Key Takeaways

What were the stablecoin inflows telling us?

The flow to centralized exchanges and movement to derivatives exchanges showed potential buying power in the market, but reinforced the possibility of another liquidity hunt southward on BTC.

How should investors react to Monday’s price action?

Unless Bitcoin climbs back above the $117k area, swing traders and investors can maintain a bearish market outlook.

On the 13th of October, Bitcoin [BTC] rallied to $115,963, marking a 5.84% gain from the previous day’s low of $109,500. However, the upward momentum was halted as bearish pressure forced a retreat from the key $115.3k–$117k supply zone.

The rejection at the resistance zone led to a 3.54% dip in Bitcoin prices, which reached $111.8k at the time of writing.

A dip to the $108k area was a possibility that traders should be prepared for. The short-term bias is bearish, unless the buyers manage to flip the $117k region to support.

Stablecoin flows show that increased volatility is imminent

Source: CryptoQuant

While the market leader faced an uphill battle at a local resistance level, analysts noted a steady inflow of stablecoins into exchanges in recent days.

In a post on CryptoQuant Insights, user Amr Taha observed that Binance saw $590 million inflows of Tether (USDT) via the TRON [TRX] network, the go-to network for stablecoin settlement.

These inflows coincided with a Bitcoin price move beyond $115k, highlighting increased buying power in the market. The stablecoin inflows were accompanied by increased activity from whale wallets (>$100 million).

The analyst pointed out that this increased the chances of a sharp move, and volatility could go both ways.

Source: CryptoQuant

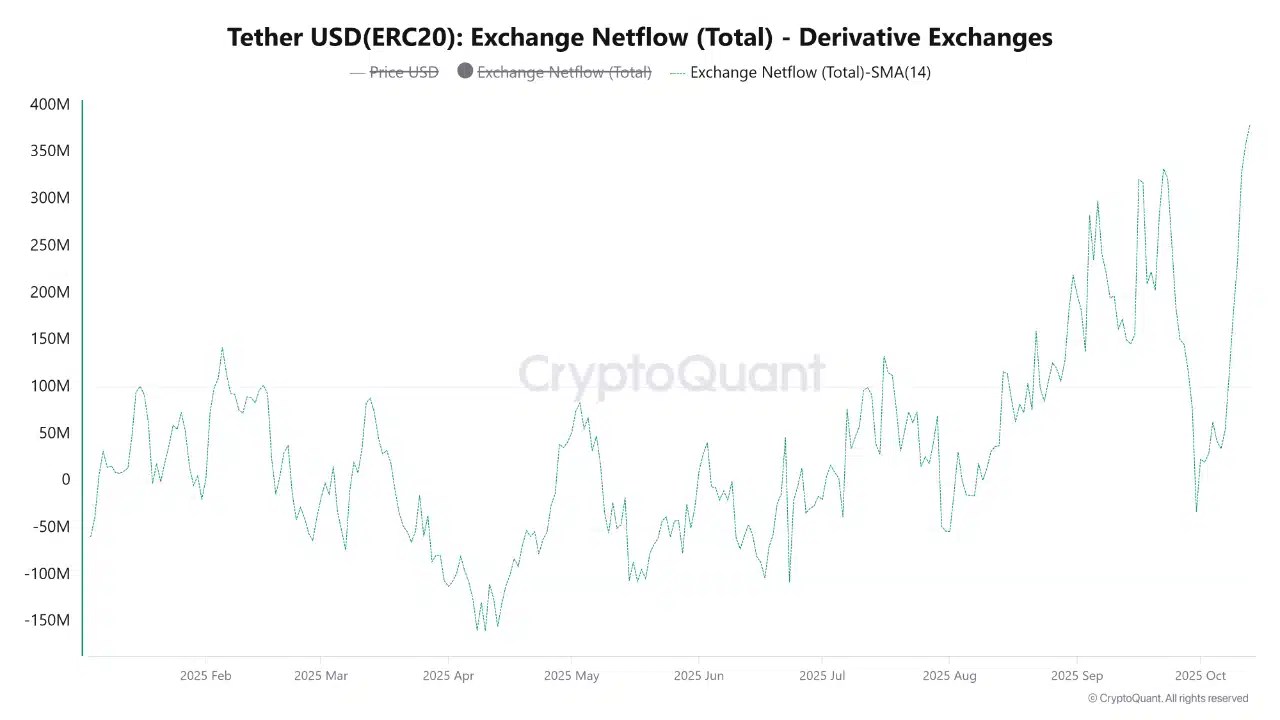

Another analyst, CryptoOnchain, highlighted stablecoin activity on the Ethereum [ETH] network. Derivatives exchanges saw a bulk of these inflows, showing that market participants were buying the dip on margin.

This was a strong sign of bullish conviction, but it might be punished by another liquidity hunt southward.

Joao Wedson, CEO and Founder of analytics platform Alphractal, estimates a 60%-75% chance that Bitcoin will retest its lows on the 10th of October, potentially triggering another price drop this week and catching overly optimistic bulls off guard.

BTC traders should brace for further downside, but can shift to a short-term bullish outlook if the price rallies past the $117k mark.

As for altcoin traders and investors, the situation is more complex given the greater volatility. Many altcoins saw 40%-70% price drops within hours on the 10th of October. Another such drop would be catastrophic for those looking to catch the bottom.

Altcoin sentiment signals opportunity!

Source: Darkfost on X

In a post on X (formerly Twitter), analyst DarkFost made the point that “the best time to gain exposure to altcoins is often when no one wants them anymore”.

Only 10% of the altcoins on Binance were above the 200DMA. The analyst argued that this proved widespread disinterest in the altcoin market and was a valuable buying opportunity.

Whether this is true remains to be seen, but not all altcoins are equal. Most of them tend to bleed value against Bitcoin over the years, and struggle to maintain relevance across market cycles.

Hence, investors must DYOR and select what they believe are strong projects if looking to buy this dip.

Source: https://ambcrypto.com/bitcoin-could-retest-october-price-lows-analyst-explains-why/