In Brief

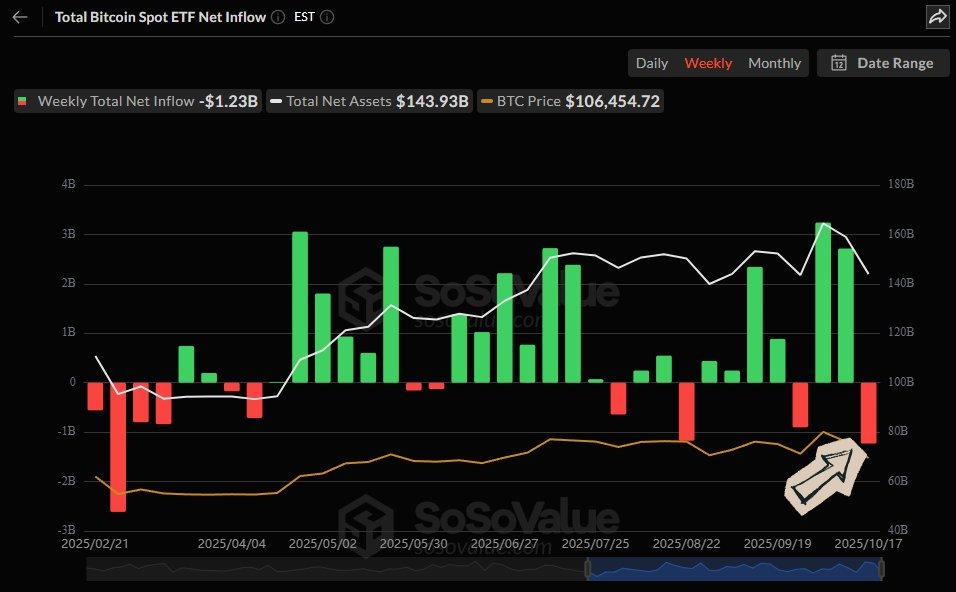

- Bitcoin ETFs faced $1.22B in outflows, including $536.4M in a single day.

- BTC price fell over $10K in a week, hitting a four-month low under $104K.

- Open interest dropped to 2025 lows, aligning with Extreme Fear zone before past reversals.

Spot Bitcoin exchange-traded funds in the U.S. saw over $1.22 billion in outflows during the past week. Friday alone recorded $366.6 million in outflows, capping a volatile period marked by declining institutional demand.

BlackRock’s iShares Bitcoin Trust led losses with $268.6 million withdrawn, while Fidelity’s fund followed with $67.2 million. Grayscale’s GBTC saw $25 million in redemptions, and Valkyrie reported minor losses, while others had no flows.

Thursday marked the largest single-day outflow since August 1, totalling $536.4 million across eight of twelve ETFs. Ark & 21Shares’ ARKB led with $275.15 million, followed by $132 million from Fidelity’s FBTC and losses across Bitwise, VanEck, and others.

This ETF exodus coincided with Bitcoin’s price plunging over $10,000 in the week, falling from $115,000 to below $103,000. The drawdown pushed the asset to its lowest level in four months, reflecting broader risk-off sentiment.

Mixed Signals Emerge From Cycle Theories and On-Chain Data

Meanwhile, some analysts view the current correction as a phase of broader market restructuring.

Merlijn The Trader noted Bitcoin’s traditional four-year cycle may be changing, influenced more by macroeconomic policies than timing. The Federal Reserve’s monetary easing could shorten bearish phases and trigger earlier recoveries.

In contrast, on-chain signals point to possible near-term stabilisation, as open interest fell to its lowest level in 2025. According to CryptoQuant, this drop aligns with the “Extreme Fear” zone, often preceding bullish reversals.

Bitcoin remains above $70,000 despite heavy ETF outflows and sentiment collapse, suggesting price resilience. Combined signals indicate the market could be nearing a consolidation zone before renewed upside momentum resumes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/bitcoin-etfs-see-1-22b-weekly-outflow-as/