Inflows into spot Bitcoin ETFs skyrocketed once again on Monday, to a total of $667 million. BlackRock’s iShares Bitcoin Trust (IBIT) led the inflow with significant contributions coming this time from Fidelity’s FBTC, and Ark Invests’ ARKB. BTC price has bounced back strongly by 3% today, trading above $105,565 levels. Also, technical charts show the ‘golden cross’ pattern formation, driving strong bullish sentiment.

BlackRock Leads Spot Bitcoin ETF Inflows Once Again

On Monday, BTC ETFs recorded net inflows of $667 million, of which BlackRock’s IBIT contributed a total of $306 million in inflows. IBIT has dominated a large part of the inflows recorded on 23 of the last 24 trading days, according to market analyst Nate Geraci.

In total, the ETF has garnered approximately $6.5 billion in new investments, reflecting strong confidence in Bitcoin’s prospects. Over the past four trading days alone, the fund received an additional $1.1 billion. On Monday, BlackRock Bitcoin ETF IBIT scooped a total of 2910 Bitcoin, taking it total holdings to 636,000 BTC.

But data from Farside Investors shows that on Monday, Fidelity Bitcoin ETF (FBTC), and Ark Invest’s ARKB also contributed significantly with $188 million and $155 million in inflows, respectively. The recent ETF inflows come amid strong upside in BTC price, which is now trading another 3% up today, as bulls target fresh all-time highs.

BTC Eyes Golden Cross For Bullish Breakout

After consolidating for around a week, Bitcoin price is once again showing strength gaining 3% and moving past $105,000. Furthermore, the Coinglass data shows that the open interest is up 7% to $73 billion, with 24-hour short liquidations having surged to $45 million.

Renowned crypto analyst Benjamin Cowen has highlighted an impending “golden cross” for Bitcoin, expected to materialize within the coming days. This highlights the setup for a strong bullish rally ahead.

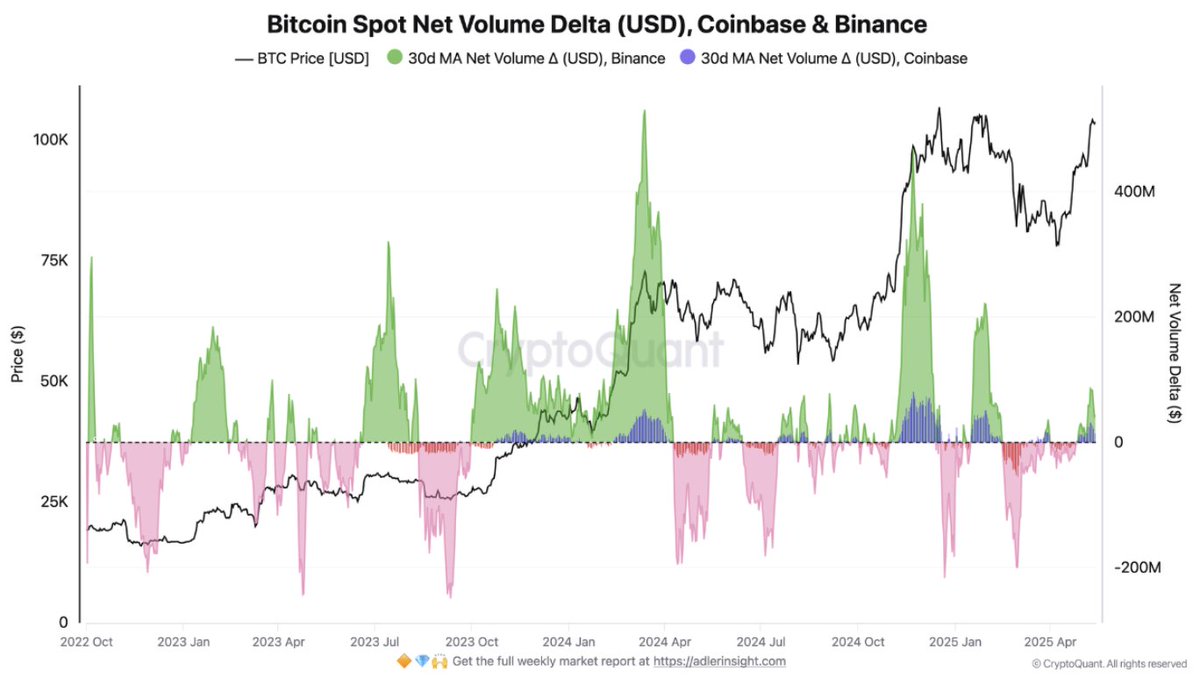

Additionally, data analytics firm CryptoQuant reports a positive shift in Bitcoin spot net volume delta (USD) on Binance, indicating a resurgence of buying activity in the spot markets. According to CryptoQuant, this development marks a reduction in selling pressure. The renewed interest in spot purchases is seen as a potentially bullish indicator for Bitcoin’s short-term price movement.

Bitcoin is showing greater strength as last week, Moody’s downgraded the U.S. credit rating, highlighting escalating debt obligations and increasing vulnerabilities within the nation’s economy.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/bitcoin-etf-inflows-skyrocket-btc-eyes-golden-cross-soon/

✓ Share: