In Brief

- Bitcoin’s price drops 7.2% in 24 hours, but remains high compared to recent levels.

- Binance order book shows largest positive Depth Delta spike, signaling strong buy pressure.

- $79,300 Realized Price for Bitcoin ETFs is a crucial support level for investor sentiment.

Bitcoin’s market has been experiencing notable volatility, with the current price standing at $84,713.37. Over the last 24 hours, the cryptocurrency has seen a 7.20% drop, while in the past hour, it rebounded with a 1% increase.

Despite the short-term losses, Bitcoin remains relatively high compared to recent price levels, indicating ongoing market interest and strong investor engagement. Over the past week, Bitcoin has seen a 12.10% decrease, adding to concerns about short-term market fluctuations.

However, the persistent high prices reflect the deep-rooted confidence in Bitcoin, suggesting that the cryptocurrency market still holds strong momentum.

Meanwhile, the data reveals that Bitcoin’s realised losses have surged to levels reminiscent of the FTX collapse in late 2022. This surge in losses aligns with extreme market fear, although Bitcoin’s fundamental outlook remains robust.

Glassnode data suggests a capitulation-level flush, indicating the possibility of a significant market pullback, but one that could be followed by stabilisation.

Such high realised losses typically coincide with periods of heightened market fear, yet historically, these signals are short-lived as stronger hands enter the market, absorbing the selling pressure.

Order Book Depth and ETF Pressure Signal Potential Market Reversal

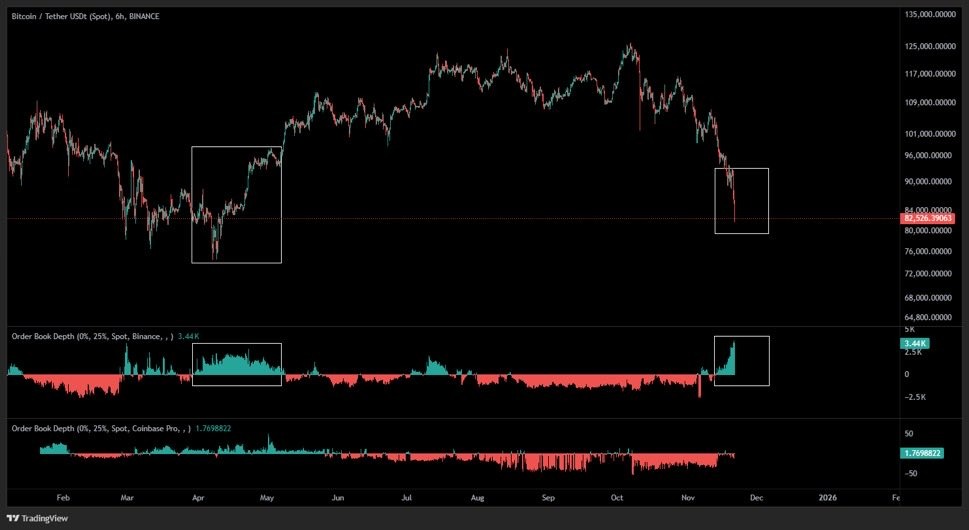

Adding to the complexity, the Binance spot order book recorded a massive positive Depth Delta spike, marking the largest of its kind on record. The growing buy orders now significantly outnumber the sell orders below Bitcoin’s current price, presenting a strong absorption signal.

This surge in buy pressure has historically marked local price lows, with Bitcoin quickly recovering in the days following such events. The deep buying interest below Bitcoin’s current price points to a potential support level, which could stabilize the market if Bitcoin’s price moves lower.

Further complicating the situation, Bitcoin’s $79,300 price level, known as the Realized Price for Bitcoin ETFs, stands as a critical threshold for institutional and retail investors alike. A price above this level could instil confidence among Bitcoin ETF buyers, who would feel more secure in their positions.

However, if Bitcoin falls below the $79,300 mark, panic selling could trigger a new wave of market weakness, particularly from retail investors. This price point remains a crucial indicator of sentiment and market stability for those holding Bitcoin via ETFs.

As Bitcoin faces pressure from both retail and institutional investors, the focus remains on these key technical and fundamental signals that could dictate the market’s next direction.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/bitcoin-faces-market-turbulence-with/