- Bitcoin price surge elevates futures open interest, testing market leverage.

- Traders add long positions amid new all-time high for BTC.

- Glassnode sees 7.7% rise in futures open interest to $47.8 billion.

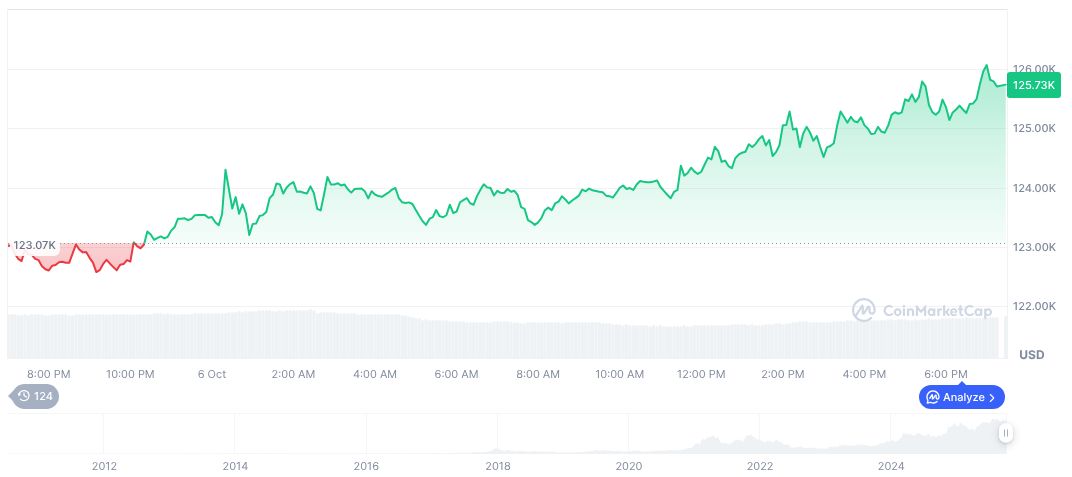

On October 7, Bitcoin reached a new all-time high, fueled by significant ETF inflows and rising BTC futures open interest, as reported by Glassnode on social media.

This surge highlights renewed investor confidence and increased market leverage, signaling potential shifts in capital flow and market sentiment.

Bitcoin Breaks Records: Futures Open Interest Climbs to $47.8 Billion

Bitcoin surged to a new all-time high in early October 2025, driven by factors including record ETF inflows and renewed spot demand. Glassnode data indicated a 7.7% rise in futures open interest, reaching $47.8 billion. This development reflects strong trading activity and positions added by traders in anticipation of continued market growth.

Traders increasing long positions contributed to significant leverage, prompting a potential market reset. As open interest rises, the market faces a pullback, testing the resilience of these positions. Attention is needed on critical indicators, such as buyer strength and support levels, to gauge ongoing market demand.

“The rally reflects a decisive shift in sentiment, with capital rotating back into risk assets and confidence building across both institutional and on-chain participants. Spot demand has reaccelerated, with cumulative ETF inflows exceeding $2.2B and daily trade volumes surpassing $26B, highlighting renewed conviction among traditional investors.” – Glassnode

Historical Patterns Suggest Potential Positive October for Bitcoin

Did you know? In October 2021 and 2024, similar leverage resets following BTC breakouts were observed. Historical data shows October yields positive Bitcoin returns 73% of the time.

According to CoinMarketCap, Bitcoin (BTC) is currently priced at $121,220.73, with a market cap of $2.42 trillion and dominance at 57.97%. Its 24-hour trading volume reached $77.27 billion, reflecting an 18.73% change. In recent months, BTC saw a 90-day gain of 11.06%.

The Coincu research team notes the current market dynamics could set the stage for further financial shifts. Regulatory outcomes and technological advancements might influence future trading patterns, with institutional investments remaining a key factor in BTC’s ongoing growth.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/bitcoin-futures-open-interest-surge/