Bitcoin, Ethereum, and other altcoins are facing further pullbacks today as traders brace for further selloffs ahead of the largest-ever $23 billion in crypto options expiry. BTC, ETH, XRP, and SOL prices slip amid rising long liquidations over the past 24 hours.

In addition, climbing long-term Treasury yields, the US dollar, and gold prices are contributing to rising selling pressure on Bitcoin. Notably, Bitcoin is diverging from gold and tech stocks, with gold following the Global M2 Money Supply.

$17 Billion in Bitcoin Options Expiry

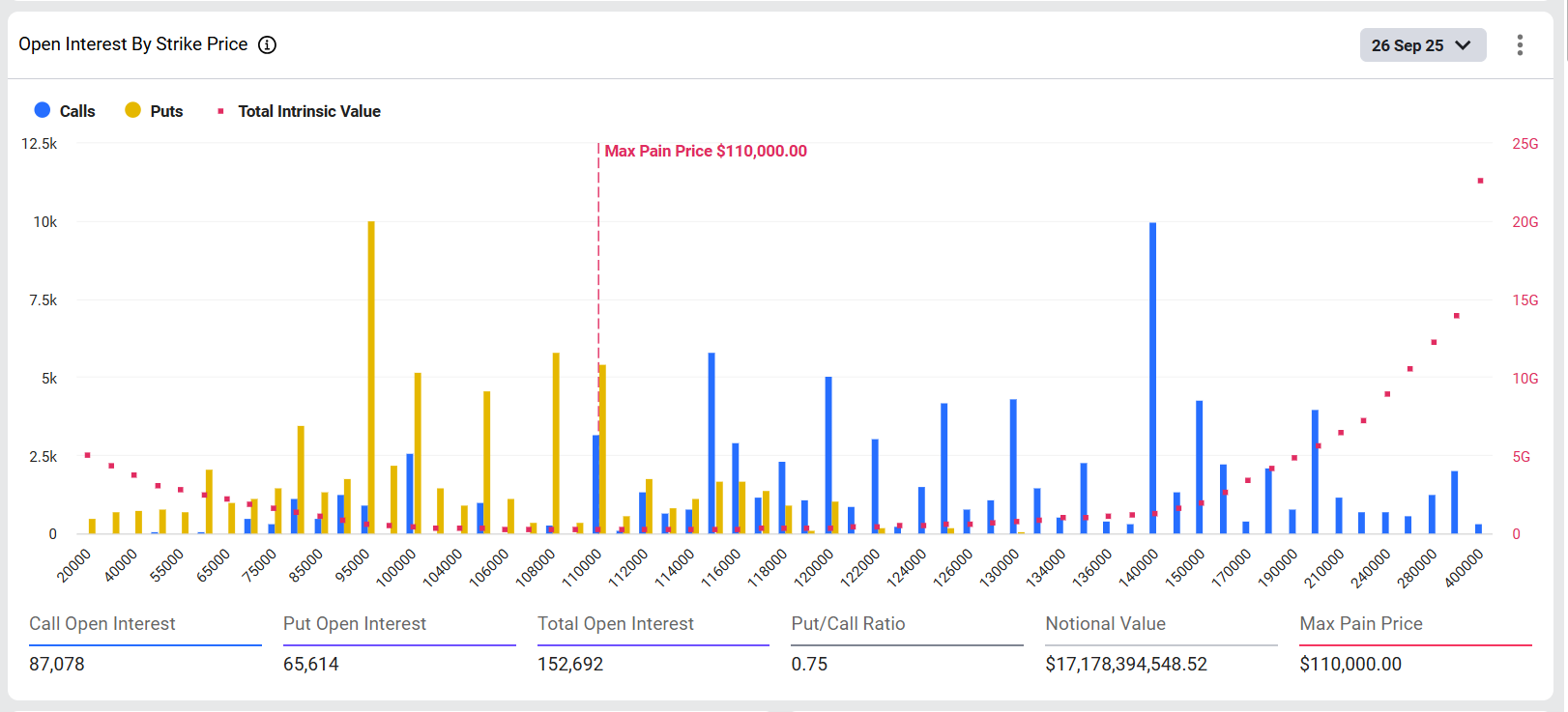

More than 152K BTC options with a notional value of $17.07 billion are set to expire on Deribit derivatives crypto exchange on Friday. The put-call ratio of 0.75 indicates slightly bearish sentiment among traders.

Bitcoin max pain price is at $110,000, significantly lower than the current market price of $111,970. Derbit revealed heavy puts positioning around $95,000-110,000 strike price, with most traders betting on a massive BTC crash. Moreover, puts are twice as high as calls at the max pain price, signaling a bias to drive the price below the point.

Adam from options terminal GreeksLive revealed that traders are actively selling put options and preparing for a potential bottom formation this week. There are expectations of either bottoming out near max pain or a slight dip to $108,000 before a potential rebound.

BTC historical seasonality patterns are played a key role in bearish sentiment for Bitcoin. Besides, BTC implied volatility gradually rising as the largest-ever crypto options expiry approaches.

$5.33 Billion in Ethereum Options Expiry

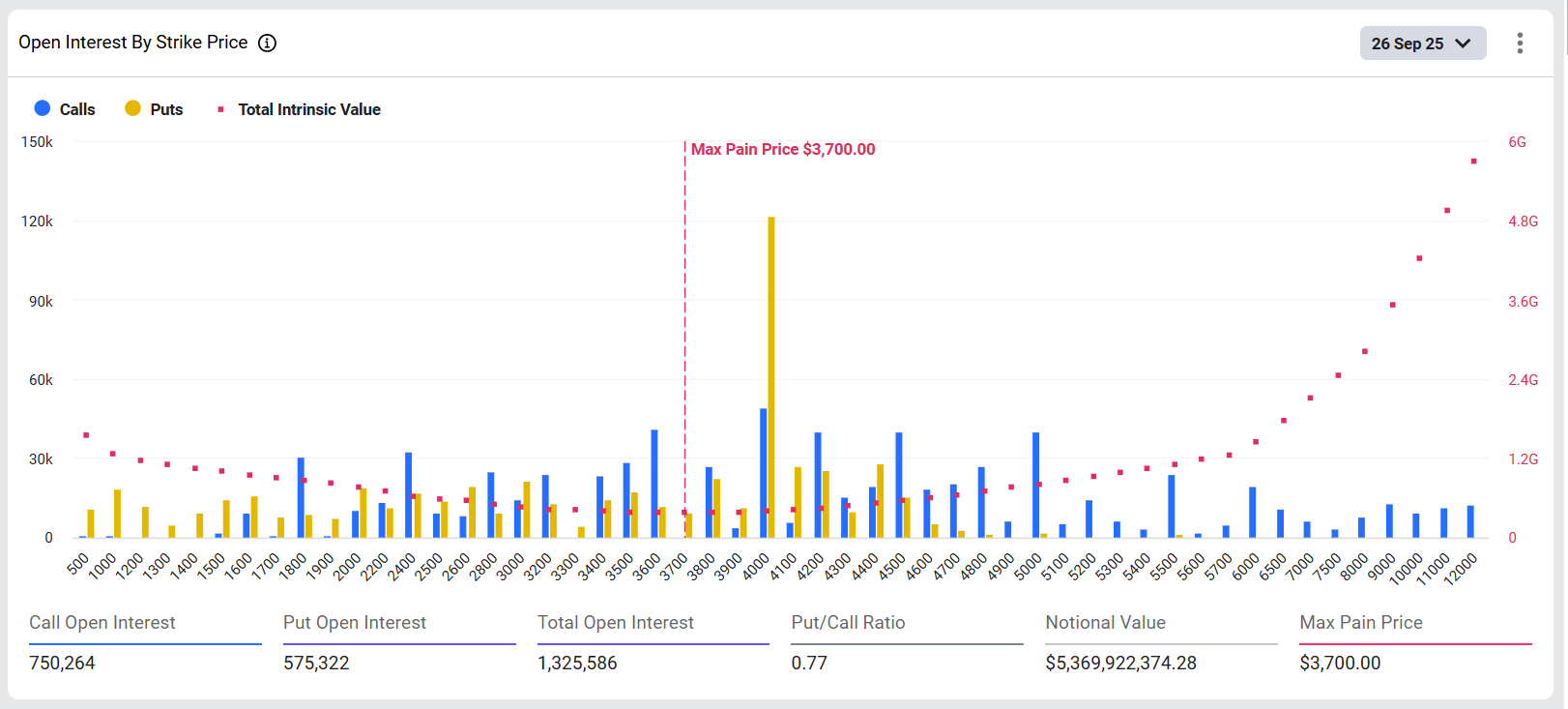

Over 1.32 million ETH options with a notional value of $5.33 billion are set to expire on Deribit, with a put-call ratio of 0.76. This slightly bearish put-call ratio indicates traders expect further downside.

Moreover, the max pain price is at $3,700, higher than the current market price of $4,018 at the time of writing. This signals higher odds of a sudden drop in Ethereum, with $4,000 strike price having extremely higher put bets.

“With vol suppressed but leverage tilted to the upside, any macro shock could set the tone for Q4,” said Deribit. Trading volume could support upside momentum and confirm a recovery towards a new ATH.

Multiple traders are actively selling ETH put options across different time frames, believing that a slow decline favors option sellers. Moreover, ETH volatility shows particular stickiness, with put options losing value even during declines, making 2-day expiry 20 Delta put options particularly profitable trades.

XRP Max Pain Price

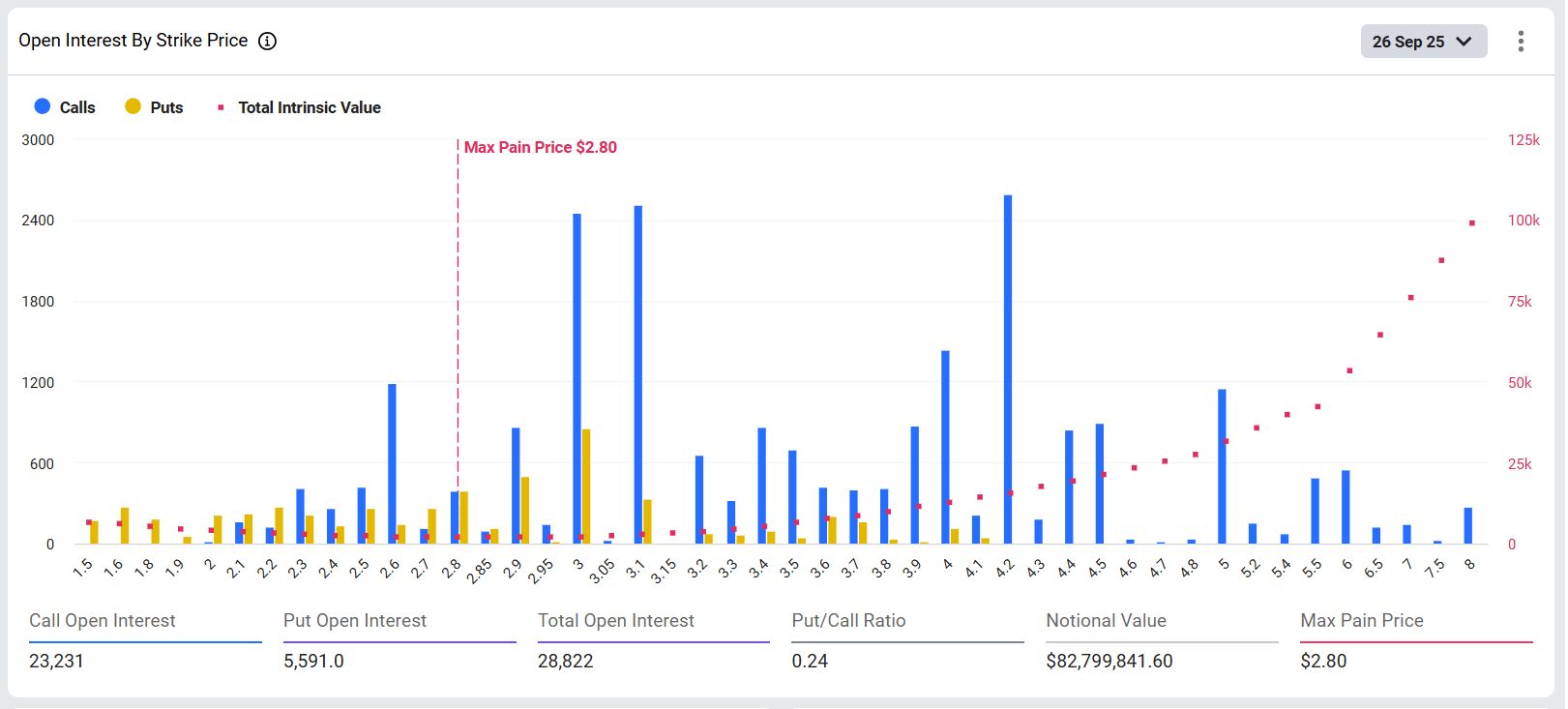

Over 28K XRP options worth $83 million to expire, with a put-call ratio of 0.24. The max pain price is at $2.80, but traders are betting for $3, $3.1, and $4.2 due to bullish technical patterns. Traders are watching the key level as the crypto asset faces selling pressure, developments such as despite tokenized BlackRock BUIDL redemption to RLUSD buzz.

XRP price today witnessing volatility as whales resists a drop to $2.80, while Bitcoin faces selloffs. The price is trading at $2.85, with an intraday low and high of $2.84 and $2.99, respectively. Moreover, trading volume has increased by 22% in the last 24 hours, indicating high interest among traders.

Solana (SOL) Max Pain Price

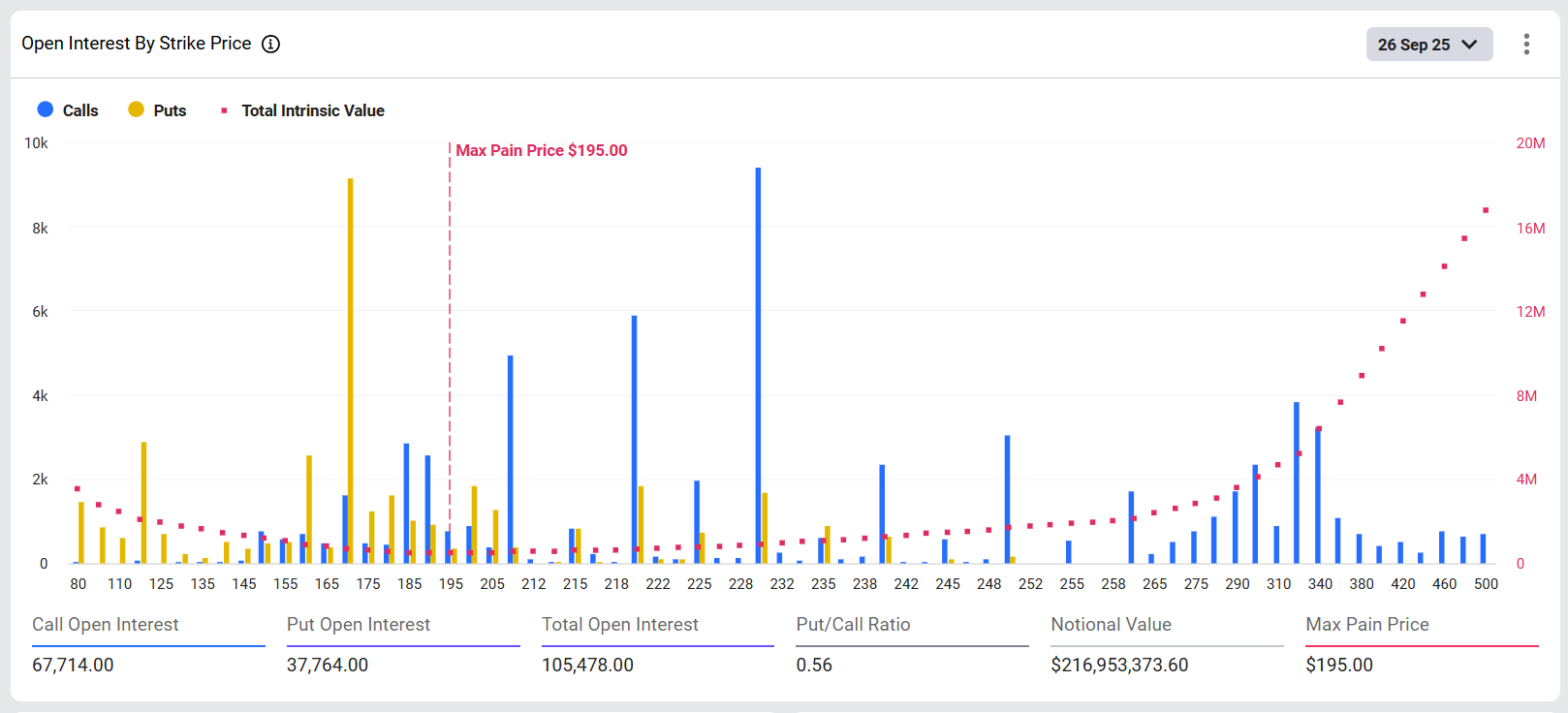

Meanwhile, more than 105K SOL options of a notional value $217 million to expire, with a put-call ratio of 0.56. The max pain price is at $195, with trader eyeing key levels $210, $220, $230.

SOL price is trading 2% down in the last 24 hours, with a 24-hour low and high of $203.56 and $216.05, respectively. Trading volume has plunged 8% over the last 24 hours, indicating a lack of interest amid uncertainty.

Source: https://coingape.com/bitcoin-eth-xrp-sol-max-pain-price-ahead-of-largest-ever-23b-options-expiry/