Source: CryptoQuant

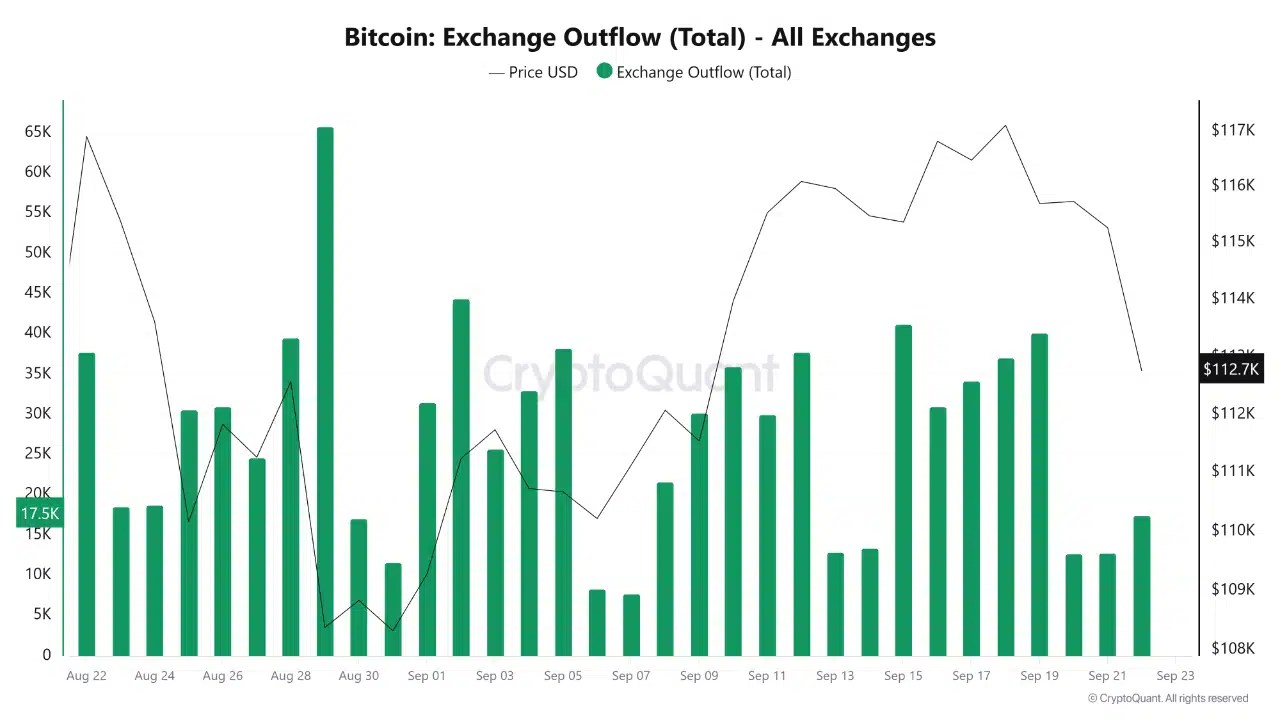

That surge was in tandem with BTC’s drop from $117K. Earlier in the month, during the rally of the 7th to 15th of September, outflows consistently outpaced inflows, supporting upside momentum.

Source: CryptoQuant

Now, the reverse is true.

Inflows remain elevated while outflows stay muted, so there’s a possibility of short-term risk unless accumulation trends pick up again.

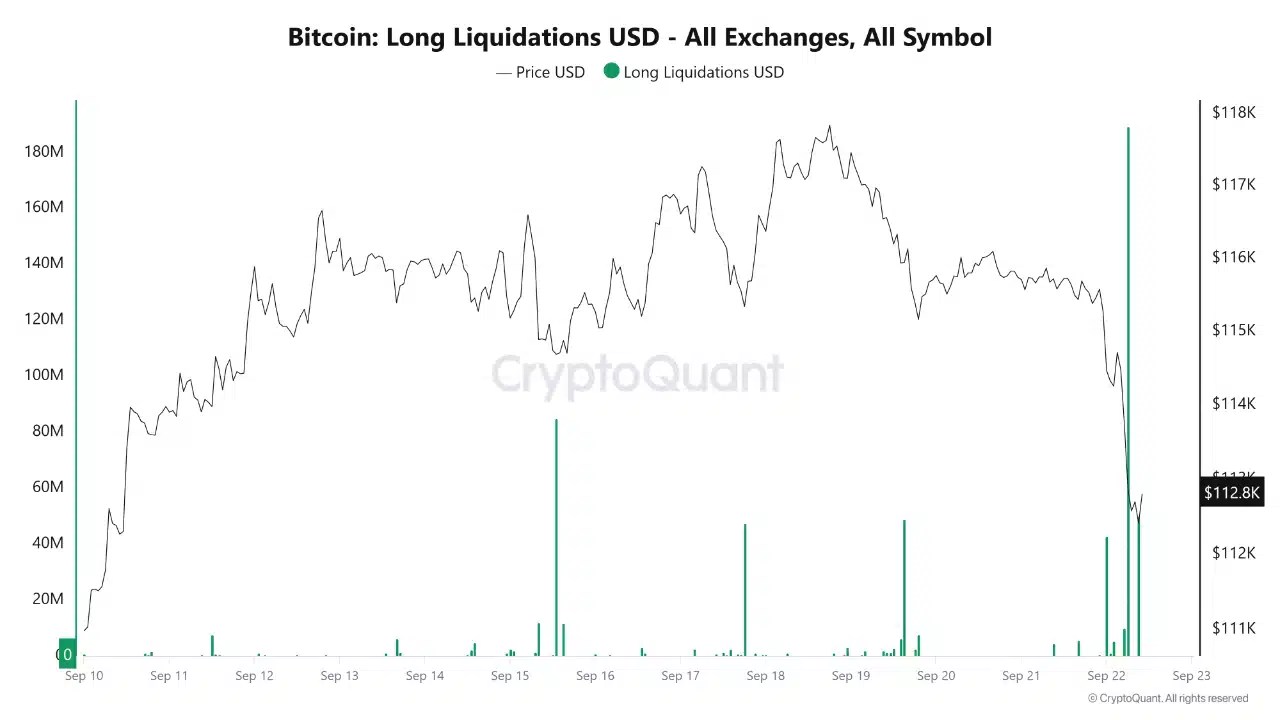

$190M long wipeout fuels volatility risks

Source: CryptoQuant

Binance alone saw $16 million liquidated, so traders were possibly in shock. At press time, BTC recovered slightly to $113K, but the scale of liquidations shows growing fragility.

Speedy deleveraging often increases volatility, leaving Bitcoin vulnerable to further downside if selling pressure continues or more liquidations are triggered.

Key levels to watch

Source: TradingView

On the upside, immediate resistance sat near $114.3K at the 20-day EMA, followed by $116K, where the recent breakdown began.

A break below $112K could open the path toward $110K and beyond, while reclaiming $114K would reduce downside pressure.

With volatility elevated, BTC’s next move depends on whether bulls can hold the $112K-113K range or risk another leg lower.

Source: https://ambcrypto.com/bitcoin-hit-hard-112k-is-btcs-last-stand-after-190-mln-wipeout/