Short-term Bitcoin holders decided to cut losses en masse amid the market’s recent correction.

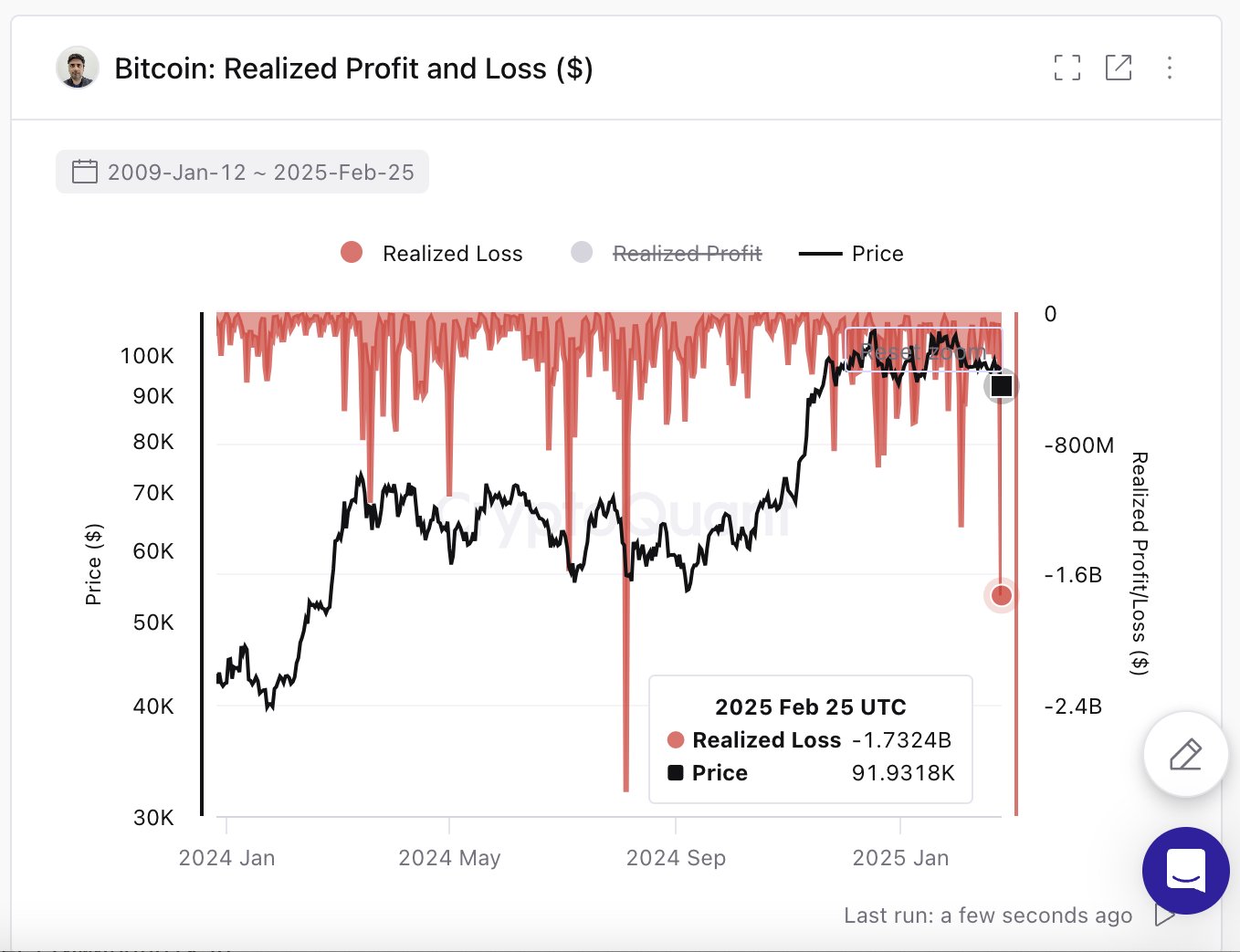

Specifically, as Bitcoin plunged from Monday, February 24, highs of $96,500 to three-month lows of $86,050 on Tuesday, February 25, several short-term Bitcoin holders rushed to sell, realizing $1.7 billion in losses, the most since August 2024, when holders saw over $2.4 billion in losses.

This is according to CryptoQuant data shared by Head of Research Julio Moreno on Wednesday, February 26.

Reacting to the data, prominent crypto analyst Miles Deutscher asserted that it represented another “capitulation” signal in Bitcoin’s latest move lower.

$BTC holders sold for a total of $1.73 billion in realized losses yesterday, which is the most since August 2024.

Just another metric that adds to the capitulation signals on this move lower for $BTC.

h/t @jjcmoreno pic.twitter.com/yHCMrku0lN

— Miles Deutscher (@milesdeutscher) February 26, 2025

In a previous X post, Deutscher had highlighted that the crypto Fear and Greed Index, which dropped to fear amid the market rout, had flashed its lowest reading since October 2024.

“People are finally getting nervous again. Believe it or not, that’s exactly what we need to eventually form a bottom,” he contended.

Be that as it may, Standard Chartered Global Head of Digital Asset Research Geoffrey Kendrick has cautioned that “the big capitulation” has yet to happen.

He expressed this in a note to investors on Tuesday, February 26, revealing that he expected even more outflows from Bitcoin ETFs (exchange-traded funds) after Monday’s record nearly $1 billion exit.

“I calculate that net ETF purchases since the US election are now running a loss of around $1.3bn, as per this chart. The average purchase price since then (using daily BTC closing prices) is $97k. These types of losses rarely end well and I still think the big capitulation is yet to come,” Kendrick wrote, urging more patience before buying the dip.

It remains to be seen where this further capitulation will take Bitcoin’s price. However, Glassnode has warned that the asset’s next significant support sits within the $71,000 and $72,000 price range.

Meanwhile, at the time of writing, the asset is exchanging hands near its local low of $86,050 at $86,200.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2025/02/26/bitcoin-holders-suffer-1-7b-loss-as-panic-grips-market/?utm_source=rss&utm_medium=rss&utm_campaign=bitcoin-holders-suffer-1-7b-loss-as-panic-grips-market