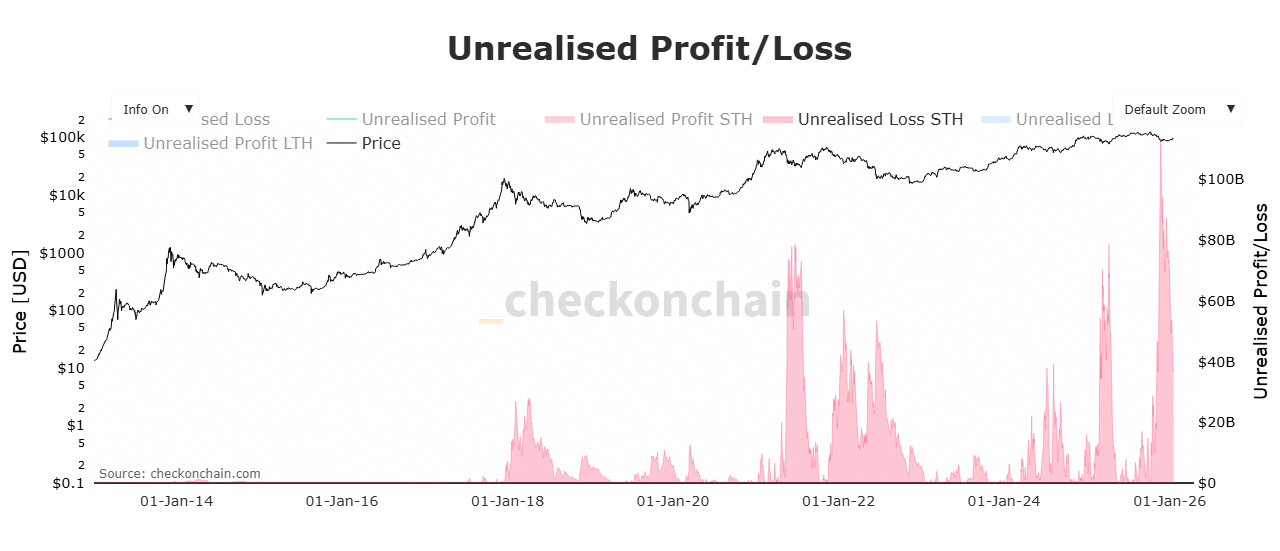

Since reaching $126k three months ago, Bitcoin faced sustained selling pressure, sliding to a cycle low near $80k. That drawdown weighed heavily on short-term holders as unrealized losses expanded.

Checkonchain data showed Short-Term Holder (STH) Unrealized Loss surged to a record $110 billion in November.

Source: Checkonchain

However, conditions shifted over the past two weeks. Bitcoin rebounded sharply, rallying to $97k. That move reduced short-term holders’ unrealized losses to roughly $65 billion, pulling the cohort out of extreme stress.

Bitcoin STHs exit extreme stress

According to CryptoQuant analyst Darkfost, Bitcoin short-term holders finally exited the extreme discomfort zone. Earlier in the cycle, BTC entered a capitulation phase, with STHs holding average losses exceeding 10%.

Source: CryptoQuant

Now, with Bitcoin trading just below $100k, short-term holders averaged losses near 6.4%. Although the cohort remained underwater, pressure eased meaningfully.

That shift reduced the likelihood of panic-driven selling from this group.

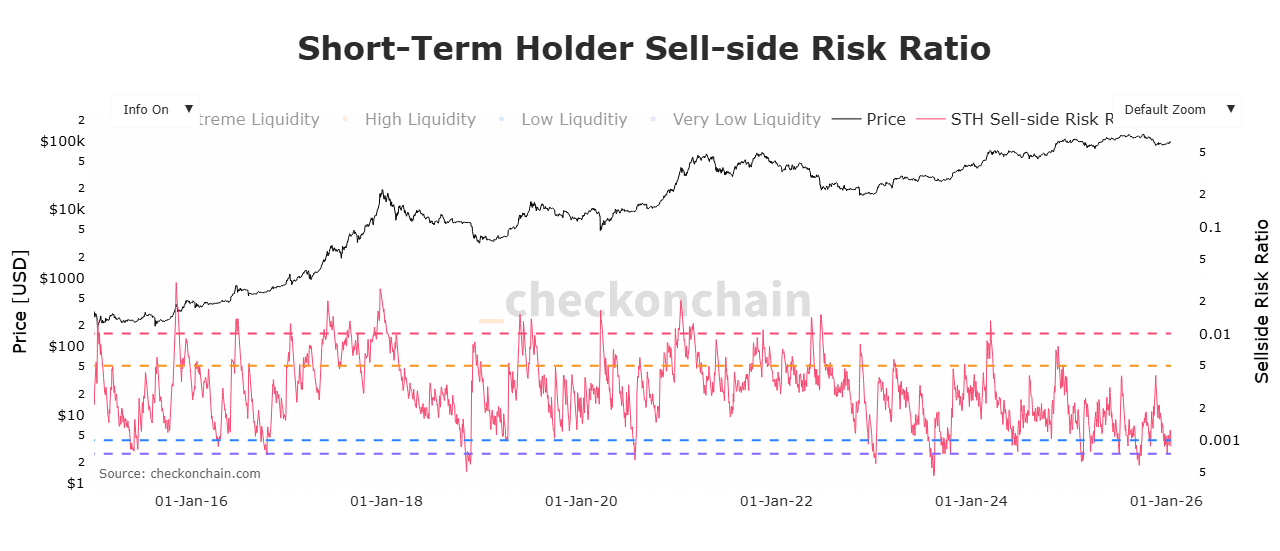

In fact, Short-Term Holder Sell-Side Risk declined sharply. The indicator dropped to 0.000875, approaching historical lows, per Checkonchain.

Source: Checkonchain

Such depressed readings suggested most STH selling already occurred. Remaining sellers appeared exhausted.

Even so, this did not guarantee immediate upside. It did imply that incremental demand could move the price more easily.

Why STHs stayed sidelined

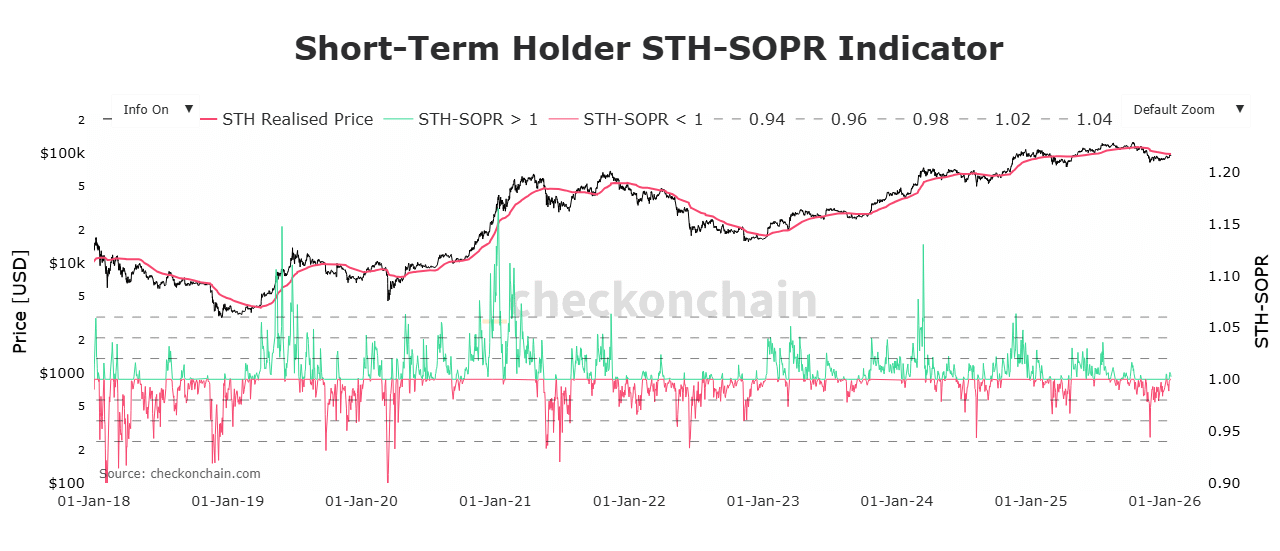

Despite Bitcoin’s rebound, short-term holders did not rush to sell into strength. The cohort largely lacked incentive.

Weaker hands already exited during prior drawdowns, reducing ongoing loss realization.

Source: Checkonchain

Checkonchain data showed the market transitioned away from forced selling.

On top of that, Short-Term Holder SOPR improved. The metric rose from 0.94 to 1.0 at press time, indicating recent losses were absorbed.

That stabilization suggested balance returned, raising the probability of continued recovery.

With limited profits available and losses already endured, STHs appeared more inclined to hold.

A glimpse of hope for BTC?

Bitcoin attempted a breakout earlier but faced rejection near $97,939, triggering a modest pullback. Price then consolidated near $95k, with $94k acting as near-term support.

Source: TradingView

At press time, Bitcoin [BTC] traded at $95,147. It was down 0.5% daily but up 4.93% on the week.

Despite the pullback, momentum improved. The Chande Momentum Oscillator climbed from 16 to 52, signaling strengthening upside momentum.

Bitcoin also moved above its 20-day and 50-day EMAs. At press time, price tested the 100-day EMA near $95,942.

A sustained flip above that level could confirm bullish control and open a move toward the 200-day EMA at $99,423. By contrast, failure at the 100-day EMA could send BTC back toward the $92,388 support zone.

Final Thoughts

- Bitcoin short-term holders are out of the extreme discomfort zone, as average losses for the cohort drop to 6.4%.

- Bitcoin [BTC] shows upside momentum, as STHs reduce selling pressure as they eye $99k.

Source: https://ambcrypto.com/bitcoin-eyes-99k-3-reasons-why-btc-holders-choose-to-hold/