- Bitcoin mining difficulty increased 4%, affecting miner profitability and fees.

- Difficulty rise marks the fifth consecutive increase since June.

- Weak fees and low hashprice compress miner profit margins.

On September 7, 2025 (UTC), Bitcoin’s network difficulty rose by 4% to approximately 136.0T at block 913,248, marking the fifth consecutive increase since June.

This change, coupled with a declining hashprice, compresses miner margins, making Bitcoin’s future profitability reliant on price recovery or increased on-chain fees.

Bitcoin’s 136.0 Trillion Difficulty Marks Fifth Consecutive Rise

Bitcoin’s network difficulty adjustment resulted in a 4% increase at block 913,248, now at 136.0 trillion. This is the fifth successive adjustment since June. The mining community faces financial pressure due to a drop in hashprice to $51, the latest low. Consecutive difficulty increases continue, resulting in an operating cost rise for miners reliant on marginally profitable equipment.

The profitability of miners has dwindled, given the weak transaction fee contributions averaging 0.025 BTC per block. The latest hashprice low reflects a 5% decline from August‘s average. Major players such as Foundry and F2Pool continue to discuss operational strategies. However, leading figures such as Satoshi Nakamoto or Paolo Ardoino have refrained from commenting publicly.

“The vast majority of our Bitcoin is held directly: bc1qjasf9z3h7w3jspkhtgatgpyvvzgpa2wwd2lr0eh5tx44reyn2k7sfc27a4” — Paolo Ardoino, CEO, Tether

Historical Resilience Amid Price Uptick and Future Predictions

Did you know? Bitcoin’s last comparable difficulty sequence saw adjustments post-2021’s hash rate migration from China, reaffirming network resilience amid increased global competition.

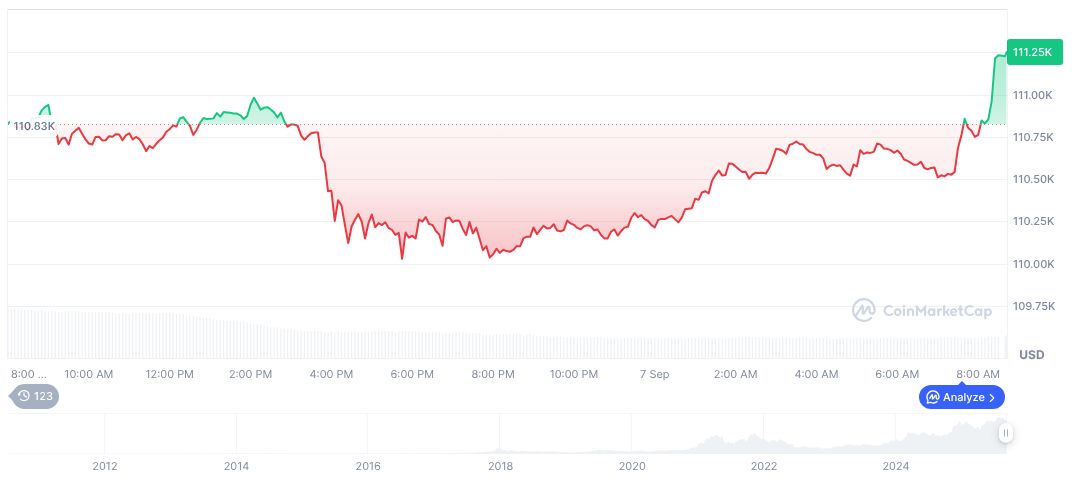

Bitcoin (BTC) currently trades at $110,922.94, with a market cap of $2.21 trillion and a 24-hour volume of $26.52 billion, as per CoinMarketCap. Recently, BTC witnessed a 0.36% increase over 24 hours and a 2.51% surge in the last week.

Experts suggest the current difficulty trajectory may lead to miner capitulations unless BTC prices recover or fee structures improve. Historical data shows such difficulty trends often stabilize network hashpower and curtail miner exits.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/bitcoin-difficulty-rise-september-2025/