- Bitcoin tests $110,000 support, analysts highlight potential bullish trend.

- Buyer interest strengthens amid support test.

- Accumulation signals suggest market confidence improving.

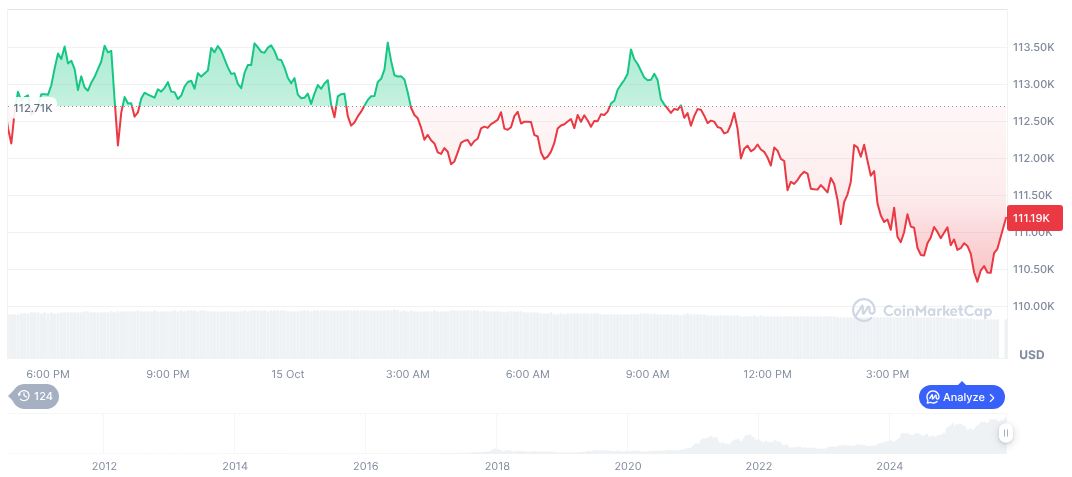

Bitcoin faced significant pressure on Thursday as it dipped below $110,000, prompting renewed buying interest, with traders focusing on key support and resistance levels.

This activity reflects investor confidence despite volatility, indicating potential market recovery and stability, supported by strong accumulation signals from on-chain data entities holding 1 to 1,000 BTC.

Investor Activity Surges as Bitcoin Tests $110,000 Support

Bitcoin’s price moved near the $110,000 support level, sparking increased investor curiosity. The order book liquidity intensified at the current local low, which highlights the BTC’s Support Zone: Potential Crash Analysis Ahead of Bulls’ Efforts as the market’s reaction to price fluctuations. Traders are watching levels closely for buying opportunities.

This change could result in a prolonged adjustment phase, with a potential upward trajectory if buyers remain active. As the price breaks through, resistance levels will be tested, crucially affecting short-term market trends.

Market reactions include significant interest from entities holding 1 to 1,000 BTC, as reported by Glassnode. Analyst Rekt Capital highlighted RSI bullish divergence, suggesting a potential trend reversal. Investor Ted Pillows cites a local support bottom based on market sentiment.

Bitcoin Market Dynamics: Price Trends and Expert Perspectives

Did you know? Despite current market fluctuations, Bitcoin’s price in October 2023 experienced a similar dip, yet saw accelerated accumulation by retail investors, indicating consistent patterns in buyer behavior during volatility.

Bitcoin (BTC) is priced at $110,857.04 with a market cap of formatNumber(2.21 trillion, 2) and dominance of 58.60%. Its 24-hour trading volume is formatNumber(71.15 billion, 2), decreasing by 10.54%. CoinCodex’s Guide to Purchase Bitcoin Safely and Easily can assist in understanding these metrics better. Bitcoin’s circulating supply is 19,934,406 of a 21 million cap. Recent declines include 0.23% in 24 hours and 8.65% over 7 days (CoinMarketCap, October 16, 2025).

Insights from the Coincu research team could influence regulatory adjustments and technological advancements, potentially driving further global adoption. A continued analysis highlights the importance of tracking these metrics effectively to monitor evolving market conditions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/bitcoin-support-110k-investor-interest/