The final week of February is here, and the crypto market is still under pressure. It continues to struggle, and this is clearly reflected in the latest ETF data.

Bitcoin ETFs saw $315.9 million in outflows this week, with $303.5 million coming from BlackRock’s IBIT. Meanwhile, Grayscale’s BTC Mini ETF attracted $36 million, offering lower-cost Bitcoin exposure for cautious investors.

Bitcoin ETF analysis

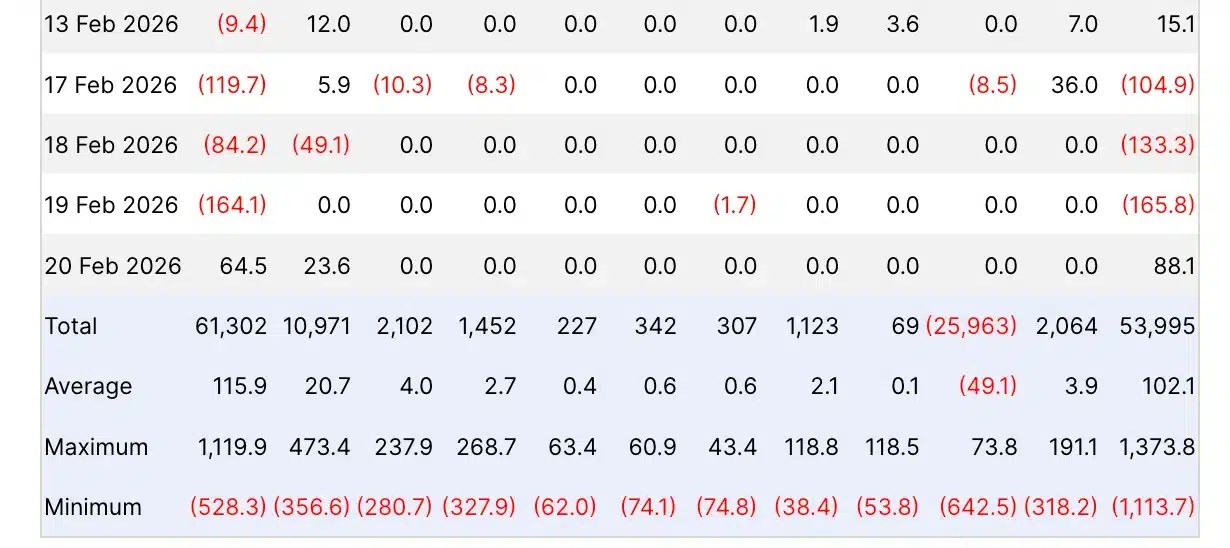

As per Farside Investors data, mid-February was a tough period for Bitcoin [BTC] ETFs, as big investors pulled money out for three days in a row.

The selling started on the 17th of February, when the market saw $104.9 million leave.

Source: Farside Investors

Most of this came from BlackRock’s IBIT, which alone lost $119.7 million. Grayscale’s BTC Mini ETF tried to balance this with $36 million in new money, but overall, investors were still heading for the exit.

The situation got worse over the next two days. On 18th February, outflows grew to $133.3 million.

Then on the 19th of February, they jumped again to $165.8 million. Once more, BlackRock led the selling, with $164.1 million leaving IBIT on that single day.

But things changed at the end of the week.

On the 20th of February, Bitcoin ETFs finally saw money come back in, with $88.1 million in net inflows. IBIT also reversed its trend and became the biggest contributor, adding $64.5 million.

The altcoin paradox

While Bitcoin ETFs were getting most of the attention, the altcoin ETF market was telling a very different story about what big investors currently prefer.

Ethereum followed a pattern similar to Bitcoin, but showed less weakness. It started the week well on the 17th of February, with $48.6 million in new inflows, mainly driven by BlackRock’s ETHA fund.

However, this positive momentum did not last long. By the 19th of February, Ethereum [ETH] ETFs saw a huge outflow of $130.1 million. Out of this, nearly $97 million came from BlackRock alone.

The situation ended on the 20th of February, when ETH ETFs recorded zero net flows, meaning no new money came in and none left.

Solana is an exception

In contrast, Solana became the top choice for institutional investors. Despite market caution, Solana ETFs have seen steady inflows since the 9th of February.

Between the 17th and 20th of February, Solana [SOL] kept attracting steady inflows. The highest point came on the 19th of February, when $6 million entered the ecosystem in a single day.

Bitwise led in total weekly volume with $11.7 million, while BlackRock’s BSOL fund supported the rally with consistent daily inflows.

At the same time, the Ripple [XRP] ETF market showed a very cautious approach. It started quietly and saw a small drop of $2.21 million on the 18th of February.

On 19th February, it briefly recovered with $4.05 million in inflows, but this did not last. By 20th February, activity slowed again and returned to almost zero.

What’s more?

Overall, the crypto ETF market is becoming more divided. Bitcoin and Ethereum are facing more pressure, while newer assets like Solana are gaining momentum.

This shift was clear on 17th February, when T. Rowe Price announced plans for an Active Crypto ETF that includes not just Bitcoin and Ethereum, but also Litecoin [LTC], Solana, and Cardano [ADA].

This move is important because it shows that big financial firms now see crypto as a serious investment space. Instead of treating it as a risky experiment, they are building strong products that include multiple digital assets.

Final Summary

- Heavy outflows from BlackRock’s IBIT suggest that institutions are reducing risk during uncertain economic conditions.

- Overall, the crypto ETF market is becoming more segmented, with different assets attracting different types of investors.

Source: https://ambcrypto.com/bitcoin-ethereum-etfs-under-pressure-inside-the-315mln-february-shake-up/