- The Bitcoin network’s low transaction activity triggers fee policy debates.

- Miners adapt by lowering transaction fee thresholds.

- Core developers emphasize Bitcoin’s anti-censorship principles.

Bitcoin network activity has seen a notable decrease, with its seven-day average transaction count dropping to 317,000, the lowest since October 2023. This decline in transaction volume has prompted Bitcoin Core developers to take action.

The event is significant due to the broader implications for Bitcoin’s decentralized ethos, with core developers opposing fee filtering that mandates users depend on private channels like Slipstream.

Bitcoin Transaction Volume Hits 317,000 Sparking Developer Debate

Bitcoin’s transaction volume hit a low, causing tension between maintaining decentralization and implementing effective networking measures. The debate centers on the actions taken by Bitcoin Core developers who opposed fee filtering. Miners like MARA are adapting by relaxing transaction fee thresholds, inviting scrutiny on whether anti-spam protections are compromised.

Some miners have started to seek out low-fee transactions through alternate channels, impacting the Bitcoin network’s procedural operations. Samson Mow, among others, expressed concerns that bypassing standard practices could affect Bitcoin’s integrity.

“Without effective anti-spam measures, the Bitcoin network risks becoming congested with dust and low-value transactions, undermining network reliability and user experience.” – Samson Mow, Founder, Jan3

Community reactions are mixed, with Bitcoin Core developers underlining the network’s foundational openness. MARA’s Slipstream channel operation exemplifies the changing landscape, while prominent figures like Samson Mow underscore efficiency concerns.

Bitcoin Value Surges With 37.12% Price Increase

Did you know? Bitcoin’s transaction count previously reached similar lows in October 2023, spurring similar debates about miner flexibility versus protocol stability.

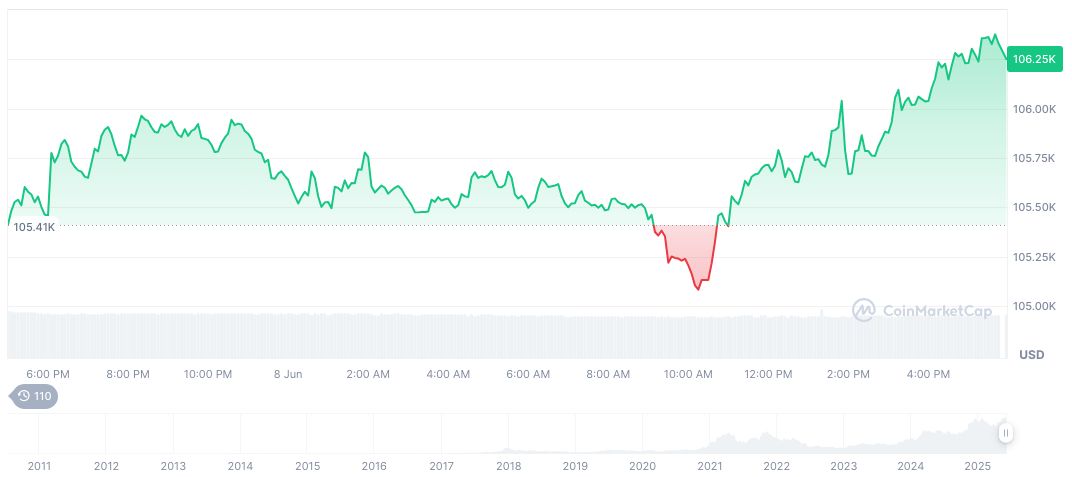

According to CoinMarketCap, Bitcoin is trading at $105,729.29 with a market cap of approximately 2.10 trillion. Its 24-hour trading volume stands at $36.72 billion. Over the past 90 days, prices have increased by 37.12%. The current circulating supply is 19,876,240 out of a maximum of 21,000,000.

The Coincu research team notes that ongoing discussions around decentralization standards could shape future blockchain policies. Experts highlight the precedent set by past fee policy decisions, which suggests this debate will likely influence protocol amendments and miner strategies.

Source: https://coincu.com/342295-bitcoin-core-fee-filtering-debate/