- New statistics from the Bitcoin Cash Explorer report a spike in network usage.

- Technicals indicate the potential for gains to continue, with the next significant resistance level at $390.5.

Bitcoin Cash (BCH) price is seeing a robust upward trend, rising more than 7% to trade at about $342 on Wednesday. The latest surge follows the cryptocurrency holding its crucial support area the previous day. Rising investor appetite, in terms of rising blockchain activity and increasing open interest (OI) in futures markets, only adds to the positive sentiment. Technicals indicate the potential for gains to continue, with the next significant resistance level at $390.5.

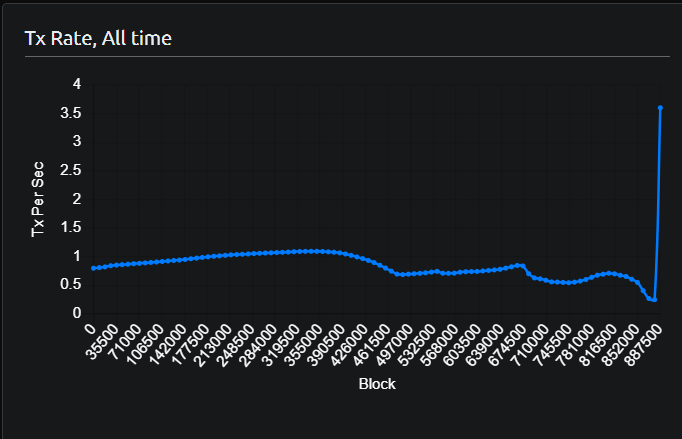

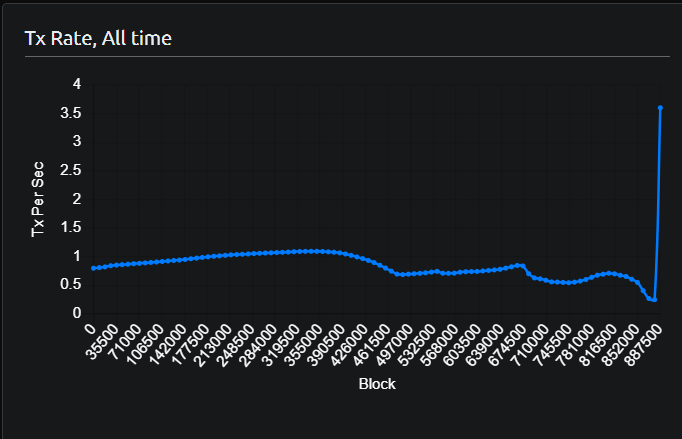

Bitcoin Cash Transaction Rate Reaches All-Time High

New statistics from the Bitcoin Cash Explorer report a spike in network usage. BCH’s transaction rate hit an all-time high of 3.6 on Wednesday, the highest on record. This increase in blockchain usage indicates rising trader interest and liquidity levels, the drivers most often behind price momentum.

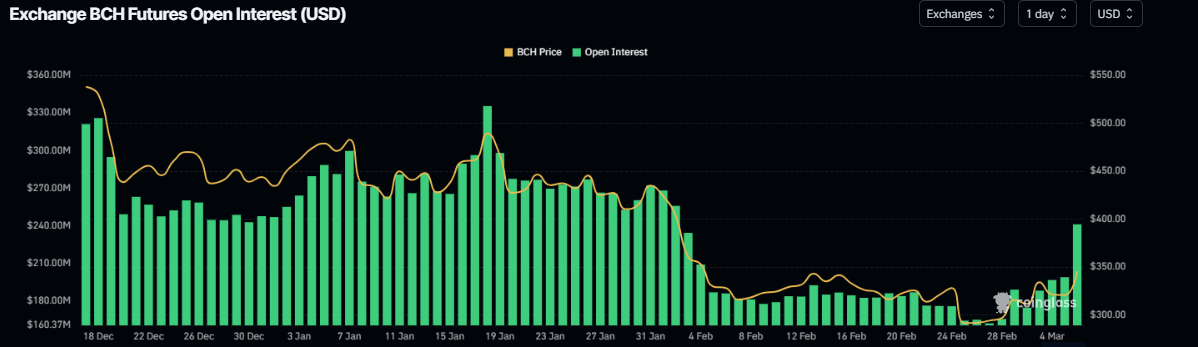

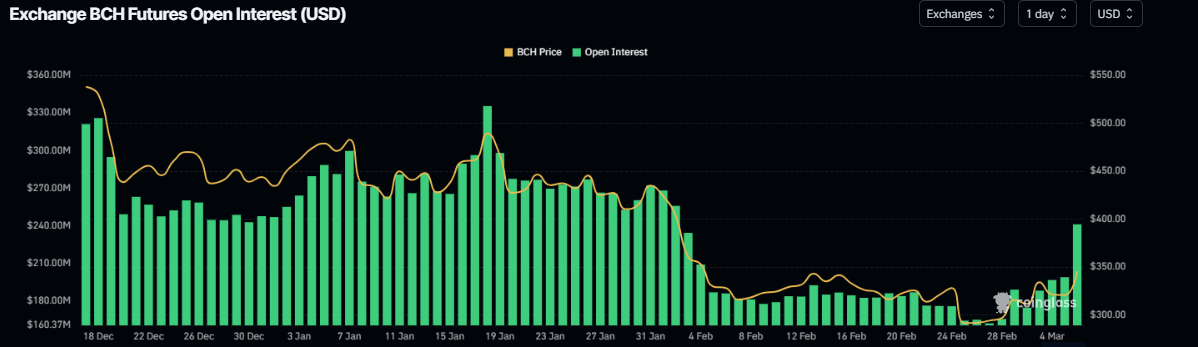

Aside from increased transaction volume, Bitcoin Cash’s futures market has also experienced a considerable increase in open interest. From data provided by Coinglass, the overall OI on BCH futures spiked from $174.48 million on Sunday to $238.48 million by Wednesday.

This is the highest open interest since February’s early weeks. An increasing OI generally reflects fresh capital flowing into the market, implying stronger buying pressure and the possibility of further price growth.

BCH recently found support in the important range of $279.2 to $299.7, which helped to strengthen its stability prior to the recent rally. On Tuesday, the BTC price tested this range before bouncing back to close at $320.5. By Wednesday, the price had jumped to around $342.4, indicating renewed bullishness.

If BCH stays above its determined support level, it may sustain its current run by another 13% and hit its next resistance level of $390.5. As reported earlier, even market momentum gauges are supportive of this outlook.

Technical Indicators Indicate Further Upside Potential

The Relative Strength Index (RSI), a leading indicator of market momentum, is at 55 on the daily chart. This is above the neutral 50 level, which means that buying momentum is gaining strength. Also, the Moving Average Convergence Divergence (MACD) indicator recently created a bullish crossover, which is an indication of a change towards an upward trend.

In spite of the powerful bullish pressure, Bitcoin Cash is still susceptible to possible pullbacks if it cannot hold its support area. A close below $279.2 may trigger another drop, with the next significant level at the February 21 low of $255.2.

For the time being, Bitcoin Cash bulls are still in charge, with technical indicators and market data indicating more gains to come. The next significant test for BCH will be if it can maintain its momentum and break above the $390.5 resistance level in the near future.

Source: https://www.crypto-news-flash.com/bitcoin-cash-momentum-builds-bch-rallies-as-open-interest-transactions-rise/?utm_source=rss&utm_medium=rss&utm_campaign=bitcoin-cash-momentum-builds-bch-rallies-as-open-interest-transactions-rise