Bitcoin is now witnessing a slowdown in the ongoing correction campaign as it gradually decouples from the bleeding U.S. stock market.

For context, Bitcoin faced a tumultuous start to the week, dropping alongside U.S. stocks amid market uncertainty. The decline followed the launch of DeepSeek by China, which raised concerns about overvaluation in the AI sector, leading to a sell-off across major markets.

However, Bitcoin appears to be recovering more effectively than traditional equities. This has prompted analysts to suggest it may be stabilizing and showing signs of resilience.

André Dragosch, European Head of Research at Bitwise, observed that Bitcoin’s gradual stabilization while the Nasdaq continued to slide is an encouraging sign. He pointed out that Bitcoin outperformed the Nasdaq over the past two trading days, and this showed limited downside.

*** The fact that Bitcoin stabilised while the NASDAQ continued to slide is extremely bullish imo.

Bitcoin also outperformed the NASDAQ over the past 2 trading days.

Bitcoin already showing limited downside here. pic.twitter.com/T9evpCHwIE

— André Dragosch, PhD | Bitcoin & Macro ⚡ (@Andre_Dragosch) January 28, 2025

For context, after recording a 2.07% slump on Sunday, Jan. 26, and a subsequent 0.47% drop on Monday, Bitcoin appears to be recovering from the recent selloff spree. It has since recovered the $100,000 mark, having gained 0.62% today.

Bitcoin Has Room for Growth

Meanwhile, on-chain data suggests the Bitcoin market still has more room to grow despite the prevalent uncertainties. In a recent report, Glassnode revealed that new Bitcoin investors, who have held the cryptocurrency for less than three months, currently control 50.2% of its wealth.

This figure is significantly below the levels seen during previous market peaks—85% in 2018 and 74% in 2021. Analysts believe this indicates the market still has room to grow before reaching speculative extremes.

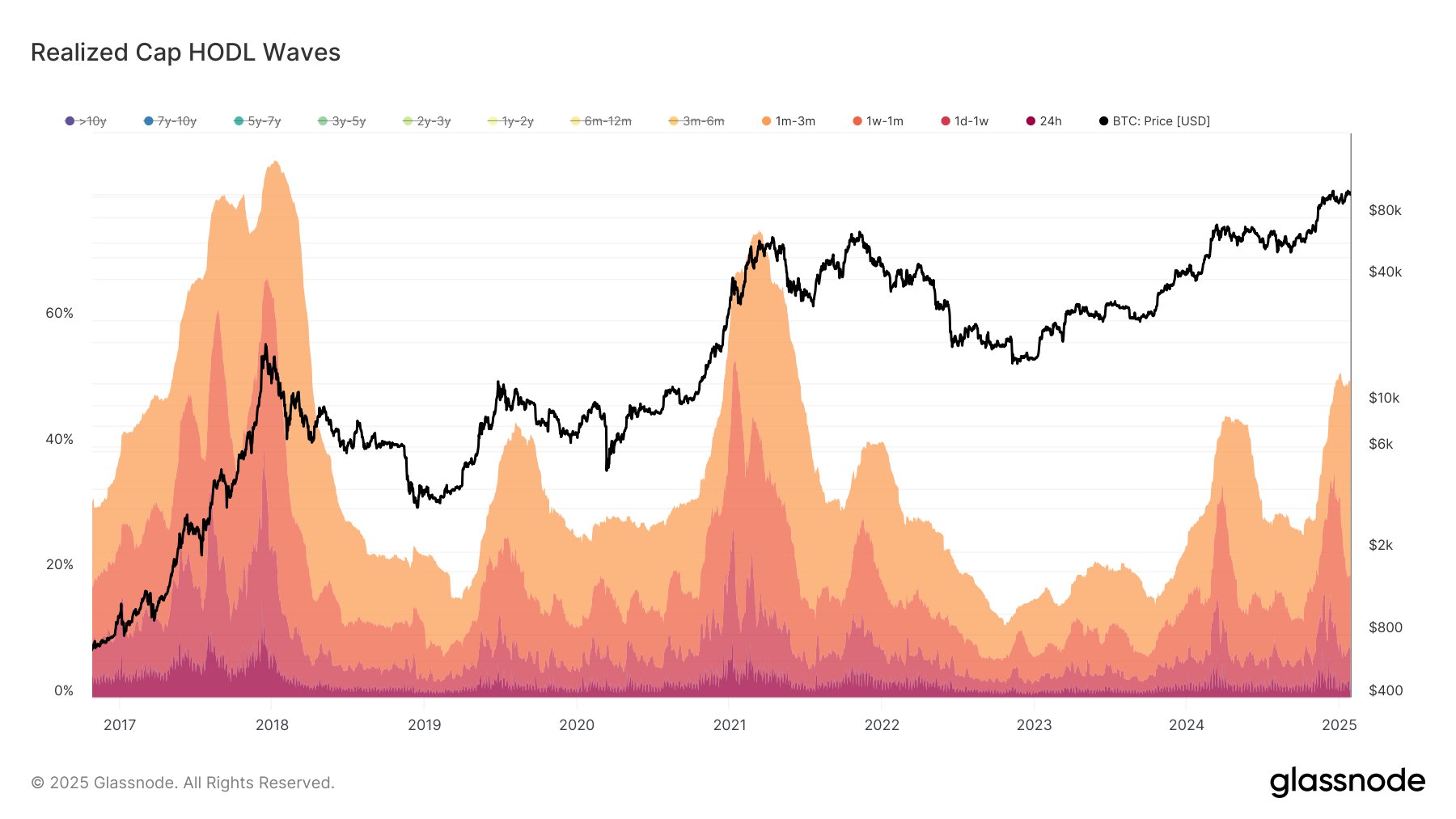

In addition, market watcher IT Tech highlighted Bitcoin’s realized cap and UTXO (unspent transaction output) age bands, which track coin movement across different holding periods, in an analysis on CryptoQuant.

Historically, market tops align with a high proportion of younger UTXOs (held for one day to three months), as seen in the 2013, 2017, and 2021 peaks.

While younger UTXOs have been increasing recently, their levels remain below those of previous cycle tops. IT Tech suggested this could signal that Bitcoin has further upside potential before reaching the distribution phase.

Analysts Remain Bullish

Moreover, most analysts remain bullish on Bitcoin. Michaël van de Poppe, a seasoned market veteran, commented on Bitcoin’s recent gains, describing its daily recovery as impressive.

Tremendous daily candle on $BTC.

I think we’ll continue to go up, all depending on tomorrow’s FED meeting.

What are the odds for a potential rate cut? Probably the markets aren’t expecting one, would be a great surprise. The kickstart for strength on #Altcoins. pic.twitter.com/5UTrJ3kscH

— Michaël van de Poppe (@CryptoMichNL) January 28, 2025

He argued that Bitcoin’s trajectory will likely depend on the outcome of the Federal Reserve’s upcoming meeting. While markets do not anticipate a rate cut, van de Poppe suggested such a move would be a positive surprise and could fuel further gains for Bitcoin.

Meanwhile, Rekt Capital, another analyst, believes Bitcoin has completed its initial price discovery correction. Citing historical data, the analyst suggested that Bitcoin may soon begin its second price discovery uptrend. He believes this could possibly lead to new all-time highs within the next two weeks.

Bitcoin has competed its 1st Price Discovery Uptrend

BTC has most likely completed its 1st Price Discovery Correction

History suggests over the next two weeks…

Bitcoin should be able to embark on its second Price Discovery Uptrend to new highs$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) January 27, 2025

Despite this, a few analysts remain cautious. Trader Daink noted concerns about Bitcoin, pointing to resistance near December’s high at $108,000. He noted that the asset is trading below this high and must surpass this level to confirm bullish momentum.

Daink warned that if Bitcoin fails to clear this resistance, it could drop to December lows of $91,000. However, a breakout above $108,000 could set the stage for a rally toward $121,900. At press time, Bitcoin currently trades for $102,683.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2025/01/28/bitcoin-holds-steady-as-nasdaq-slides-signals-strong-bullish-momentum/?utm_source=rss&utm_medium=rss&utm_campaign=bitcoin-holds-steady-as-nasdaq-slides-signals-strong-bullish-momentum