- Bitcoin sees reduced demand, profit-taking since July, impacting market dynamics.

- Demand from institutional investors and ETFs has waned significantly.

- Current market sentiment has cooled from being extremely bullish.

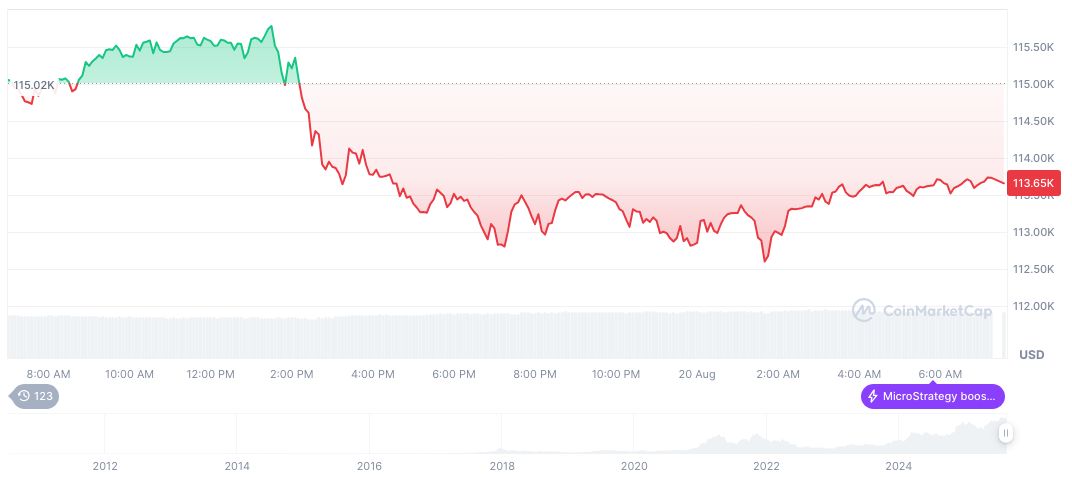

Bitcoin demand has decreased since July, as reported by CryptoQuant on August 20, with institutional interest waning and profits among holders reaching $74 billion.

This market adjustment highlights potential support at $110,000, reflecting reduced incentive to sell amid diminished ETF inflows and shifting sentiment.

Institutional Withdrawals and Price Consolidation Insights

CryptoQuant’s analysis highlights a marked decline in Bitcoin demand since July, with apparent demand falling from 174,000 to 59,000 BTC. Institutional interest has also significantly waned, demonstrated by a sharp drop in 30-day net ETF purchases to 11,000 BTC, the lowest since April, impacting market dynamics substantially. “The drop in apparent BTC demand from 174,000 to 59,000 between July and August reflects a significant cooling period in market activity,” said Darkfost, an Analyst at CryptoQuant.

Price consolidation is evident, with Bitcoin’s price stabilizing just above $120,000, correlating with key support levels, notably at $110,000. Profit-taking has played a major role, with $74 billion realized in net profits among Bitcoin holders. This significant amount includes $2 billion earned by whale investors within a single day in August.

Market sentiment and reactions point to a cautious atmosphere, with many stakeholders expressing concern over the falling demand and the need for support maintenance. Absent substantial public statements or detailed reactions from regulatory bodies or prominent individuals, the mood has shifted to a more cautious optimism amid these developments.

Historical Context and Current Market Statistics

Did you know? Declines in Bitcoin’s ETF demand to historic lows signal a notable shift from previous bullish phases, often leading to price consolidations highlighted in CryptoQuant’s data.

Bitcoin (BTC) is currently priced at $114,267.67, with a market cap of $2.27 trillion, according to CoinMarketCap. The cryptocurrency dominates 58.55% of the market, showing a 0.78% increase in price over the past 24 hours. Despite this short-term gain, Bitcoin experienced a 6.91% drop in value over the last week and a 2.48% decrease over the past 30 days. The trading volume in the last 24 hours is slightly down at $69.62 billion.

Financial outcomes and regulatory considerations are essential in analyzing current trends. Historically, demand cycles and realized profit patterns suggest a potential holding phase dominating the market landscape. However, any significant shifts in regulatory perspectives or institutional decisions could alter this trajectory, reinforcing support or challenging investor confidence.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/bitcoin-demand-declines-profit-taking/