Disclaimer: This content is a sponsored article. Bitcoinsistemi.com is not responsible for any damages or negativities that may arise from the above information or any product or service mentioned in the article. Bitcoinsistemi.com advises readers to do individual research about the company mentioned in the article and reminds them that all responsibility belongs to the individual.

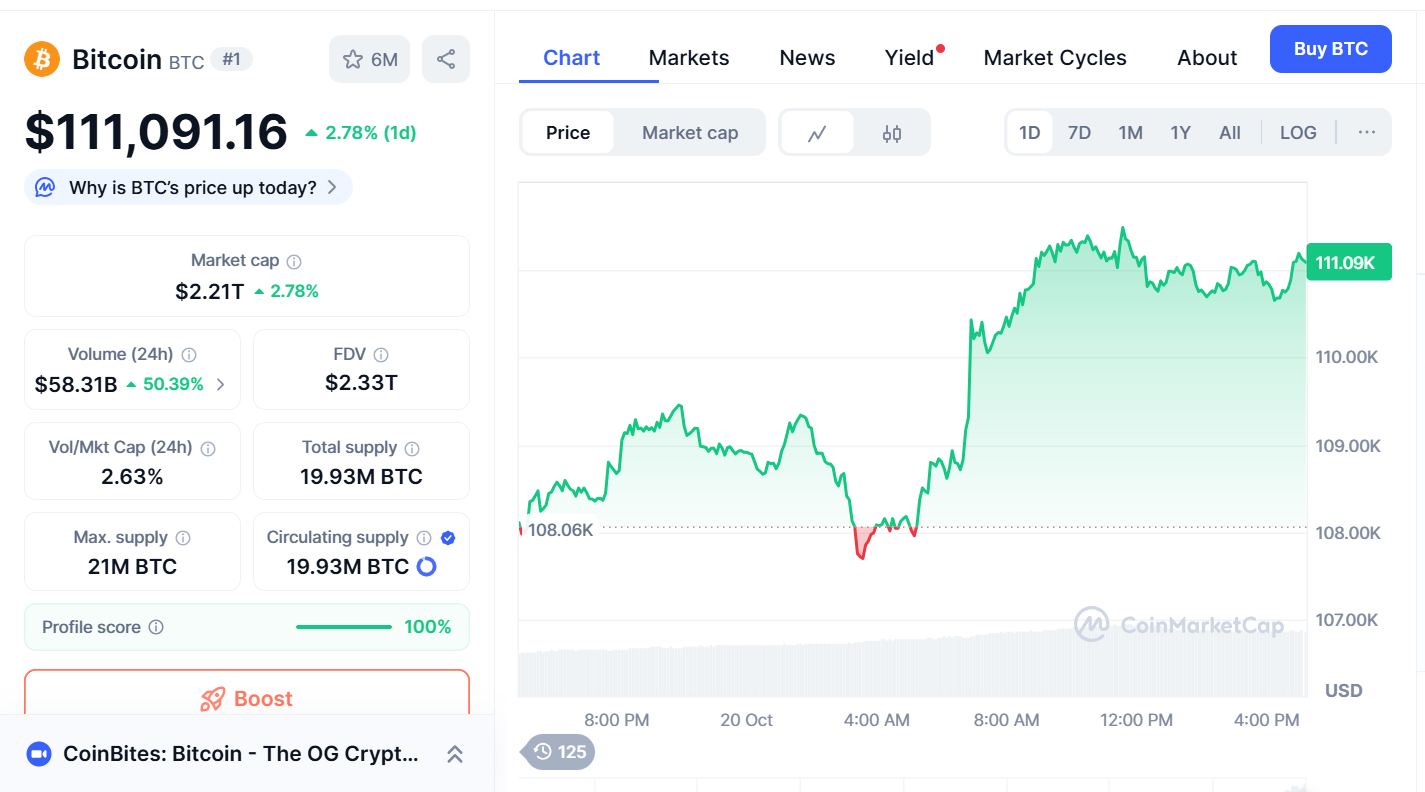

Bitcoin (BTC) is holding strong above $111,000, indicating a period of market calm after weeks of increased volatility. The steady performance is indicative of growing investor confidence as traders adjust to the current mid-cycle phase, a period of often quiet accumulation ahead of the next big rally.

Analysts pointed out that this is an environment that favors disciplined buyers. Both Cardano (ADA) and MAGACOIN FINANCE are shaping up as the best accumulation plays for investors who are looking for long-term exposure. Their stability, strategic development, and growing interest by both investors suggest that they can outperform when market momentum returns.

Bitcoin Consolidates Above Key Support

Bitcoin has solidly rallied in recent days, which improves its mid-term case. After hitting a low of $104,000, the top cryptocurrency has regained the $111,000 level and continues to show signs of resilience. Market data suggests that this range is now a good accumulation range for both the retail and institutional participants.

Source: CoinMarketCap

Analysts say that Bitcoin’s historical mid-cycle stance events are often accompanied by long periods of consolidation. During these times, traders take positions slowly in preparation for the next surge. The $100,000 support continues to be crucial as a breakout above $125,000 could signal renewed bullish momentum.

The wider market sentiment has been boosted by a reduction in geopolitical risk as well as new optimism around trade negotiations. With the macro risks stabilized, the market is moving from short-term volatility to long-term positioning and fundamentals.

ADA Attracts Long-Term Buyers

Cardano (ADA) continues to draw attention from patient investors who are focused on the long-term. For weeks, the asset has been going sideways, without moving away from support near familiar levels.

Analysts point out that ADA’s steady activity among long-term holders is indicative of confidence in its network growth. Its steady updates with development and an active community, along with its growing DeFi ecosystem, strengthen the argument to amass during this quieter phase of the market.

ADA has rallied strongly in the late stages of previous cycles. Traders consider its current range of $0.65 to $0.70 a healthy base. If Bitcoin holds, ADA may be one of the first major altcoins to break higher as the next wave of capital rotation starts.

MAGACOIN FINANCE Gains Recognition in Mid-Cycle Strategy

MAGACOIN FINANCE is getting more attention from large investors quietly buying up as the market is stabilized. These whales are often early movers in new cycles, and so it looks like they are positioning for the next phase of expansion. Their steady purchasing reflects confidence in the long-term potential of the project and confidence in the market’s ability to withstand.

To add to the excitement, the project recently introduced the Patriot50X bonus, offering early participants 50% additional tokens during the presale. The bonus has boosted investor sentiment, offering a tangible reward for those who jump on early while reinforcing allegiance to existing supporters.

Analysts say this combination of high whale interest, combined with the structured rewards, is rare in early-stage projects. It is a disciplined approach that focuses more on sustainable growth and less on short-term hype. Many consider MAGACOIN FINANCE a middle-of-cycle standout – a project operating well during a consolidation period when others are stagnant.

As the markets increase in stability, its verified transparency and early demand made it one of the best crypto opportunities lined up with Bitcoin’s wider recovery phase.

Final Outlook

Bitcoin’s ability to trade above $111,000 demonstrates growing confidence in the crypto market at large. This calm period, also often referred to as the mid-cycle accumulation zone, allows investors to prepare for the next uptrend.

Within this landscape, ADA and MAGACOIN FINANCE are emerging as leaders. ADA appeals to those looking for network strength and gradual growth, while MAGACOIN FINANCE is gaining recognition for those investors who see the value in ‘early’ entry, known transparency, and smart reward systems. Together, they are the sort of assets you define to the mid-cycle accumulation that matters, profitable-patient plays based on conviction, not hype.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance