- Bitcoin saw its first red October in six years since 2018, signaling a potential shift in market sentiment with long-term holders selling around $33 billion in BTC last month.

- Ethereum, XRP, BNB, SOL, and DOGE dropped 5–7% as the overall altcoin market touches bottom, with signs of potential accumulation ahead.

Bitcoin (BTC) and the broader crypto market have been facing a sharp selloff today, triggering more than $540 million in crypto market liquidations.

After negating the ‘Uptober’ rally sentiment by ending in the red for the last month, BTC is once again having a poor start for the month of November. Historically, this month has been the strongest for BTC with an average return of 42%.

Bitcoin’s First ‘Red October’ Since 2018 May Signal Key Market Shift

Crypto trading firm QCP Capital reported that Bitcoin dropped from $110,000 to $107,000 in early October amid profit-taking by early holders, marking its first negative October since 2018. Despite heavy selling pressure exceeding 400,000 BTC, the leading cryptocurrency managed to hold above the crucial $100,000 level.

QCP Capital noted that this consolidation could represent either a brief pause before a renewed rally or the beginning of a potential crypto winter.

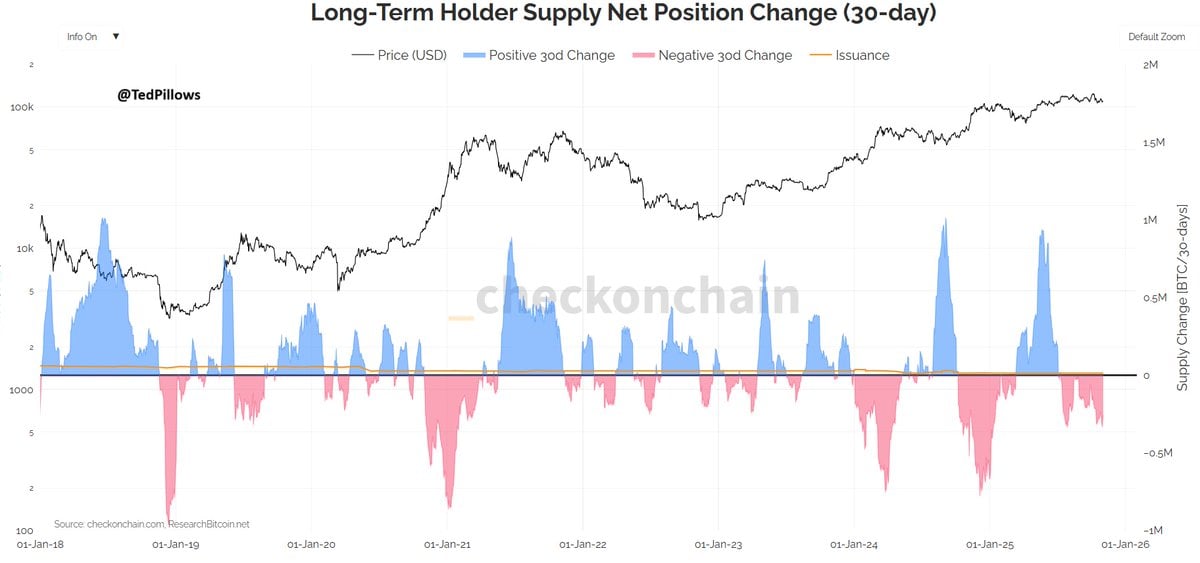

Crypto analyst Ted Pillows reported that long-term Bitcoin holders sold approximately $33 billion worth of BTC last month. This added a massive $1 billion in daily selling pressure. He noted that this substantial profit-taking activity was one of the key factors contributing to Bitcoin’s bearish performance throughout October, as mentioned in our previous story.

October was the month of extreme volatility, with BTC price shooting $126,000 earlier this month. However, the 100% Trump tariffs on China triggered massive liquidations across the broader crypto market, pushing BTC to lows of $105,000.

On the other hand, the Fed rate cut announcement also didn’t help for a BTC recovery ahead. As reported by CNF, the total number of active addresses on the Bitcoin network has been declining, indicating waning retail interest. Thus, every catalyst for a Bitcoin price upside remains absent as of now.

Altcoins Buckle Under Pressure, Is A Revival Possible?

In addition to Bitcoin, altcoins are facing even greater selling pressure, led by Ethereum (ETH) price correcting 5% to under $3,700. With this, ETH has extended its weekly losses to more than 10%.

A similar bloodbath is visible across other top altcoins, with XRP, BNB, SOL, and DOGE all falling by 5-7%. On-chain data suggests that the bottom could be in, and this could be the right time for accumulation for long-term holders.

The overall altcoin market cap, excluding the top ten, has hit rock bottom during this market sell-off. Market experts Ash Crypto noted that altcoins are gearing up for one of the biggest rallies in the past 5 years and a full-blown altseason.

Altcoins remain deeply undervalued this cycle.

A cycle won’t end without having retailers enter the market

If history repeats, we are about to witness the biggest euphoria for altcoins soon pic.twitter.com/2QLYErGQN4

— Ash Crypto (@Ashcryptoreal) November 2, 2025