Following the recent Bitcoin (BTC) price action, the coin’s short-term holders are now in profits, a situation that may herald a crucial change in trend.

As spotted by Julio Moreno, the Head of Research at CryptoQuant, this on-chain positioning has signaled a price correction in the past, making the possibilities at this time also likely.

The researcher noted that the likelihood of Bitcoin reversing its trend is higher, considering the current “cycle phase” the market is in right now.

Is Bitcoin Reversal Imminent?

Over the past few months, Bitcoin has impressed observers with its price rising from $26,858 on October 16 to the $42,783 it is trading at today.

– Advertisement –

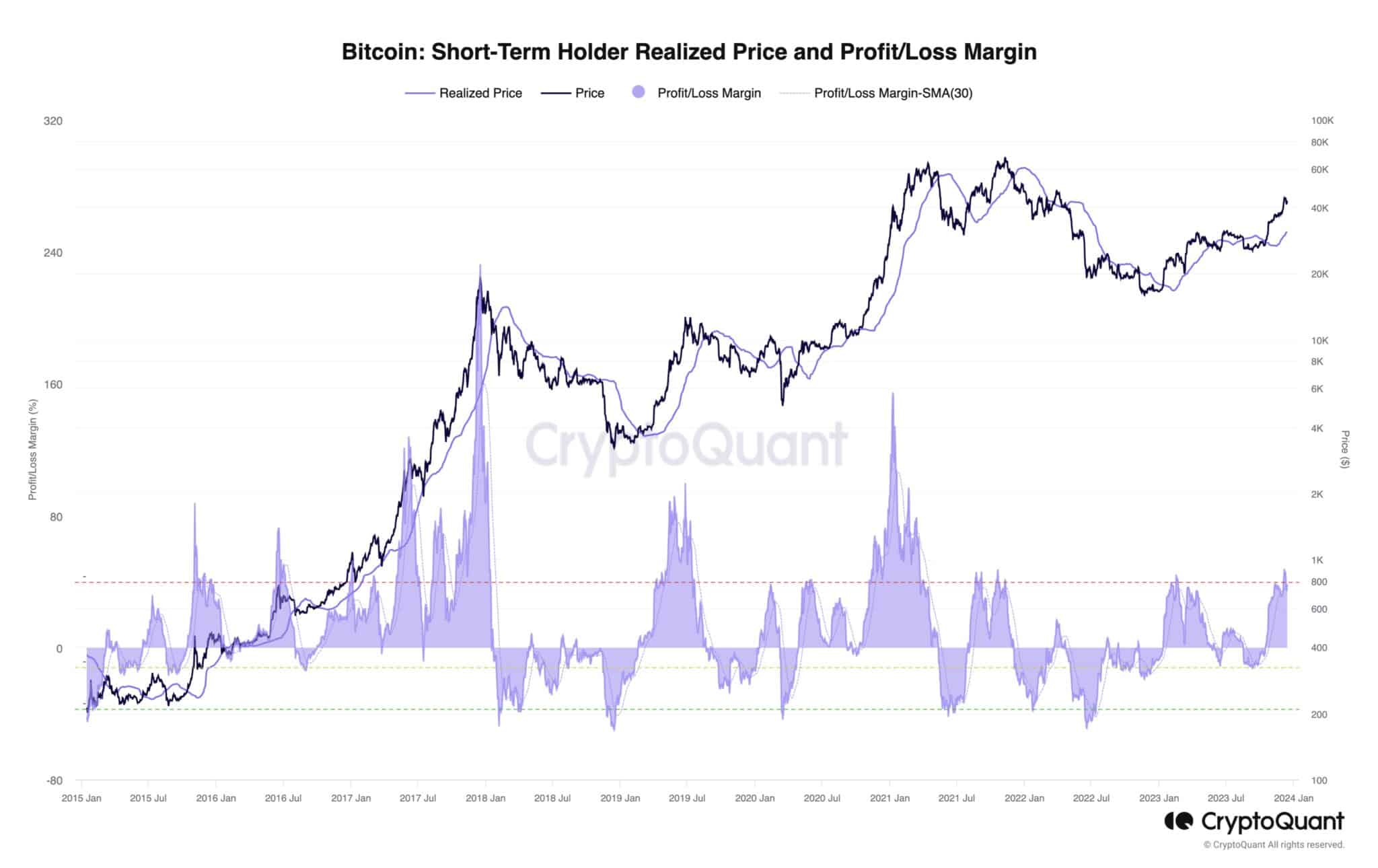

This jump is an ideal set-up for short-term Holders, as spotted by Moreno. As presented in a chart he shared dating back to January 2015, a reversal typically emerges whenever Bitcoin’s price rallies to a local high.

From the chart, a reversal accompanied the first parabolic run from January 2015 to a peak around January 2018.

This trend was also seen from January to July 2019. With Bitcoin soaring from January 2023 to date, it has recorded 141% growth in that period.

While the projection of a likely reversal is valid based on the historical setup, the timeline remains what may change if the bears eventually overtake the market.

At the time of writing, Bitcoin sells for $42,712, down 0.99% in 24 hours, with market capitalization dropping by a similar rate to $834,833,566,872. The coin’s trading volume has dropped 4.8% to $24,618,694,222.

Bitcoin Outlook and Underlying Triggers

Bitcoin price might have soared to a short-term high level, according to the data insights shared by Julio Moreno.

There is a chance the cryptocurrency will add more gas in the future, riding on the growing hype surrounding the potential approval of a Bitcoin Spot Exchange Traded Fund (ETF) product by the US Securities and Exchange Commission (SEC).

If the regulator intrigues the market by approving the product, it may usher in a new era that will confirm the emergence of a bull run. Should this scenario play out, then the chances Bitcoin’s price will test the $100,000 level, as predicted by some observers, will be higher.

Follow Us on Twitter and Facebook.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Source: https://thecryptobasic.com/2023/12/15/bitcoin-btc-short-term-traders-hit-profit-what-comes-next-for-price/?utm_source=rss&utm_medium=rss&utm_campaign=bitcoin-btc-short-term-traders-hit-profit-what-comes-next-for-price