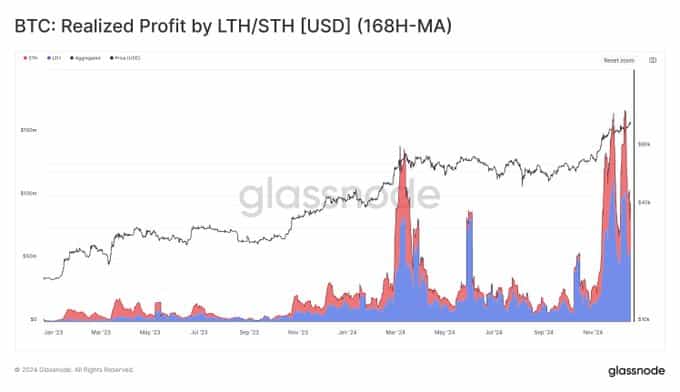

According to Glassnode, market distribution patterns shifted notably after BTC reached a new high, crossing into the $90,000 range in mid-November.

During this period, long-term holders (LTHs) initiated a substantial sell-off, taking profits and driving market activity. This sell-off accounted for 54% to 70% of the trading volume, equating to $73–$117 million per hour.

Notably, a specific market segment has been at the forefront of this profit-taking trend.

Source: X

Further analysis reveals that activity is largely driven by BTC holders who have held their positions for 6 to 12 months. This group, many of whom accumulated during the last market cycle, has been responsible for the majority of profit-taking in recent weeks.

The Spent Output Profit Ratio (SOPR) for this 6–12 month cohort mirrors patterns observed during the 2015–2018 bull market. At that time, the SOPR remained below 2.5 throughout significant portions of the cycle.

Source: X

If history repeats itself, BTC could soon enter an exhaustion phase where profit-taking slows and buying activity resumes. This shift would likely lead to a renewed rally in BTC prices, as seen in previous cycles.

Read Bitcoin’s [BTC] Price Prediction 2024-25

AMBCrypto notes that profit-taking and exhaustion patterns may persist as BTC hits new price milestones.

These phases are expected to trigger corrective moves before further rallies. Potential price corrections could occur at key levels, including $110,000, $125,000, and $150,000.

Source: https://ambcrypto.com/bitcoin-how-this-historical-pattern-can-push-btc-to-220k/