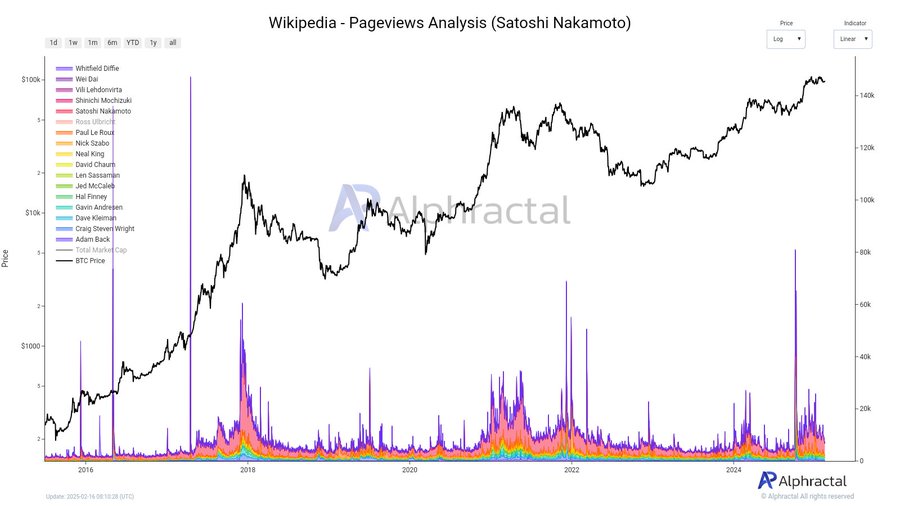

- Satoshi searches spike during Bitcoin’s bull runs, correlating with retail market euphoria.

- A drop in curiosity regarding Satoshi may signal a calm before Bitcoin’s next big move.

Public interest in Bitcoin’s [BTC] mysterious creator, Satoshi Nakamoto, tends to spike in sync with Bitcoin’s bull runs, reflecting the excitement of retail investors, media buzz, and market euphoria.

As Bitcoin consolidates below key resistance levels, interest in Satoshi has begun to fade. Historically, public curiosity around Satoshi has mirrored BTC’s price movements.

This often provides a subtle signal for the market’s next direction.

Satoshi searches surge during Bitcoin bull runs

Public interest in Satoshi Nakamoto and other key figures like Hal Finney, Nick Szabo, and Gavin Andresen has historically surged during BTC bull runs.

Data spikes in Wikipedia searches for these figures align with BTC’s major rallies in 2017 and 2021. During these periods, market euphoria drew retail investors deeper into Bitcoin’s origins, fueling speculation and curiosity.

Each surge in Bitcoin’s price mirrored heightened public interest in its creator, reinforcing the link between market sentiment and Satoshi-related searches.

Fading interest amid Bitcoin’s consolidation

In recent months, interest in Satoshi Nakamoto surged thanks to HBO’s Money Electric: The Bitcoin Mystery, speculation surrounding Ross Ulbricht’s release, and growing discussions about Len Sassaman.

Source: Alphractal

However, as BTC struggles below key resistance levels, this wave of curiosity has largely dissipated. We can see this reflected in decreasing Wikipedia pageviews and Google searches.

This signaled that retail interest may be cooling during Bitcoin’s price consolidation.

Retail vs. institutional interest

Retail investors often chase narratives, with speculation around Satoshi acting as a hype indicator during price surges. Institutional players focus on liquidity, macroeconomic trends, and regulatory clarity.

Retail-driven searches spike in bull markets, while institutional interest remains steady, prioritizing BTC’s fundamentals.

This divergence suggests that while retail excitement may wane, institutional involvement continues to grow. Such an involvement could potentially stabilize the market during low-sentiment phases.

What fading Satoshi interest means for BTC

Does this fading interest in Satoshi signify market complacency, or could it be the calm before BTC’s next major move? Historically, periods of low retail enthusiasm are often followed by significant price shifts — either a breakout or a downturn.

As retail speculation wanes, institutional involvement continues to grow, helping to stabilize the market during quieter periods.

While it’s uncertain which direction BTC will take, the current lull in Satoshi-related searches may well be a signal for something big on the horizon.

Source: https://ambcrypto.com/bitcoin-heres-how-major-btc-price-moves-correlate-to-satoshi-searches/