- BTC’s long/short ratio dropped, hinting at a price correction.

- Technical indicators continued to remain bullish.

Bitcoin [BTC] successfully crawled above $66k a few days back, sparking excitement in the community. But the trend didn’t last as it again fell below that mark. In fact, the latest data suggested that this just might be the beginning of a major price correction.

Bitcoin has danger going forward

Bitcoin witnessed a price correction in the last 24 hours, pushing it under $66k. To be precise, at the time of writing, BTC was trading at $65,504.34. In fact, AMBCrypto reported earlier that there were chances of BTC falling victim to a price correction.

In the meantime, Crypto Bullet, a popular crypto analyst, recently posted a tweet revealing a bearish divergence on BTC’s 4-hour chart.

Whenever such a divergence appears, it suggests that the chances of a price correction are high. The tweet mentioned that in case of the bearish trend reversal, then its investors might as well witness BTC once again dropping to $60k.

Source: X

What metrics suggest

AMBCrypto then checked the king coin’s on-chain data to find out whether they also indicated a price correction.

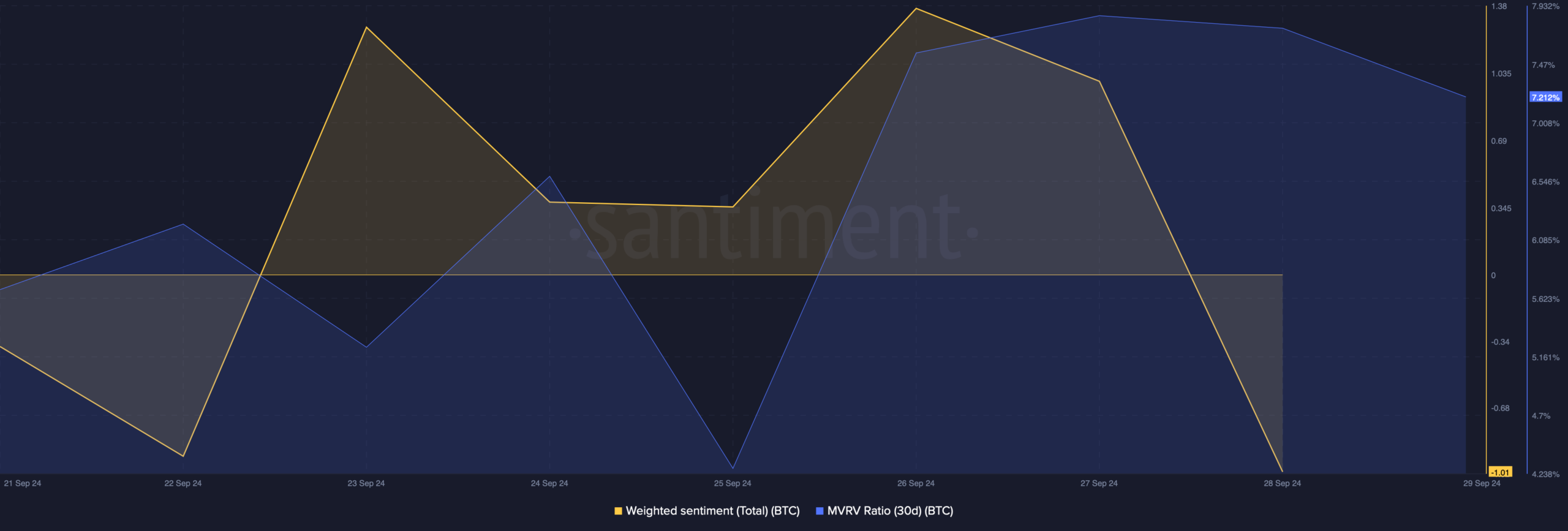

As per our analysis of Santiment’s data, it revealed that after a spike, BTC’s MVRV ratio dropped slightly in the last few days, which can be inferred as a bearish signal.

Market sentiment around the coin also turned bearish, which was evident from the drop in its weighted sentiment.

Source: Santiment

Apart from that, AMBCrypto’s look at Coinglass’ data also revealed a bearish signal. We found that Bitcoin’s long/short ratio dipped. A drop in the metric means that there are more short positions in the market than long positions.

This can be considered a bearish signal as it hints at a rise in bearish sentiment.

Source: Coinglass

However, not everything was in the bears’ favor. For instance, the fear and greed index had a value of 38% at press time. This meant that the market was in a “fear” phase.

Whenever that happens, it suggests that there is a possibility of a price increase. If that turns out to be true, then BTC might not as well drop to $60k again in the near term. Therefore, we checked the coin’s daily chart.

Is your portfolio green? Check out the BTC Profit Calculator

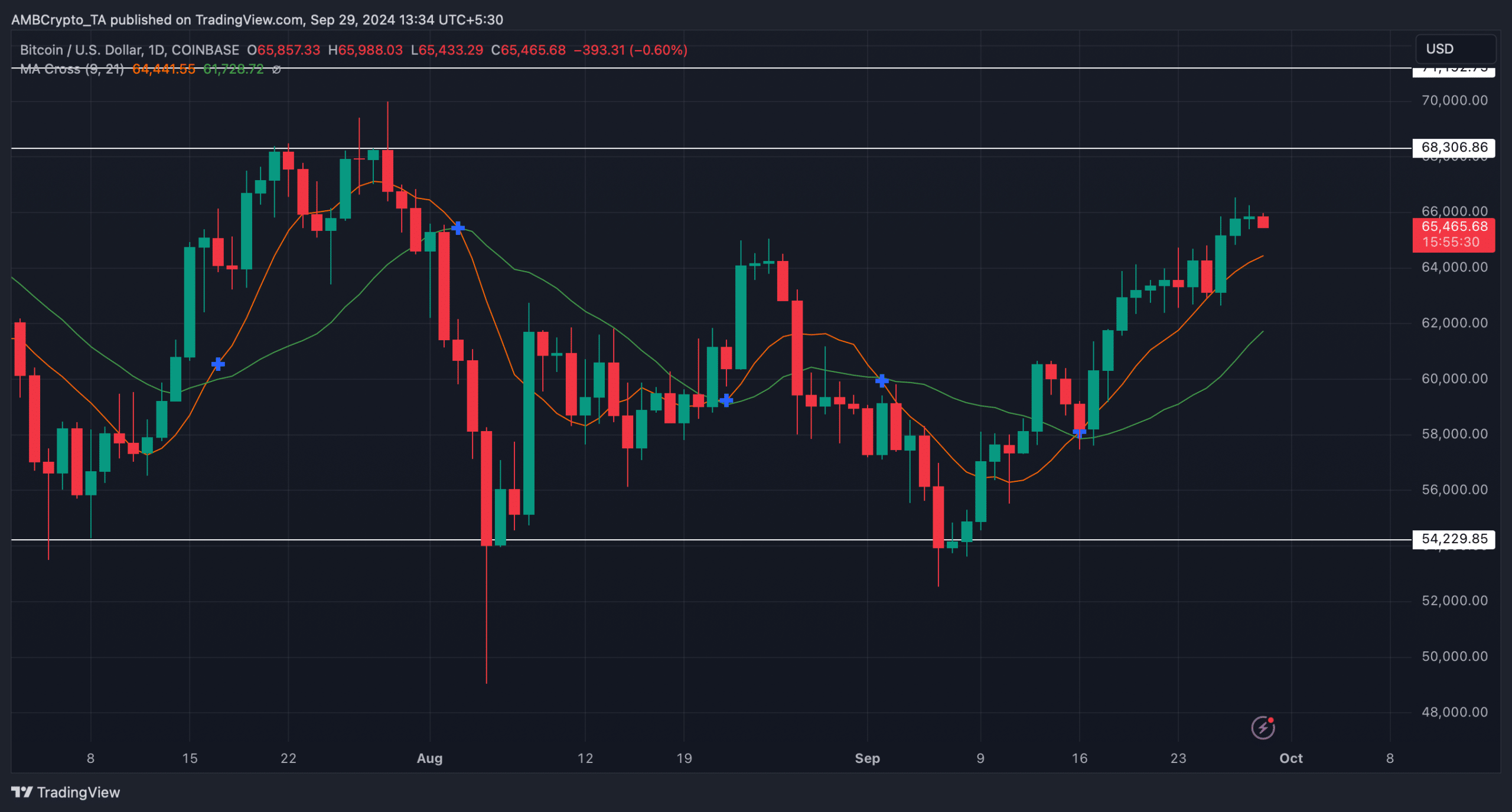

As per our analysis, the 9-day MA was still well above the 21-day MA, signaling a bullish advantage in the market. If the bull rally begins again, then BTC might first target $68k.

If the aforementioned analysis is true, then BTC might fall to $60k again.

Source: TradingView

Source: https://ambcrypto.com/bitcoin-faces-bearish-divergence-is-a-60k-plummet-coming/