- Bitcoin profit-taking driven by new whales; $6-8 billion realized by July-end.

- Price correction signals altcoin season onset.

- Bitcoin dominance declines as capital shifts to altcoins.

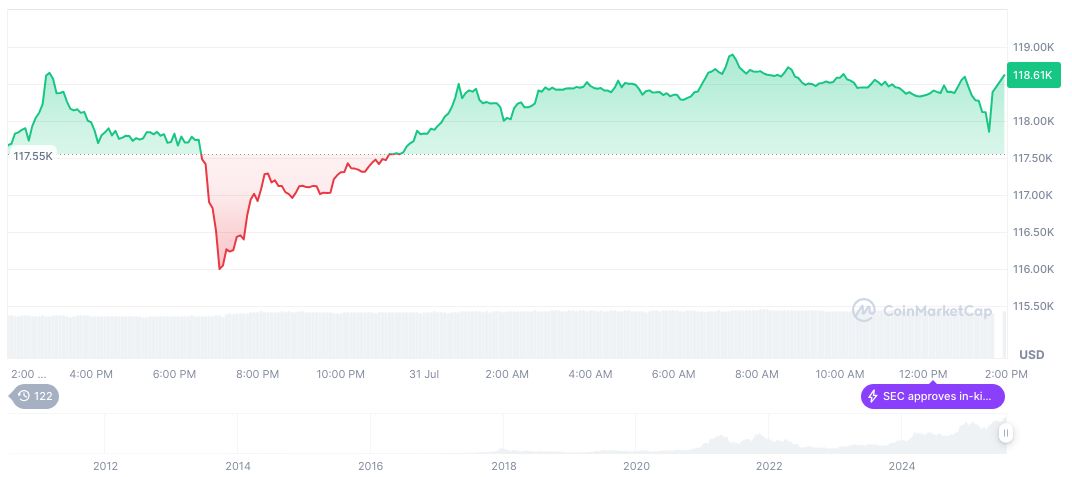

Bitcoin experienced significant profit-taking in late July 2025, with newly-entered whales selling above $120,000, realizing profits between $6 billion and $8 billion.

This event indicates a shift in market dynamics, leading to Bitcoin outflows and signaling potential altcoin investment opportunities.

New Whale Activity Drives $6-8 Billion in Realized Profits

Large-scale profit-taking by newly-entered whales marked the third major wave in this bull market. CryptoQuant reported these whales pushed Bitcoin realized profits to $6-8 billion, elevating activity to levels seen in 2024 peaks. The whales shed assets at price points exceeding $120,000, significantly impacting trading dynamics.

Market reactions showcased increased altcoin inflows and Bitcoin’s reduced dominance. Institutional investors maintained bullish undertones despite whale sell-offs. Reallocations were notable toward Ethereum and mid-cap tokens, driven by profit rotation.

“Such large-scale profit-taking reflects that whales are taking profits at nearly record levels, signifying a potential shift in market dynamics.” – CryptoQuant

Bitcoin Dominance Falls to 60% Amid Altcoin Surge

Did you know? The current drop in Bitcoin’s market dominance from 64% to 60% from July 17-21, 2025 parallels earlier instances of altcoin seasons, especially significant in reflections on prior cycle dynamics.

Bitcoin (BTC), currently priced at $118,294.24, exhibits notable metrics: a market cap of formatNumber(2354042287426.12, 2) and a circulating supply of 19,899,890 coins. Reflecting on recent trends, it records a 21.46% price rise over 90 days, driven by intense trade volumes.

Coincu’s research team indicates potential shifts in market regulation or infrastructure aren’t imminent. Institutions maintain a pivotal role, strategically buying lows while exhibiting confidence in Bitcoin’s long-term viability. The analysis underscores new whale cohorts’ potential impact, challenging prior cycles’ retail-driven activity.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/bitcoin-whales-profit-taking-july-2025/