Key Highlights:

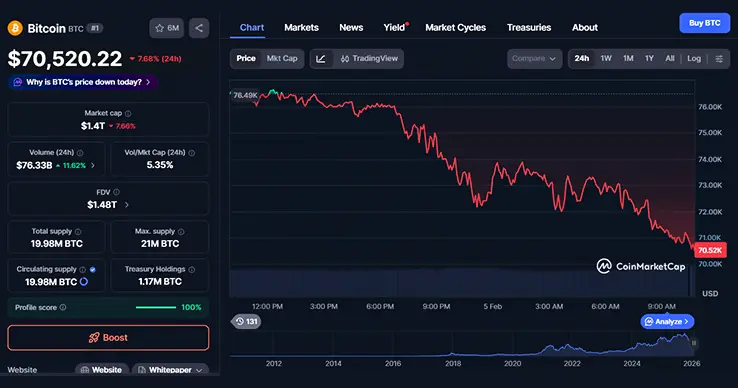

- Bitcoin (BTC) dropped to $70,000 mark today, February 5, 2026.

- BTC ETFs saw outflows on February 4, 2026.

- Global tech sell-off and Bhutan selling its BTC has also triggered the BTC’s price drop.

Bitcoin dropped by significant levels in the last 24-hours. According to CoinMarketCap, the token dropped by 7.4% today, February 5, 2026 and has been underperforming the overall crypto market which fell by 6.6%. With this drop the token continues a 7-day loss of about 20%. The price of the token is currently hovering around the $70,000 mark.

At press time, the price of the token stands at $70,520.22 with a drop of 7.68% in the last 24-hours as per CoinMarketCap. This is the lowest that the token has traded in over 200 days.

ETF Outflows Weigh on Market

The Bitcoin ETF saw an outflow of $171.50 million on February 4, 2026, as per SoSoValue data. In the previous days, the BTC ETFs saw a significant outflow and the total asset under management went from $123.6 billion a month ago to $95.51 billion today.

According to Eric Balchunas, Senior ETF analyst at Bloomberg, stated in a tweet that even though Bitcoin has dropped around 40% and many investors are in red, only 6% of ETF assets have been withdrawn. According to this, 94% of investors are still holding, which is a sign of resilience even though the market is super volatile at the moment.

He even highlighted that IBIT briefly reached $100 billion in assets and then it dropped down to $60 billion. Even though there is a decline, IBIT is on track to be the fastest ETF in history to reach $60 billion, maintaining steady growth over three years.

Facts. Only about 6% of the assets in the bitcoin ETFs have left (= 94% hanging tough), despite nasty 40% downturn and many being underwater. OGs on the other hand.. https://t.co/CUWyrZwlr1

— Eric Balchunas (@EricBalchunas) February 4, 2026

Global Tech Sell-Off Hits Crypto

This drop for Bitcoin was also triggered by a global tech market rout. Stocks in AI and semiconductor companies, including Alphabet and AMD, dropped after weak earning and fading AI hype. Bitcoin, which is usually viewed as an asset that is risky, followed the same suit. Even traditionally safer assets such as silver and gold also took the hit. Analysts also commented that with the current market conditions, traders are treating Bitcoin like a “speculative tech stock” and not as a safe digital gold.

Government Bitcoin Sales Add Pressure

According to data from Arkham Intelligence, it has been brought to light that Bhutan’s government sold $22.3 million in Bitcoin through QCP Capital. With this move, the country has reduced its BTC holdings from 13,295 BTC in October 2024 to 5,700 BTC today. Such forced sales during such market conditions does nothing but adds extra downward pressure on prices of BTC.

Also Read: BTC ETFs Slip, Price of BTC Drops to $76K; XRP, ETH, SOL ETFs Gain

Source: https://www.cryptonewsz.com/bitcoin-crash-amid-tech-panic-etf-sell-off/