Bitcoin, Ethereum, and other altcoins are facing pullbacks amid continued profit booking in the broader crypto market. Traders are bracing for further selloffs ahead of $4.5 billion in crypto options expiry and key U.S. jobs data this week.

BTC, ETH, XRP, and SOL prices slip amid liquidations of $115 million in long positions by traders. In addition, rising long-term Treasury yields and gold prices due to fiscal concerns increased selling pressure on Bitcoin price.

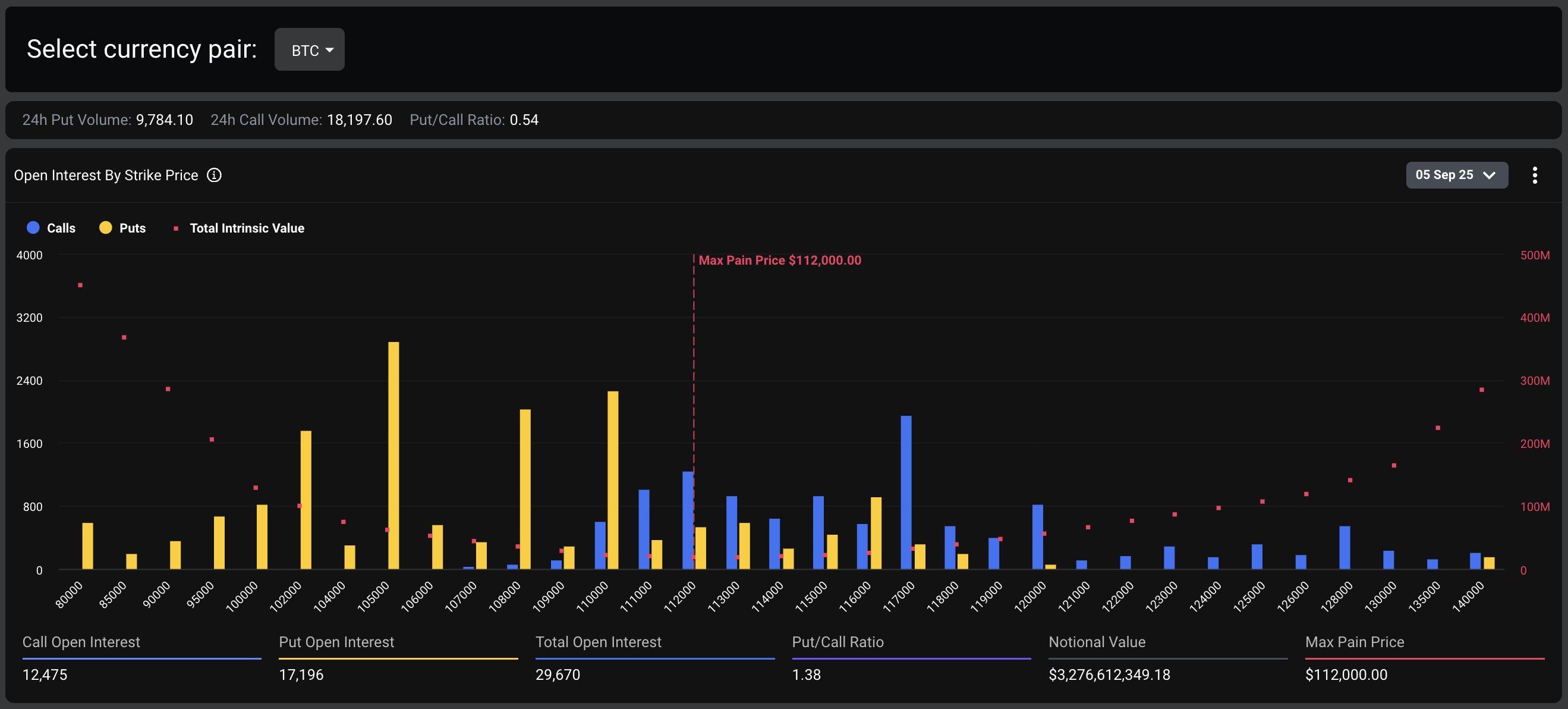

$3.28 Billion in Bitcoin Options Expiry

According to Deribit, more than 29K BTC options with a notional value of $3.28 billion are set to expire on Friday. The put-call ratio is 1.39, which is extremely high and indicates bearish sentiment among traders.

Moreover, the max pain price is at $112,000. Derbit revealed that puts have clustered around $105K-110K strike price, with most traders betting on a Bitcoin price fall below $105,000.

Analyst Caleb Franzen revealed that Bitcoin broke below its daily Ichimoku cloud for the first time since February 2025, potentially flipping it into resistance. Historical seasonality patterns are playing a key role in bearish sentiment for Bitcoin, with bearish crossover on the weekly MACD.

$1.28 Billion in Ethereum Options Expiry

Over 293K ETH options with a notional value of $1.28 billion are set to expire on Deribit, with a put-call ratio of 0.78. This indicates mixed sentiment among traders due to a neutral put-call ratio.

Moreover, the max pain price is at $4,400, higher than the current market price of $4,385 at the time of writing. This signals. Options traders are watching three key levels of $4,500, $4,700, and $5,000.

“Flows lean more balanced, but calls build up above $4.5K, leaving upside optionality,” said Deribit. Trading volume could support upside momentum and confirm a recovery towards a new ATH.

XRP and Solana Max Pain Price

XRP options worth $5.54 million to expire, with a put-call ratio of 0.93. The max pain price is at $2.90, indicating the key level to watch as the crypto asset remains under pressure amid deeper negative XRP whale flow.

XRP price today is trading sideways near $2.83, with an intraday low and high of $2.82 and $2.88, respectively. Moreover, trading volume has declined by 34% in the last 24 hours, indicating low interest among traders.

Meanwhile, $29.87 million in Solana options to expire, with a put-call ratio of 0.32. The max pain price is at $200, lower than the current market price of $207.

SOL price is trading 0.60% down in the last 24 hours, with a 24-hour low and high of $205.88 and $212.82, respectively. Trading volume has plunged 38% over the last 24 hours, indicating a lack of interest ahead key jobs report.

Investors Eye Jobs Data for Recovery

JOLTS Job Openings data in the United States earlier this week triggered a slight rebound in the crypto market. Traders now await the key August nonfarm payrolls data release and unemployment rate data on Friday.

Nonfarm payrolls data is expected to come in at 75K, higher than 73K in the previous month. Moreover, economists forecast the unemployment rate rising to 4.3%, up from 4.2% previously. If nonfarm payrolls data comes in lower-than-expected and the unemployment rate prints at 4.3%, the crypto market will recover.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Source: https://coingape.com/bitcoin-eth-xrp-sol-max-pain-price-ahead-options-expiry-key-jobs-data/