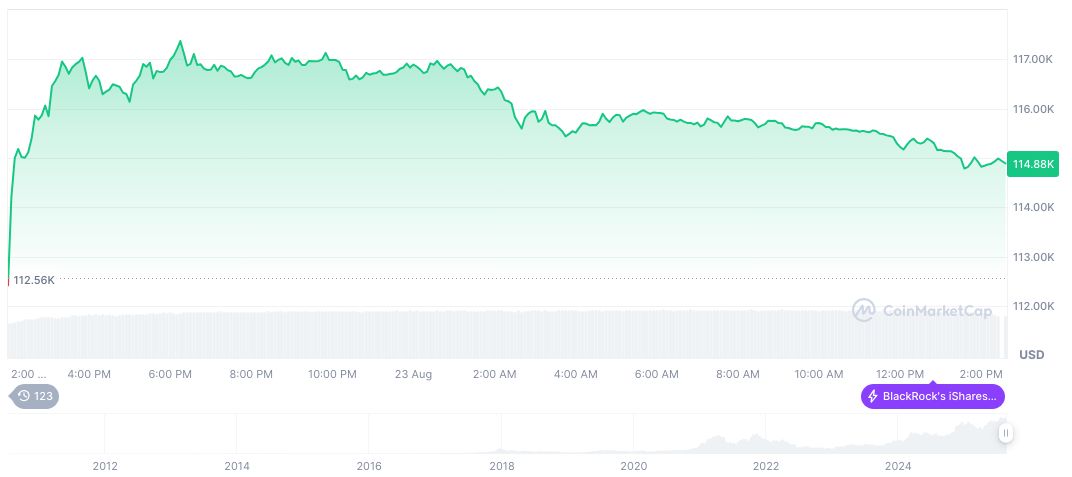

- Bitcoin consolidates between $111,000 and $117,000, indicating a market in stasis.

- Market supported by Federal Reserve rate cut expectations.

- Spot ETF shows net outflow of 2,400 BTC, reflecting easing pressures.

CryptoQuant analyst Axel Adler Jr stated that Bitcoin traded between $111,000 and $117,000, maintaining a 90-day return of 5% during late August consolidation.

The consolidation signals potential market stability, with a bullish tone from the Federal Reserve’s rate cut hints, but ongoing tariff risks may influence volatility.

Bitcoin Navigates Federal Reserve Impact and Market Indecision

Bitcoin’s market trended sideways, with prices fluctuating narrowly between $111,000 and $117,000, signaling sustained trader indecision. This stasis reflects market forces in equilibrium, per Adler’s analysis. Influential factors include Federal Reserve’s hint at rate cuts, complementing Bitcoin’s macro backdrop.

Market sentiment shows a cautious bullish tilt, moderated by tariff and cost concerns. Bitcoin’s exchange reserves increased by 12.9%, possibly preparing for a surge in volatility. Simultaneously, liquidity flowed into ETH, pressuring BTC dominance.

Community discussions leaned towards a watchful stance, with no substantial updates from major figures like CZ or Vitalik Buterin. Analysts await potential volatility re-emergence, spotlighting macro conditions and leveraged position risks.

Price Consolidation Signals Potential Bullish Accumulation

Did you know? Axel Adler Jr noted that Bitcoin’s current stasis resembles prior pre-rally consolidations seen before the 2023 bull run, suggesting a possible bullish accumulation phase if historical patterns hold.

Bitcoin currently trades at $114,581.65, with a market cap of $2.28 trillion, representing a 24-hour decline of 0.87%, according to CoinMarketCap. The circulating supply stands at 19,910,796 BTC, near its maximum limit of 21 million.

According to Coincu research, Bitcoin’s RSVP patterns remain supportive of a longer-term bullish outlook. Analysts highlight that regulatory shifts or technological advancements, such as layer-two solutions, could further influence Bitcoin’s trajectory in the coming quarters.

Axel Adler Jr, Analyst, CryptoQuant, said, “BTC market compressed in the $116–118.7K range… Max Pain ‘magnet’ $118K to expiration Aug 15. On-chain activity and hashrate declining with exchange reserves growing +12.9%, liquidity rotation to ETH pressuring dominance. Macro backdrop moderately bullish (weak DXY/Fed rate cut expectations), but tariff risks keep headline volatility elevated.”

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/bitcoin-price-late-bullish-accumulation/