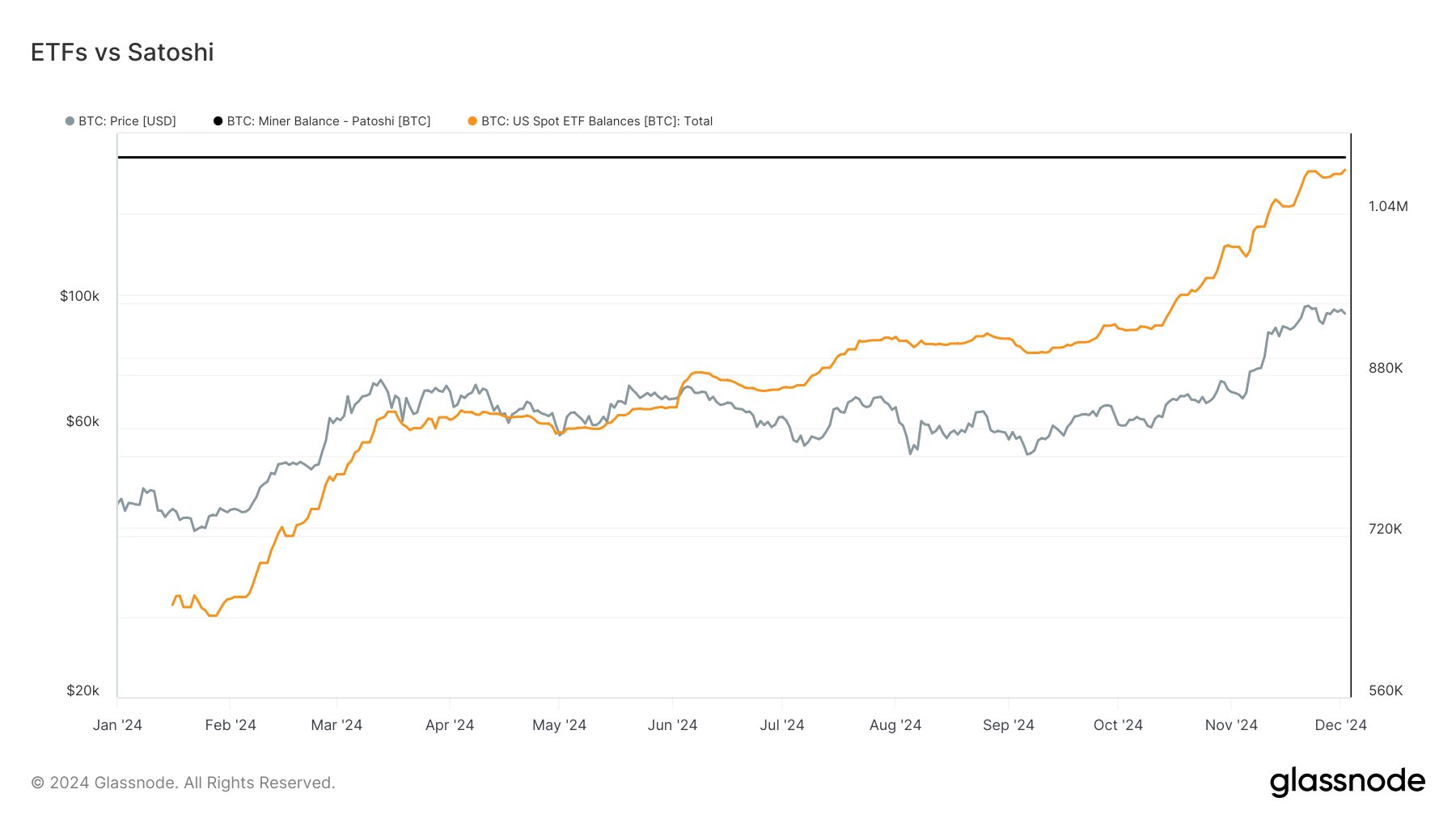

The US spot Bitcoin ETFs are nearing a significant milestone, with their holdings almost equaling founder Satoshi Nakamoto’s Bitcoin stash.

Notably, the US Bitcoin ETFs have been a gamechanger for the crypto sector since their launch on January 11. The investment vehicles have spurred Bitcoin’s price upsurge while turning the pioneering cryptocurrency into a mature asset class.

Since their market debut, Bitcoin ETFs have been one of the fastest-growing funds, with two of them entering the top ten biggest ETF funds launched this decade. As of December 2, the US Bitcoin ETFs have seen a cumulative inflow of $31.06 billion.

Bitcoin ETFs Near Satoshi Nakamoto’s Bitcoin Holdings

Meanwhile, these investment products’ impressive exploits have drawn them closer to a notable milestone. The funds are now a few BTC tokens away from topping founder Satoshi Nakamoto’s stash of the premier asset.

According to data, the pseudonymous founder holds over 1 million BTC, specifically 1.096 million of the asset. Satoshi Nakamoto is the largest Bitcoin holder, keeping a staggering 5.22% of the asset’s total supply cap.

However, the US spot Bitcoin ETFs are already looking to upset the founder’s years-long accolade. Having surpassed Michael Saylor’s MicroStrategy earlier in the year, the funds are 13,000 BTC tokens away from reaching Satoshi’s.

Per Sosovalue, the spot ETFs’ $353.67 million inflow on Monday brought their total holdings to 1.083 billion BTC. Interestingly, the products would need an inflow worth $1.23 billion at the current market price to reach the impressive milestone.

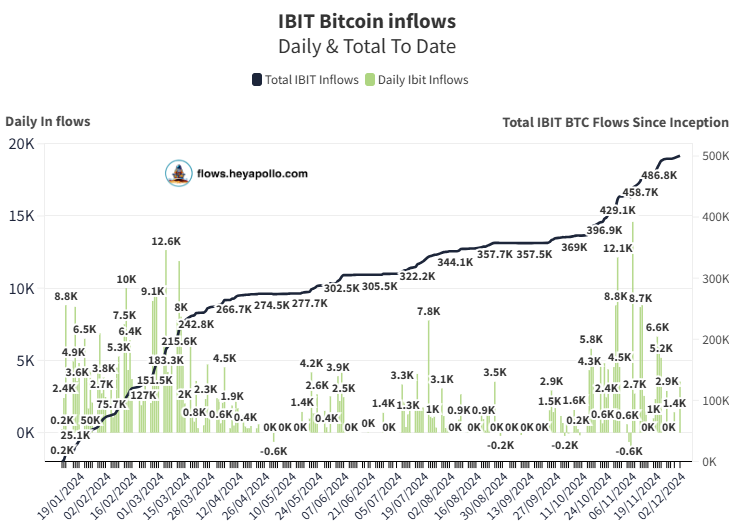

BlackRock’s ETF Surpasses 500,000 BTC

More particularly, BlackRock iShares Bitcoin Trust’s (IBIT) Bitcoin holdings have also surged to a remarkable level. On Monday, the leading issuer acquired 3,525 BTC ($338.33 million), taking its stash above the landmark figure.

Notably, IBIT has seen a cumulative inflow of $32.08 billion since its inception and now holds a net asset of $48 billion. Impressively, this is still above MicroStrategy’s 402,100 BTC as of December 2.

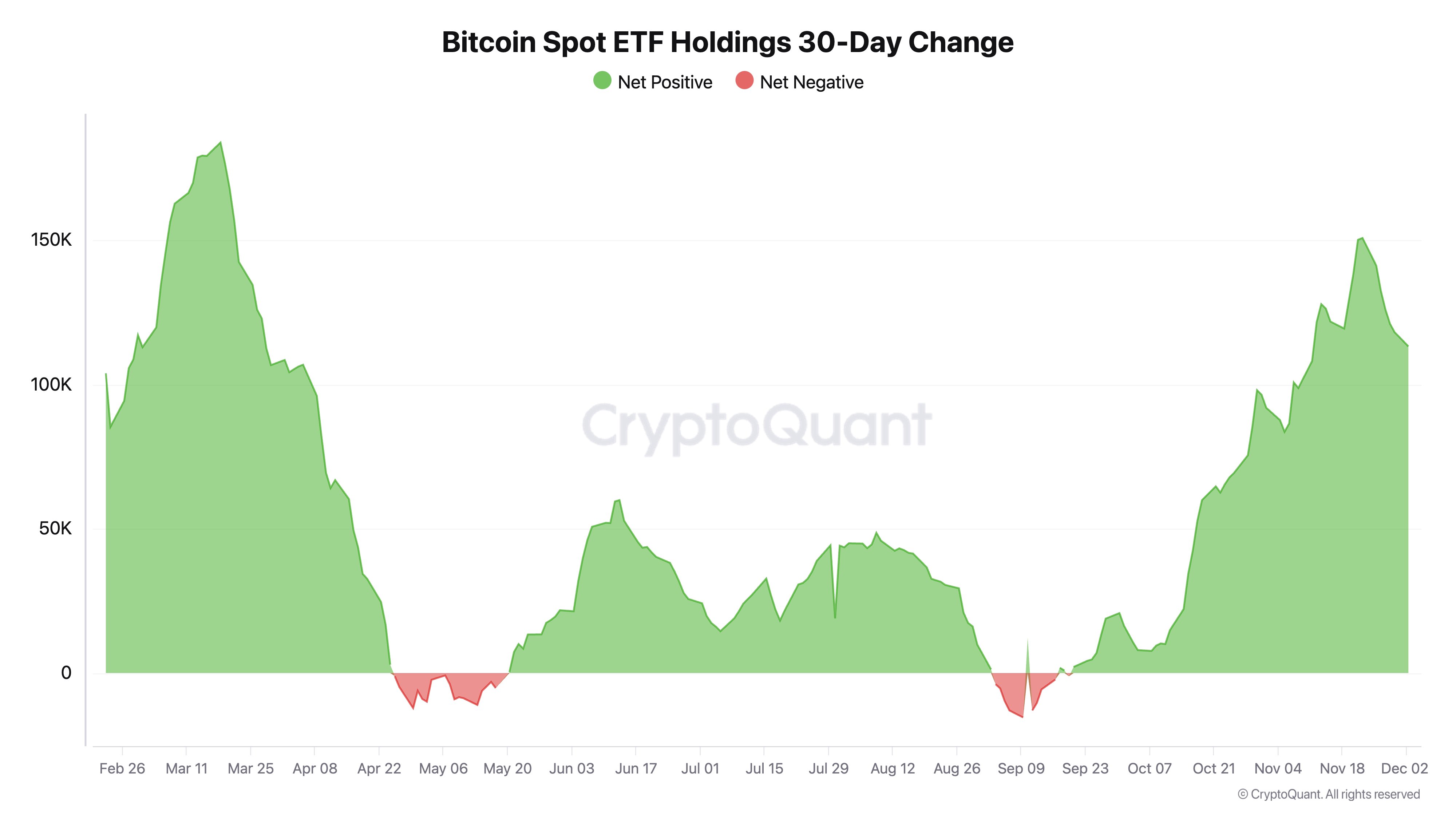

Meanwhile, the buzzing US spot ETF inflows mirror growing traction for the funds. In a tweet today, CryptoQuant’s CEO Ki Young Ju shared an analysis showing that demands for the investment vehicles have reached the levels seen when they first made their market debut in January.

An accompanying chart shows that the net positive 30-day change in Bitcoin spot ETF holdings recently reached the 150K BTC mark. Notably, the funds had a turbulent time between April and May and in September as outflows dominated the scene.

However, investors have rekindled their interest in the products following Donald Trump’s November election win. On the back of the victory, the Bitcoin ETFs recorded a single-day net inflow of $1.37 billion on November 7, their largest since inception.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2024/12/03/bitcoin-etfs-almost-equal-satoshi-nakamotos-stash-as-demand-heightens/?utm_source=rss&utm_medium=rss&utm_campaign=bitcoin-etfs-almost-equal-satoshi-nakamotos-stash-as-demand-heightens