Key Takeaways

A high percentage supply in profit is not always worrisome, but also a by-product of a bullish market phase. Bitcoin was in one right now, but it is bearishly poised for the coming days.

Bitcoin [BTC] was trading at the $112.1K level, a 0.36% gain over the past 24 hours, at press time. The short-term price action leaned bearishly, although there was a chance of a bounce toward $115K.

The market sentiment appeared neutral to bullish. The Fear and Greed Index was at 46, which was neutral.

Last weekend, BTC experienced a pullback from $117K to $109K and has not yet fully recovered.

Source: Farside Investors

The spot ETF inflows have been positive since the 25th of August, a more encouraging sign. However, an analyst pointed out that derivatives flows would be needed to propel the market into a bullish mode.

The Bitcoin bullish phase is ongoing; holders need not panic

Source: CryptoQuant

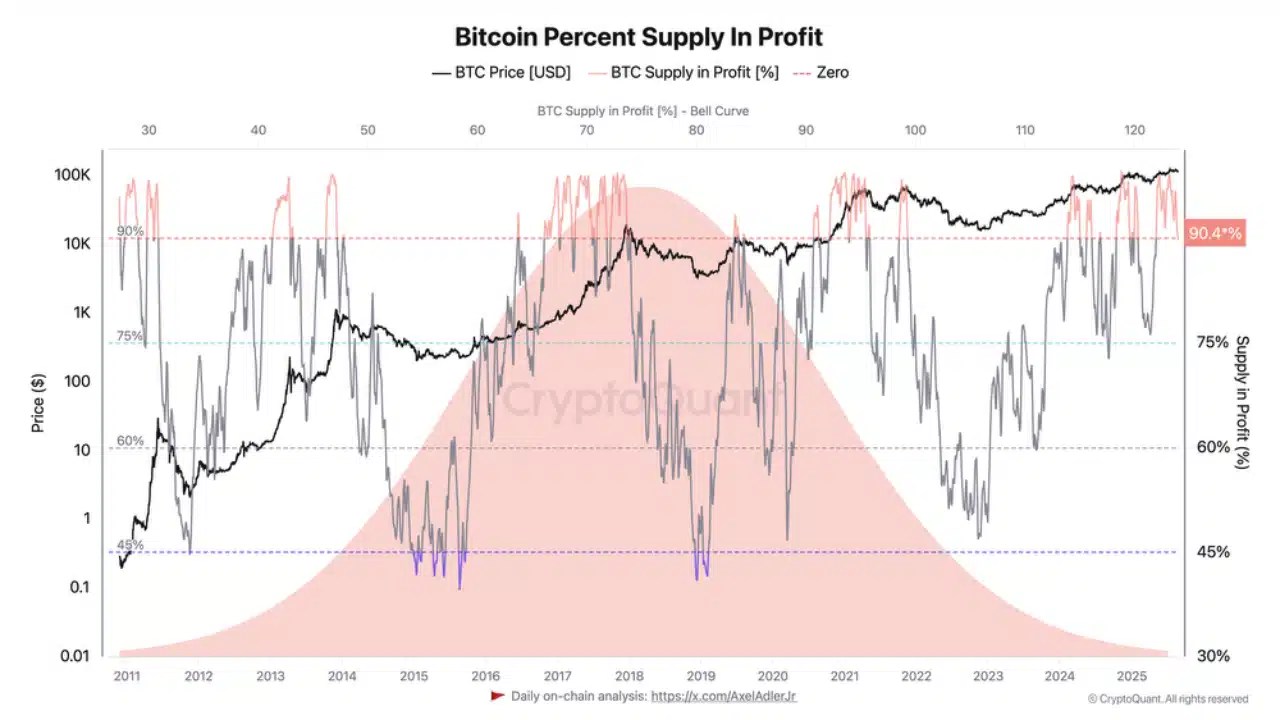

In a post on CryptoQuant, analyst Darkfost pointed out that the percentage of supply in profit was at 90%. This was a key threshold that bull markets are often accompanied by.

The analyst argued that a high percentage of supply in profit need not be all negative. Rather, they are necessary to drive prices higher and fuel the waves of euphoria the market relies on.

Hence, the long-term holders need to remain patient for short-term conditions to turn bullish. If the supply in profit drops below 90%, which it has not at press time, it could mark the beginning of a corrective phase.

Source: Axel Adler Jr on X

In a post on X, crypto analyst Axel Adler Jr observed that the market was on the border of bearish mode.

At the time time of writing, the integrated market index was at 43%, indicating slight bearishness, but it remained close to neutral.

The market was at a tipping point: a few hours of sustained positive flows in the derivatives sector could shift sentiment back toward neutral or even slightly bullish.

Without renewed confidence in derivatives, any move toward the $115K resistance would likely be a temporary bounce rather than a true bullish reversal.

Short-term indicators also leaned bearish, particularly if the supply in profit falls below 90%. However, if that threshold holds, there remains a viable path to recovery for BTC.

Source: BTC/USDT on TradingView

On the 4-hour chart, the price was climbing toward the 50-period Moving Average (MA) dynamic resistance at $113K, at press time.

The A/D indicator showed that the buying volume has been weak in recent days.

The MA underlined bearish momentum. The Trading Volume has also been in decline this week as the price dropped lower.

Source: https://ambcrypto.com/bitcoin-heres-what-could-drive-btcs-next-push-to-115k/