Key takeaways

Why did Bitcoin fail in October 2025

BTC dropped as retail interest fell, network activity cooled, and macro pressures weighed on the market.

Can November bring a rally?

Historically strong for BTC, November could see upside with macro catalysts.

‘Uptober’ didn’t show up this year.

Instead of the usual upside, Bitcoin [BTC] slipped, and retail interest faded with it. Network activity is slowing as fear takes grip.

Can the rally continue in November?

BTC struggled, all eyes on November

Bitcoin price dropped from around $118K to near $110K by October-end, with mid-month red candles and volume spikes indicating profit-taking.

RSI was below neutral, and BTC traded under key EMAs, at press time, confirming trend exhaustion.

Source: TradingView

Macro factors added pressure. Hopes for a December Fed cut have faded somewhat, taking some support out of the market.

At the same time, U.S. equities outperformed, China kept crypto restrictions in place, and worries over “DAT companies” in Washington added to the narrative.

Source: CoinGlass

Looking ahead, November has historically been one of Bitcoin’s strongest months. CoinGlass showed a median 8.81% return since 2013, with double-digit gains in 2020, 2021, and 2023.

Source: CME FedWatch

Several positive market catalysts are beginning to take shape.

First, trade tensions between President Donald Trump and Xi Jinping have eased, reducing geopolitical uncertainty.

Meanwhile, data from CME FedWatch indicates over a 60% chance of a Federal Reserve rate cut in December, which could boost investor sentiment.

In addition, quantitative tightening (QT) is scheduled to end on the 1st of December, potentially increasing liquidity in the market.

Finally, potential approvals for new ETFs are on the horizon, adding to the growing optimism across financial sectors.

The tides may turn.

Retail fear by the numbers

Open Interest jumped nearly 10% on a 7-day basis, climbing from $7.95 billion to $8.65 billion as BTC traded near $110K, but CVD dropped sharply at the same time.

Source: CryptoQuant

Usually, that combo means fresh shorts are being opened, not longs. Retail is betting on another pullback.

Source: CryptoQuant

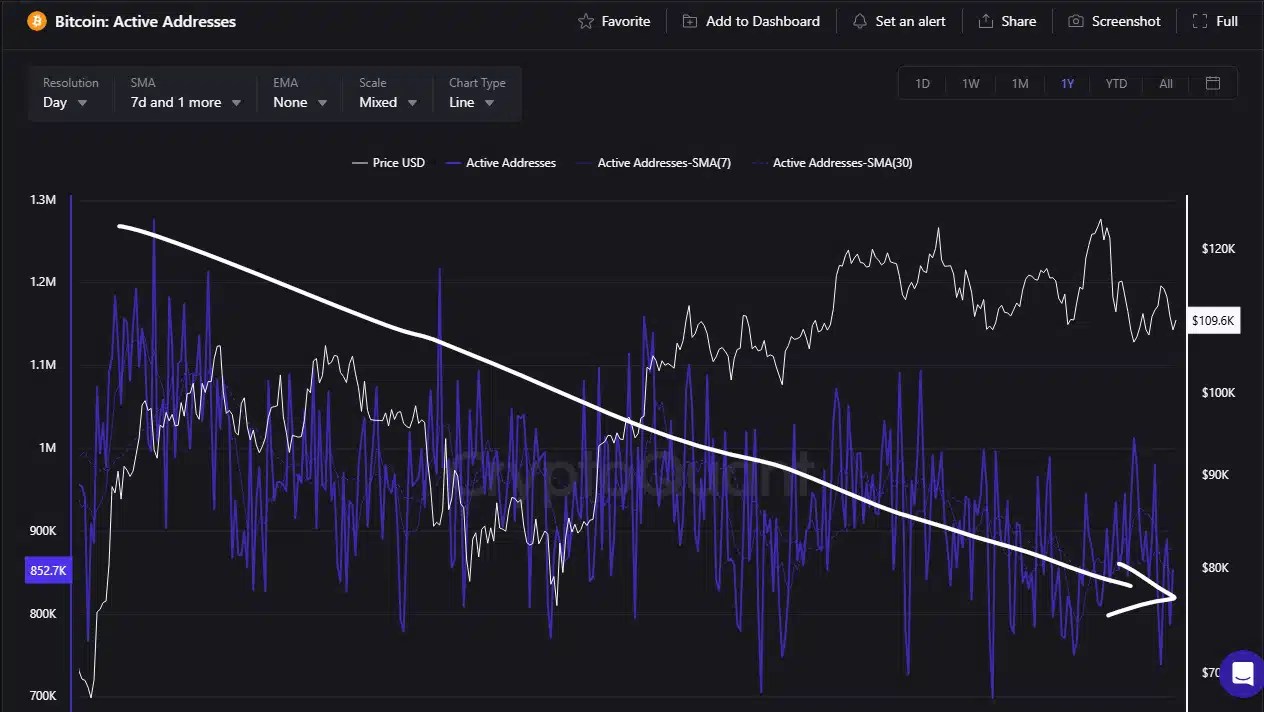

Active addresses have also fallen from 1.18M in November 2024 to 872K as of the 30th of October – a decline of 26.1%.

Source: CryptoQuant

Transaction fees dropped sharply from $8.44 to $0.56 during the same period, indicating partially-filled blocks and reduced activity from retail users.

Source: CryptoQuant

This fading retail presence is what extends cycles, so rallies will take longer to mature.

Source: https://ambcrypto.com/bitcoin-fizzles-in-uptober-is-a-november-rally-still-possible/