Key Points:

- Bitcoin’s price fell to its lowest since the US approved several Bitcoin ETFs, dropping 3% to $41,341.

- BlackRock’s Bitcoin ETF surpassed $1 billion in inflows, with Fidelity’s FBTC Bitcoin ETF close behind.

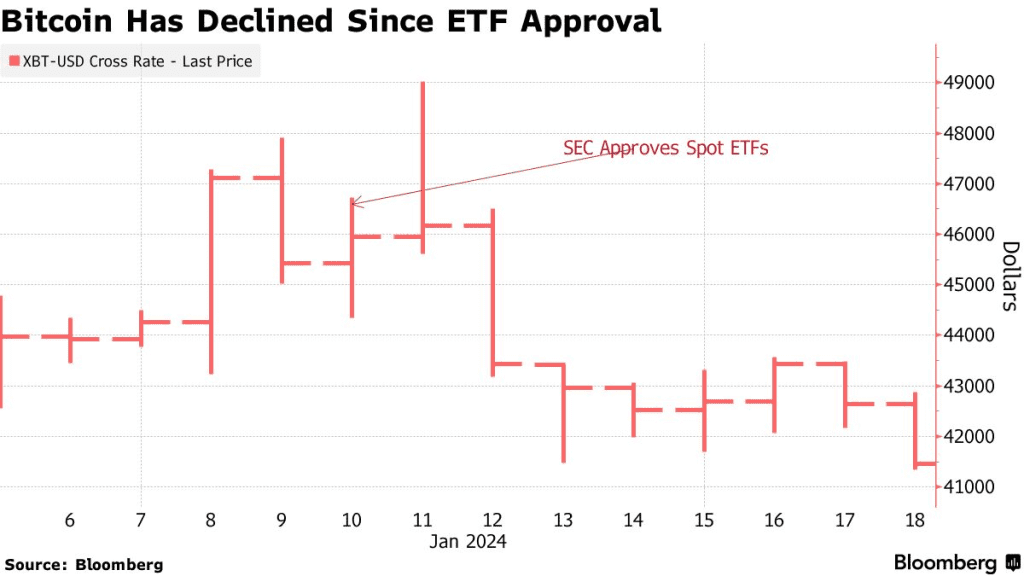

Bitcoin hit lowest level, dropping 10% since US ETF approval. BlackRock’s fund exceeds $1B. Grayscale’s GBTC saw $1.6B in outflows.

Bloomberg reported that Bitcoin dipped to its lowest price since the US authorization of several cryptocurrency exchange-traded funds (ETFs).

The largest cryptocurrency fell by over 3% to $41,375, a 10% drop since the US Securities and Exchange Commission approved it on Jan. 10.

Observers attribute this to the shift in traders’ attention following the initial excitement over the ETFs. Options positioning indicates support at the $40,000 price point.

Inflows into ETFs are being closely watched, with BlackRock’s fund surpassing $1 billion. Investors deposited $371 million into this fund, making it the first to reach this milestone since trading began.

Readmore: BlackRock’s Bitcoin ETF Surpassed $1 Billion In Inflows

Bitcoin Hit Lowest Level As Investors Flock to ETFs

Fidelity Investments’ FBTC Bitcoin ETF is also doing well, with the highest single-day inflow of $358 million.

A significant part of the inflows is from investors moving from Grayscale Investment’s GBTC fund. The GBTC fund had over $28 billion in assets when it converted to an ETF, but has seen about $1.6 billion in outflows since.

Despite its high management fee, Franklin Templeton’s Bitcoin ETF, which has the lowest management fee among the new Bitcoin ETFs, has received less than 2% of total inflows.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Visited 25 times, 7 visit(s) today

Source: https://coincu.com/242888-bitcoin-hit-lowest-level-amid-surge-etf-inflows/