- Geopolitical tension triggers Bitcoin’s 4% drop, rapid recovery predicted.

- Analysts identify $106,406 as resistance, targeting new highs.

- Institutional demand and global liquidity drive potential rally.

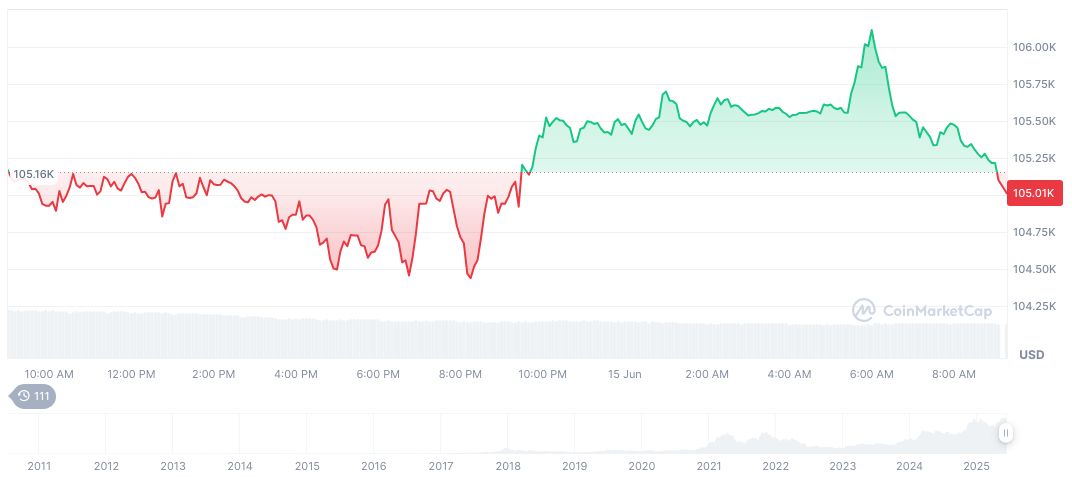

Bitcoin’s price briefly fell 4% following geopolitical instability from the Israeli attack on Iranian nuclear facilities. The incident underscores Bitcoin’s sensitivity to geopolitical risks, affecting market dynamics.

BTC Markets analyst Rachael Lucas reported that geopolitical instability caused a brief Bitcoin drop, signifying its risk sensitivity. However, as a geopolitical hedge, Bitcoin quickly rebounded.

Israeli-Iran Tensions Trigger 4% Bitcoin Dip, Fast Recovery Signals

The breakthrough of the $106,406 resistance level, identified by Lucas, suggests continued bullish momentum. This scenario places Bitcoin on a trajectory to target its all-time high once geopolitical tensions ease.

Vincent Liu of Kronos Research highlighted that institutional demand and global liquidity position Bitcoin for potential rallies. As international pressures subside, Bitcoin might witness increased market activity aligned with institutional strategies.

Geopolitical instability, such as the recent Israeli attack on Iranian nuclear facilities, caused Bitcoin to experience a brief 4% drop, highlighting Bitcoin’s sensitivity to risk-off events. Nevertheless, as investors view it as a geopolitical hedge, Bitcoin typically rebounds quickly. The recent breakthrough of the $106,406 resistance level suggests continued bullish momentum, with the next major target being the all-time high.

— Rachael Lucas, Cryptocurrency Analyst, BTC Markets

Bitcoin Near All-Time High: Market Data and Expert Analysis

Did you know? Bitcoin’s price volatility during geopolitical events, as observed in the 2022 Russia-Ukraine conflict, often features sharp declines followed by quick recoveries—points of interest for market analysts and investors alike.

Bitcoin (BTC) traded at $106,593.34 as of June 16, 2025, with a market cap of $2.12 trillion and a 63.70% market dominance, according to CoinMarketCap. The trading volume rose by 18.72% to $40.55 billion, indicating intense market participation amid geopolitical unrest.

Coincu Research insights indicate that Bitcoin’s role amidst geopolitical events could shift its function as a swift recovery asset. Analysts emphasize that institutional patterns and liquidity factors are crucial for understanding these financial impacts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343528-bitcoin-reaction-israeli-iran-tensions/