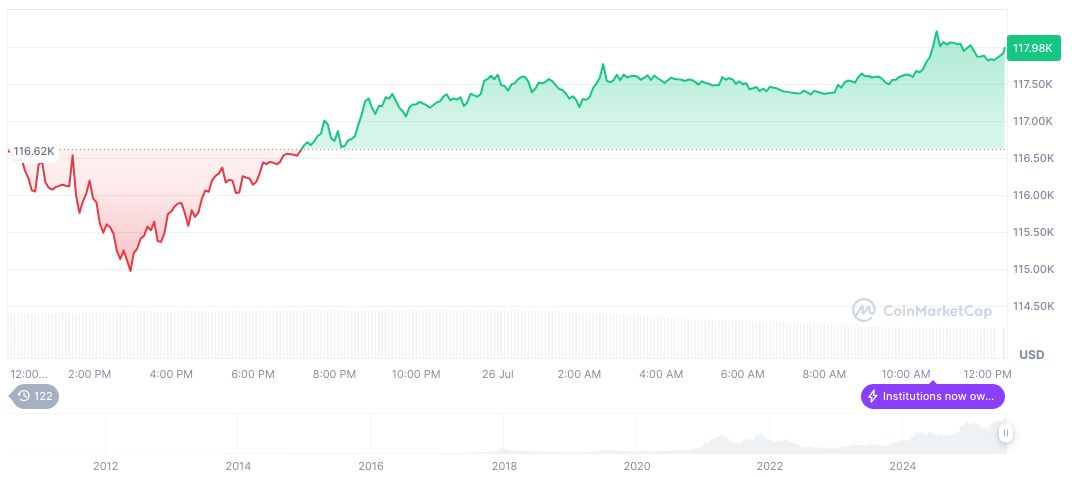

- Bitcoin achieves stability; spot ETFs alter market dynamics post-January 2024.

- Volatility significantly reduced, inviting institutional investment.

- Parabolic surges unlikely; spot ETF absorbs institutional liquidity.

Blockware BTC analyst Mitchell Askew asserts that Bitcoin’s market landscape has been permanently altered by U.S. spot ETF approval, reducing extreme volatility and changing its future price dynamics.

This transformation signifies increased stability, pulling in institutional investors while shedding short-term traders, according to Eric Balchunas of Bloomberg, likening Bitcoin’s volatility to major equity ETFs.

Spot ETFs Drive Institutional Investment Surge in Bitcoin

Spot Bitcoin ETFs fundamentally change Bitcoin’s market structure by reducing volatility and fostering wider institutional participation. Mitchell Askew suggests these developments make parabolic price fluctuations unlikely. Reports show Bitcoin’s ETF-driven market shift aligns its volatility with traditional equities.

Since the SEC’s approval of Bitcoin spot ETFs in January 2024, substantial financial changes include ETFs holding over 3% of BTC’s total supply. These ETFs absorb institutional liquidity, reducing supply in the open market. Eric Balchunas indicates that Bitcoin’s volatility now parallels prominent equity ETFs, attracting institutional investors.

Parallels with Gold as Bitcoin Shows Reduced Volatility

Did you know? The Bitcoin spot ETF impact on its volatility has drawn parallels to the historical introduction of gold ETFs, where institutional adoption similarly transformed market dynamics in their early phases.

Bitcoin (BTC) currently trades at $118,271.30, with a market cap of $2.35 trillion, per CoinMarketCap. The circulating supply stands at 19,898,009 BTC. Notable price changes include a 0.60% increase over 24 hours and a 25.70% rise over 90 days, showcasing stabilizing trends post-ETF introduction.

Insights from the Coincu research team highlight potential greater mainstream financial integration of Bitcoin, leveraging reduced price volatility. These ETFs, together with institutional interests, can fortify Bitcoin’s position as a more stable asset for longer-term investments, aiding in broader market acceptance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/uncategorized/bitcoin-spot-etf-stability/